Equity investment is one of the alternatives to explore when considering investment or savings to secure the future. Mutual funds, treasury bills, and government bonds outperform banks’ annual interest on savings.

Returns from dividend and bonus-paying stocks are likely to exceed 30 per cent of invested funds in a year if properly managed by brokers.

Since you are buying for the long term, it is advisable to religiously buy into stocks or companies that pay dividend and bonus regularly so that your money will grow gradually and steadily. The returns should be allowed to grow in the investment account as you plough back the dividends.

It is safe to assume that many regularly dividend-paying stocks are stable financially, implying consistent cash-flows and earnings. The stock prices of these firms usually appreciate and grow over time, as most investors remain loyal to these firms due to regular dividend.

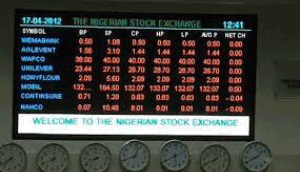

A good number of stocks in the banking, consumer good, oil & gas and industrial goods sectors on the Nigerian Stock Exchange (NSE) are value stocks, and their dividend pay out ratio and yield growth is essential.

However, in choosing quality stocks for investment, Warren Buffett’s value stock strategy is of tremendous help. It has helped him beat the market continually and become one of the world’s richest men.

Using Buffett’s quality stock strategy, investors wishing to make fortunes from the capital market should seek out stocks that are undervalued whose prices do not obviously reflect their true or intrinsic value.

Since no specific formula exists for calculating the intrinsic value of an organisation, some fundamental analysis will have to be performed. The earnings, revenue, assets, track record, debt burden, and balance sheet all have to be examined carefully before making a decision.

Value investors are always looking for the next good deal and need companies that are of high quality, undervalued, but poised to experience significant growth in the future.

In turn, the market will eventually correct its valuation mistake and the price of the stocks should rise significantly as in the case of Forte Oil which has maintained strong upward trend.

Unlike the typical value investor, Buffett does not necessarily care if the markets ever correct their mistakes. He is not looking to make any kind of quick turn around on his investment either.

Investing in the equities for the long haul, Buffett would hold stocks for five or 10 years before thinking about selling them – that is, he employs the “buy and hold” strategy as well.

Even then, he is not necessarily looking to profit off his investments in terms of capital gains. Rather, his quality stock strategy includes finding stocks based upon the overall potential of the companies themselves.

Buffet is more concerned with a company’s ability to make money than anything else. Finding these quality stock investments is the hard part but something in which he seems to have little problem.

He and those who follow his quality stock investment strategy are looking for quality companies. Past performance may not determine future performance, but it is a valuable tool to use when trying to determine the intrinsic value of a company.

Consistent performance is critical to the long term viability of a company and a key indicator of consistency is the rate of return (ROE) of shareholder’s equity. This will show what kind of return investors are getting on their investment and it can be useful in determining the overall health of the company when compared to the ROE of other companies in the same industry.

The ROE is calculated by dividing net income by the shareholder’s equity. Calculating the ROE for the past seven to 10 years is a good way to see how consistently the company is delivering a satisfactory return on shareholders’ investment.

ROE = Net Income / Shareholder’s Equity. Another clue to the intrinsic value of a company is its debt burden. Avoiding excess debt is critical to sustaining growth and profitability which is why every quality investor wants to know the debt to equity ratio for any potential investment.

Higher ratios indicate high debt burdens, uncertain earnings, and high interest charges. The debt to equity ratio is calculated by dividing total liabilities by shareholder equity.

Debt/Equity Ratio = Total Liabilities/Shareholder’s Equity. Buffett and quality stock investors also investigate the overall profitability of a company when gauging its intrinsic value. Are the current profit margins above market average? Have they been steadily increasing for the past few years?

Sustained profitability is a key factor to a quality stock investment, so the profit margins have to be acceptable and they must be increasing.

When a company is highly profitable, it usually means that it is running its business effectively. Profitable businesses are efficient and look for ways to stay ahead of market trends rather than react to them.

Companies that are able to increase profit margins tend to be those that continually improve efficiency, increase productivity, and reduce expenses.

Profitability can be calculated by dividing net income by net sales. It is necessary to look back five to seven years to see whether or not the profits are increasing at an acceptable level to be considered a quality stock investment.

Profitability = Net Income / Net Sales. In order for Buffett to consider any company for his portfolio, he wants it to stand the test of time.

Quality companies are those that can weather market trends and still not only maintain profits, but increase them. Quality investors like to see a company around for at least a decade before taking a serious look at them.