Fiscal risks are deviations from fiscal outcomes expected at the time of budget formulation or other forecasts.

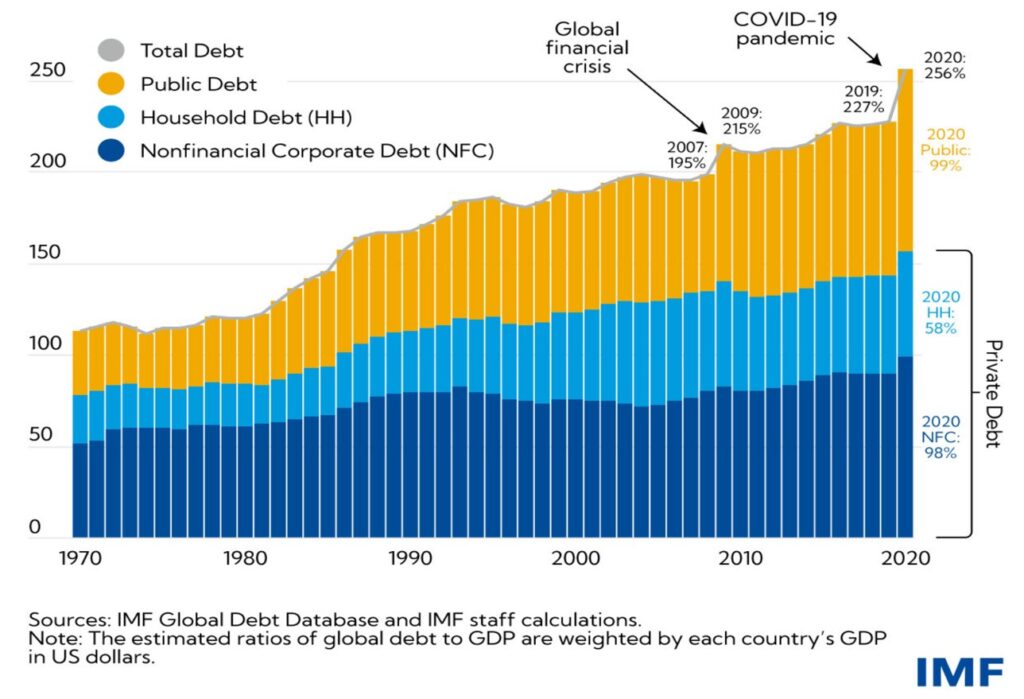

Public finances of governments, businesses and individual citizens of most countries around the world today have had and are still feeling the devastating impacts and economic upheaval caused by crises that could not have been forecast few years ago. These crises ranges from the Covid-19 global pandemic, recessions, financial crises, climate change or natural disasters to inflation and energy crises stemming from the war Russian/ Ukraine war and the altered global interest rate landscape that is making lending to Low Income Countries (LICs) and debt servicing prohibitively expensive. Various governments had to take steps to shield their citizens and economies from the worst effects of these challenges which is taking place against a backdrop of high debt level, limited fiscal spaces and elevated uncertainty that we cannot predict what events may develop next year or the year after so that policy makers can structure public finances with resilience in mind.

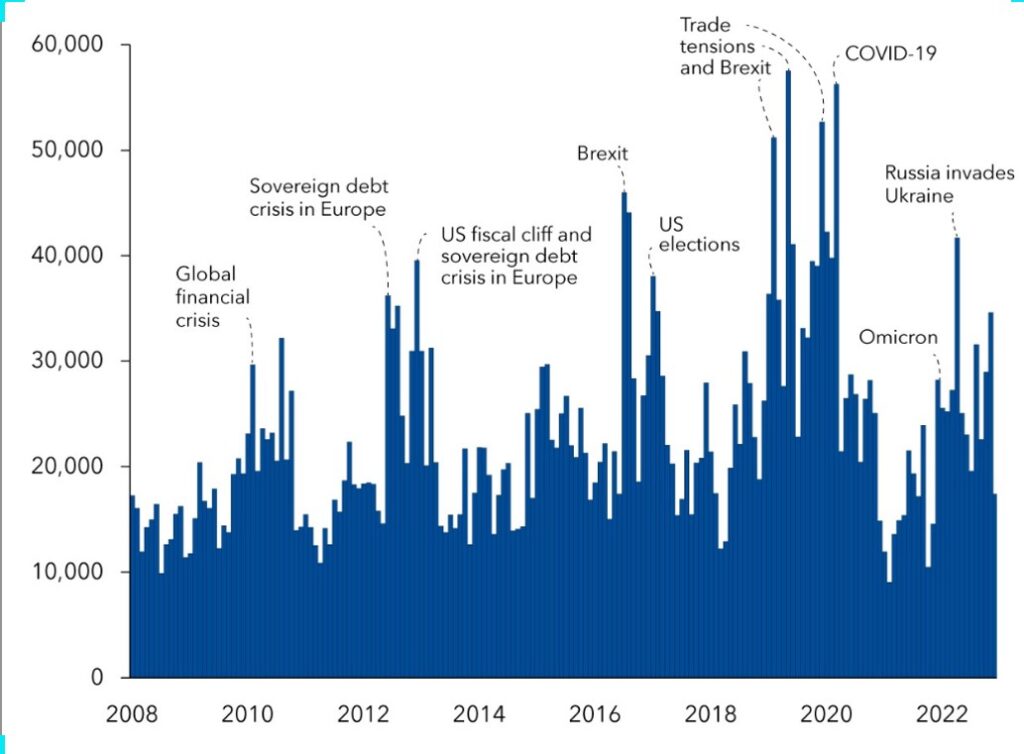

The shocks that have shaken the global economy in recent years have introduced a new normal for turbulence lifting uncertainty to exceptionally high levels, which in turn hurts economic growth and caused fiscal risks.

Fiscal risks that may arise from a range of different sources which can be classified as follow:

Economic, Environment, Geopolitical, Technological and Societal.

World Uncertainty Index 2008 – 2022

(Index, GDP weighted average)

Sources: Ahir, Bloom, and Furceri (2022), Chart of the Week Jan.2023

What is Fiscal Risk ?

Fiscal risks are deviations from fiscal outcomes expected at the time of budget formulation or other forecasts. This deviation might create significant impact on government finances and impair the capacity of governments to use fiscal policy to stabilize economic activity and support long-term growth. (World Bank 2019). Thus, Fiscal Risk Management refers to comprehensive analysis, disclosure and management of fiscal risks.

Fiscal risks are factors that may cause fiscal outcomes to deviate from expectations or forecasts. i.e. all those factors that can cause government finances to deviate from what we expect.(IMF Lesley Fisher and Amanda Sayegh 2022).

Fiscal risks refer to the uncertainty associated with the outlook in public finances and can be defined as the probability of significant differences between actual and expected fiscal performance, over the short to medium-term horizon (Kopits 2014).

Read Also: The game of thrones at First Bank

Macroeconomic shocks

Growth, Exchange rates, Interest rates, and Commodity prices

Contingent

Liabilities, Explicit/implicit, Guarantees, SOEs & PPPs and Legal claims

Tail-risk events

Pandemic, Nature & climate disasters, Societal &

Conflicts, Technological

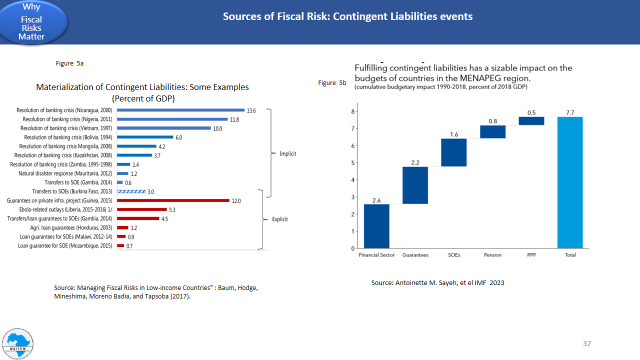

Contingent Liabilities

Debt managers and fiscal risks mangers are concerned about risks from contingent liabilities – explicit, as well as implicit contingent liabilities from debt of state-owned enterprises and subnational governments, as well as financial sector risks and natural disaster.

Explicit Contingent Liabilities

Legal or contractual financial arrangements that give rise to conditional requirements to make payments of economic value. The requirements become effective if one or more stipulated conditions arise.

Guarantee on PPP

Guarantee on sub-national or SOE’s Loans

Guarantee on Insurance Programme

Settlement of Investment disputes

Projected Shortfalls in Pension Schemes

Implicit Contingent Liabilities

Bailout of Sub-national entities, SOE’s losses and arears

Bail out of Banks & microfinance institutions

Bailout of private enterprises (Too big to fail)

Settlement of Investment disputes

Cost of recovery from Natural Disasters, Pandemic etc

iKey Message

Contingent liabilities have been one of the largest sources of fiscal risk in Africa. In several cases, materialization of guarantees, failure to disclose some SOEs debt and arrears, exchange rate depreciation and lack of capacity to prepare for fiscal risk has led to large increases in public debt.

Why Fiscal Risks Matter

Sources of Fiscal Risk: Macroeconomic Shocks

Heatmap outlook for selected key macroeconomic indicators of Africa countries, average, 2023–24

Read Also: Ex-Nigerian Ambassador drags First Bank to court over missing N1b worth of jewellery in their vault

Fiscal Risk Management Process

Key Message

Fiscal risk management require that risks to the public finances are identified, analyzed, and managed and disclosed. In addition, the fiscal decision on managing fiscal risks across the public sector is effectively coordinated.

Step 1:

Identify and Quantify

Step 2:

Mitigate

Step 3: Provision

Step 4: Accommodate Residual & create space

Step 5:

Disclose

Legal Framework for Fiscal Risk Management

(Republic of Sierra Leone)

The Public Financial Management Act, 2016 mandate the Minister of Finance to:

PFM Act mandate

– Development of government’s fiscal policy

– Monitor and management fiscal risks

Through Fiscal Strategy Statement in addition to the budget

Medium Term Budgetary Framework

Make forecasts of macroeconomic and fiscal indicators

Actual outcomes of these indicators and an explanation of the reasons for significant differences between them, if any

Fiscal risk statement; (j) ceilings on total expenditures details for 3 years

The act requires that Fiscal Strategy Statement laid before Parliament

Minister shall identify and analyze risks which may have a material effect on the fiscal outlook.

(a) results of sensitivity analysis based on different assumptions in respect of main macroeconomic and fiscal indicators;

(b) information and analysis of existing exposures of entities included in the central government to contingent liabilities, including those arising from guarantees, losses on pending court cases, and any other sources, and to loans and advances;

(c) any other information as may be deemed appropriate by the Minister.

Legal Framework for Fiscal Risk Management

(Republic of Ghana)

PFM Act 2016 mandate

– Development of government’s fiscal policy

– Monitor and management fiscal risks

Fiscal Strategy Statement

Budget, Medium Term Budgetary Framework

Make forecasts of macroeconomic and fiscal indicators

Actual outcomes of these indicators and an explanation of the reasons for significant differences between them, if any Fiscal risk statement; ceilings on total expenditures details for 3 years

The act requires that Fiscal Strategy Statement laid before Parliament

Minister shall identify and analyze risks which may have a material effect on the fiscal outlook.

(a) results of sensitivity analysis based on different assumptions in respect of main macroeconomic and fiscal indicators;

(b) information and analysis of existing exposures of entities included in the central government to contingent liabilities, including those arising from guarantees, losses on pending court cases, and any other sources, and to loans and advances Fiscal Responsibility Act, 2018

Fiscal Responsibility rules .

(a) results of sensitivity analysis based on different assumptions in respect of main macroeconomic and fiscal indicators;

(b) information and analysis of existing exposures of entities included in the central government to contingent liabilities, including those arising from guarantees, losses on pending court cases, and any other sources, and to loans and advances

Framework for Fiscal Risk Management (Republic of Kenya)

The National Treasury identify and quantifying the fiscal risks arising from the State Corporations (SC) Sector to determine the amount of fiscal exposure from the SC sector, which can migrate to the national budget and negatively impact the economy

The key fiscal risks to Government of Kenya are define in 3 areas as follows:

Expenditure and revenue risk from unforeseen developments such as higher operating expenses or lower sales that reduce the net profit or increase losses.

Liquidity risks and arrears accumulation, which are a consequence of adverse revenue and expenditure developments and uncompensated public service obligations where entities are unable to raise revenues or recover costs. These may result in a call on Government – in case the SC fails to have sufficient working capital – to finance short-term obligations, whereby debts continue to accumulate, become uncollectible, or are written off.

3. Direct and contingent liabilities of which the Government may have an explicit legal obligation (such as a loan, guarantee, or contractual obligation as part of an investment project) or an implicit obligation, such as supporting an SC facing liquidity problems, given the strategic importance that it plays in the economy.

Challenges

Adherence to the Laws: fiscal discipline is weak and remains a concern;

Absence of an overarching and coordinated PFM strategy in some countries;

Capacity and skill gaps in Fiscal risk management strategy development to comprehensively record and monitor fiscal risks and;

Inadequate ICT infrastructure in the public sector to support rollout of computerized platforms for effective records of contingent liabilities and other fiscal risks variables;

Sub-National Governments: in some cases, there is lack of comprehensive information on the financial condition and performance of sub-national governments individually and as a consolidate sector;

• Public Corporations: Many governments don’t regularly publish comprehensive information on the financial performance of public corporations, including any quasi-fiscal activity

Global landscape is dominated by manifesting risk and other external shocks.

Conclusion

While ongoing shocks unfold, the Africa stands at a crossroads. As we enter a low-growth, low-investment and low-cooperation era, countries need to :

Establish clear accountability for monitoring, managing and reporting contingent liabilities;

Ensure a monitoring mechanism for regular review of: (i) the potential for risk realization as new information becomes available; (ii) whether existing policies remain appropriate; and (iii) whether existing mitigation measures are adequate;

Establish intra-governmental coordination mechanisms to assess and monitor risks and policy responses, particularly between finance and economic ministries and central banks to monitor and manage financial sector exposures;

Parliamentary involvement in monitoring the guarantees given and called as well as the impact on the economy and employment of support measures will help provide additional legitimacy;

Ensure the full disclosure of all fiscal measures, be they direct or contingent, on-budget or off-budget;

Enhance capacity to mitigate and manage risks. The need for training and retraining on the World Bank Fiscal Risk Assessment (FRA)framework, and the IMF Fiscal rule toolkit

Better integrate fiscal risk analysis into fiscal policymaking: fiscal frameworks could be strengthened, together with the analysis and understanding of these risks and the reporting of Contingent Liabilities.

• Musa, Director General, West African Institute for Financial and Economic Management (WAIFEM)