Banks and Tinubu’s $1tr economy: The elephant in the room is the unwillingness of the banks to contribute positively in building the economy. Without production, no economy grows and there can be no productivity without access to capital. So, for the Nigerian economy to blossom, beyond the issue of recapitalisation, the banks must perform their core duty of providing loans to businesses and consumers, which in turn will help in financing new investments and stimulating the economy.

As part of his economic reforms for which he demands a place of pride in the Guinness World Records (GWR), President Bola Tinubu promised in October 2023 to bequeath Nigeria with a $1 trillion economy by 2026.

That sounds rather ambitious considering that 2026 is almost here. But as many Nigerians have realised, in Tinubu’s lexicon, impossibility is an anathema. Yet, the hurdle is a steep climb. Right now, Nigeria which is classified as a developing/emerging lower-middle income economy with an estimated population of about 220 million has a nominal GDP of $489.80 billion.

Therefore, as at the time President Tinubu dreamt about the $1 trillion economy, the total market value of all goods and services produced in Nigeria stood at less than half a trillion dollars although the GDP per capita based on purchasing power parity (PPP) was $1.275 trillion .

But for those who think that doubling Nigeria’s GDP in two years is way too ambitious, Tinubu raised the stake with his $3 trillion economy within the decade push.

Of course, those records if achieved should earn any president a place of honour in the pantheon of world leaders. But here is the snag: Realisation of the dream will largely depend on what the banks decide to do. And the government is aware which explains why the Central Bank of Nigeria (CBN) is directing deposit money banks to increase their capital base in order to make the projected $1 trillion economy a reality.

The CBN Governor, Olayemi Cardoso, while delivering his keynote address at the 58th annual dinner of the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos explained that Nigerian banks do not have sufficient capital relative to the financial system’s needs in servicing a $1 trillion economy unless action was taken.

“We need to ask ourselves: Will Nigerian banks have sufficient capital relative to the financial system’s needs in servicing a $1 trillion economy in the near future? In my opinion, the answer is “No!” unless we take action. Therefore, we must make difficult decisions regarding capital adequacy. As a first step, we will be directing banks to increase their capital,” Cardoso said.

While banks can always do with bigger capital base, I doubt whether financial inadequacy is the issue or the unwillingness of the banks to make capital accessible. I will come back to this point shortly.

READ ALSO: Recapitalized banks sine-qua-non for reinvigoration of Nigeria’s economy – Odibo

But, to be sure, this is not the first time Nigeria will be navigating this route. Faced with similar circumstances, President Olusegun Obasanjo, in 2004, embarked on elaborate banking reform which focused on consolidation through the mechanisms of merger and acquisition resulting in the raising of the banks’ capital base from N2 billion to a minimum of N25 billion.

The consolidation programme, which ultimately reduced the number of banks from 89 to 25 in 2005, and later to 24, was necessitated by the need to strengthen the banks and position them to play pivotal roles in driving development across all sectors of the economy.

Addressing the Special meeting of the Bankers’ Committee in Abuja on July 6, 2004, Prof Chukwuma Soludo under whose watch the consolidation project was executed as the then CBN governor noted that: “In Nigeria, we have 89 banks with many banks having capital base of less than US$ 10 million, and about 3,300 branches. Compare this to eight banks in South Korea with about 4,500 branches or the one bank in South Africa with larger assets than all our 89 banks. The truth is that the Nigerian banking system remains very marginal relative to its potentials and in comparison to other countries – even in Africa.”

Soludo’s successor, Sanusi Lamido Sanusi, in a lecture he delivered at the University of Warwick’s Economic Summit on February 17, 2012 reemphasised that the need for an effective and efficient banking system was underscored by the critical role they play in national economic development.

“Banks, for instance, mobilise savings for investment purposes which further generates growth and employment. The real sector, which is the productive sector of the economy, relies heavily on the banking sector for credit. Government also raises funds through the banking system to finance its developmental programmes and strategic objectives,” he said.

Sadly, while consolidation achieved the goal of enhancing their capital base, the now bigger and better resourced banks failed on the critical goal of stimulating the economy by guaranteeing access to capital.

The biggest problem inhibiting the growth of the Nigerian economy is the fact that most entrepreneurs don’t have access to capital as the banks become more transactional in their dealings. Without increased flow of credit to Small and Medium Scale Enterprises (SMEs), an economy tanks.

Those who clamour for recapitalisation insist that considering the level of inflation and erosion in the value of the Naira, the N25 billion capital base which was considered adequate 20 years ago has become a pittance. And they have a point: the N25 billion capital requirement two decades ago was only $190 million using the exchange rate at the time of N132 to $1. But as at January 24, 2024, $1 exchanged for N902.45.

That said, another school of thought holds firmly that whatever may be the extant exchange rate, capital adequacy is no longer the big issue because as at September 2023, Nigerian banks boast a cumulative capital base of about N11 trillion.

Among the country’s tier-1 banks, seductively called FUGAZ banks – an acronym for FBNH, UBA, GT Bank, Access Bank and Zenith Bank – GTCO boasts of a capital base of N1.27 trillion; FBN Holdings – N1.37 trillion; Access Holdings – N1.64 trillion; UBA – N1.78 trillion; and Zenith Bank boasts of N1.92 trillion.

A report on the top 10 largest banks in Nigeria based on their shareholder funds as at September 2023 done by Nairametrics shows that even tier-2 banks such as Fidelity Bank, FCMB, Stanbic IBTC have solid capital base. For instance, Fidelity Bank, which made a foray into international banking by acquiring the UK division of Union Bank of Nigeria in September 2023, had a capital base of N410.75 billion.

In reality, therefore, many Nigerian banks today are quite comfortable ahead of any recapitalization exercise leading some industry buffs to question the need. So, if government decides to go through with the process, it can only be déjà vu because the country has been here before.

Yet, the seeming lack of seriousness by the CBN to follow through is enervating. Aside the pronouncement, the government has not rolled out any plan to drive the process.

That is where Jeff & O’Brien Knowledge, UK, an international professional knowledge development firm that has pioneered financial, corporate and deep content knowledge development in Africa, steps in.

As a critical player and knowledge advisor in the sector, Jeff & O’Brien assisted in capacity building as well as sensitising operators and banking professionals with the necessary applicable expertise that enabled them take positions when the financial system travelled the consolidation route in 2004.

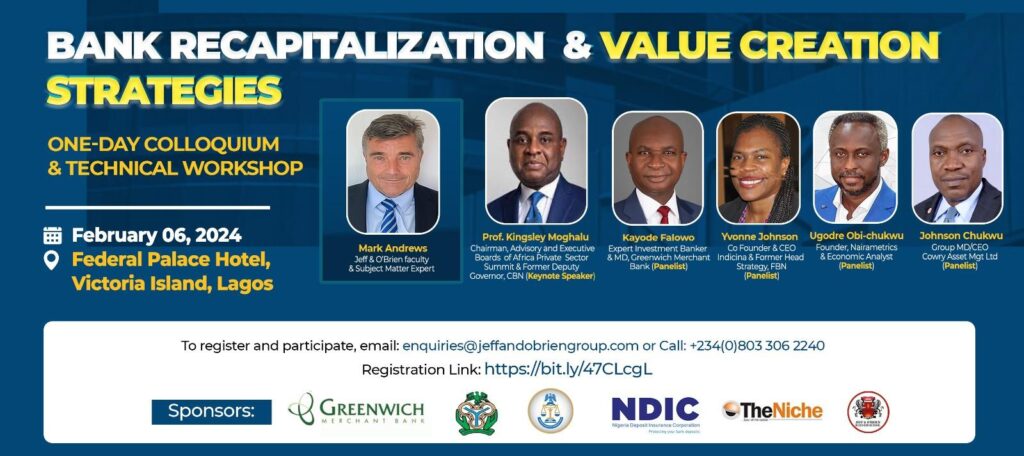

And recognising that the banking sector is at the cusp of yet another crucial phase in its evolution with the prospects of a recapitalisation exercise as a critical ingredient of CBN’s tool to ensure stability of the financial system and to enable it drive the proposed $1 trillion economy, as it was the case 20 years ago, Jeff & O’Brien has elected to organise a one-day colloquium and technical workshop in Lagos on “Bank recapitalisation and value creation strategies” with Prof Kingsley Moghalu, former Deputy Governor of the CBN, as the keynote speaker, and Mr Mark Andrews, Jeff & O’Brien faculty and subject matter expert, as the speaker.

Mr Pascal Odibo, the company’s Group Country Director, and host of the colloquium, says it “offers a rare opportunity for key stakeholders in the sector to understand the various moving parts for a bank recapitalisation both at technical and strategic levels in order to be able to make informed decisions that will enable the executive team and the board build stronger and virile financial institutions.”

But the elephant in the room is the unwillingness of the banks to contribute positively in building the economy. Without production, no economy grows and there can be no productivity without access to capital. So, for the Nigerian economy to blossom, beyond the issue of recapitalisation, the banks must perform their core duty of providing loans to businesses and consumers, which in turn will help in financing new investments and stimulating the economy. That is the only way an enhanced capital base of banks can add value to Nigeria’s economy and impact on living standards.