A new par value rule intended to create liquidity may first crash equities value before producing positive results.

The Securities and Exchange Commission (SEC) recently approved the rule submitted by the NSE National Council to solve the problem of illiquidity in many stocks listed on the Nigerian Stock Exchange (NSE).

The new rule revises the price floor of company shares traded to 10 kobo from the previous price floor of 50 kobo per share.

Regulators and stakeholders who unanimously devised the rule expect it to boost trading in dormant companies whose share prices are currently 50 kobo.

When the NSE announces the implementation date of the rule, possibly by the last quarter of this year, the price floor of 10 kobo per share may make such stocks too attractive for investors to resist and possibly invest and resuscitate a company.

However, the par value rule may eventually crash market valuation of shares with total market capitalisation of N154.7 billion, TheNiche has discovered.

This figure represents 1.35 per cent of the N11.42 trillion equities market capitalisation as of June 22, 2015.

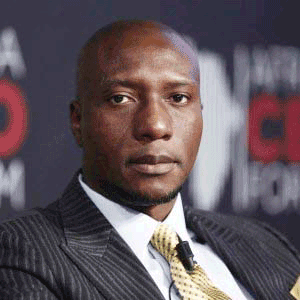

David Adonri, an operator and member of the market committee that reviewed the rule, said its foreseeable positive impact will outweigh any negative outcome in the short term.

According to him, there have been no trading activities on most of the affected equities, implying that their liquidity level is currently zero. But with the new rule, core investors may restore liquidity in the companies.

Adonri, Managing Director of Highcap Securities, a dealing member of the NSE, argued that market capitalisation for the affected stocks in aggregate is not up to 2 per cent of total market capitalisation, and therefore cannot affect the market capitalisation of the NSE.

Association of Stockbroking Houses of Nigeria (ASHON) President, Emeka Madubuike, also a member of the par value review committee, expressed optimism that a downward review of equities par value from 50 kobo to 10 kobo would boost trading in dormant companies and investor confidence in dormant stocks.

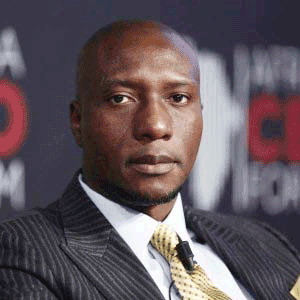

APT Securities and Funds Managing Director, Garuba Kurfi, applauded the plan, insisting that the forces of demand and supply should determine the prices of every listed equity.

Said he: “The prices of all listed shares cutting across every sector will be fully market driven by the forces of demand and supply, as all stocks could trade as low as one kobo instead of the current 50 kobo so long as supply continues to outweigh demand.

“We expect this amendment to engender improved market efficiency in the price discovery mechanism of the market as price would reflect all public available information in line with global best practice.”

But Kurfi acknowledged the likelihood of a sharp drop (on implementation of the rule) in investors’ net worth, as most stocks currently trading at 50 kobo may decline to one kobo on weak fundamentals and sentiments.

“Although the prices may fall gradually, investors can take advantage of the prices and exit earlier before the price hits the bottom of one kobo.”

He noted, however, that the liquidity level of the affected equities may improve in the long run at market determined prices and fair valuations.