By Jeph Ajobaju, Chief Copy Editor

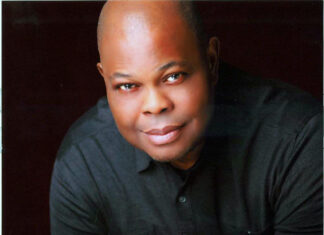

Oil and gas exploration is in decline in Nigeria because of inconsistent fiscal and regulatory policies, says Mike Sangster, Total E&P Nigeria managing director.

He bared his mind at the monthly technical presentation of Nigeria Association of Petroleum Explorationists (NAPE) against the backdrop of news that Aso Rock and lawmakers are drafting a bill to reform the oil industry.

The bill is expected to sidestep the gridlock of the past which has prevented upgrading the law on drilling and selling oil, the backbone of the Nigerian economy.

Vanguard reports that Sangster blamed the decline in exploration on uncertain fiscal and regulatory regimes, which push out policies that make new investments unattractive and uncompetitive.

He said there are no proportionate exploration activities to ensure long term sustainability and replenishment of the resource that accounts for more than 90 per cent of Nigeria’s foreign exchange (forex) earnings.

“Total as a key stakeholder in the Nigerian oil and gas industry is prepared to work with the government, partners, and other stakeholders, to address these bottlenecks to new exploration investments,” Sangster added.

He reiterated that the coronavirus pandemic has had a grave impact on lives and businesses, especially the oil and gas industry.

“These will have implications on the investment strategies and imperatives for businesses and even governments around the world.

“NAPE should adapt to a post-coronavirus world and seek ways of reinventing itself for the purpose of continued relevance.

“I have no doubt that the respectable membership of this body will take advantage of this month’s presentation to make deliberate, robust, and incisive contributions aimed at addressing the many challenges confronting our industry and nation.”

Sangster disclosed that Total contributed $3.2 million (N1.2 billion) as part of the N21 billion donation spearheaded by the Nigerian National Petroleum Corporation (NNPC) in support of the government’s COVID-19 efforts.

“The company also supported the Lagos State Government with critical supplies and medical equipment. In Rivers State, we reached out to our stakeholders by providing medical supplies and support for our host communities and the state government.

“Our downstream company, Total Nigeria Plc, donated N50 million as part of a combined contribution from the Major Oil Marketers Association of Nigeria (MOMAN), under the auspices of the NNPC and provided the Lagos State government with fuel for logistical support during the pandemic.”

Oil reform bill

Reforming the economy, including the oil industry, is one of the key requirements the World Bank wants Nigeria to meet to get a $1.5 billion loan the lender has delayed to grant.

The law underpinning oil, the financial lifeline for Africa’s biggest exporter, has not been updated since the 1960s.

But the Petroleum Ministry will present the reform bill to President Muhammadu Buhari in the coming days aimed at boosting output and attracting foreign investment, three sources close to the negotiations told Reuters.

Once Buhari signs off on the draft, it will go to the National Assembly (NASS), which is controlled by his All Progressives Congress (APC).

The alignment of the presidency and the NASS gives the measure the best chance of passage it has had in years.

The reforms, 20 years in the making, are particularly urgent this year as low oil prices and a shift towards renewable energy have made competition tougher to attract investment from oil majors.

Fiscal uncertainty has delayed a decision on a multi-billion dollar expansion by Royal Dutch Shell and its partners, while Chevron, Total, and ExxonMobil are selling various Nigerian assets.

Shell, the largest international operator in Nigeria, said a botched reform effort would be “putting at risk and making unviable most of the planned projects.”

“We hope that the final bill would be one that would unlock potential investments that Nigeria’s rich resource base truly deserves,” a spokesman for Shell companies in Nigeria told Reuters.

Proposals in the bill

A draft summary seen by Reuters included provisions that would streamline and reduce some oil and gas royalties.

One of the sources described even the government’s reduced take of oil revenues, through taxes, royalties and other fees, as “aggressive” compared with other nations.

Some African countries are trying to cut red tape and taxes in order to make developing their oil and gas reserves attractive to companies.

The bill proposes to boost the amount of money companies pay to local communities and for environmental cleanups.

It would alter the dispute resolution process between companies and the government, though specifics of the changes were not included in the summary.

The bill also includes measures aimed at pushing companies to develop gas discoveries and a framework for gas tariffs and delivery.

Commercialising gas, particularly for use in local power generation, is a core government priority.

The bill will be presented in one piece with four chapters, the sources said.

An effort to pass reforms by breaking them into several bills in 2018 fell flat; just one portion made it to Buhari’s desk, and he never signed it.

Pumping its oil has historically been hugely profitable, but changes late last year that hiked Nigeria’s take of oil earnings, and a VAT increase, frustrated companies.