By Ishaya Ibrahim

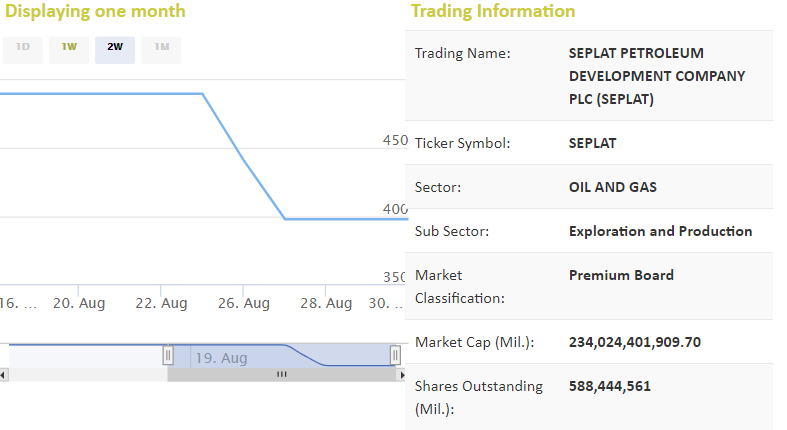

On Friday, August 23, the market shares of Seplat Petroleum and Development Company steadied at N490 per unit. It had remained so for the previous two weeks.

But the next trading day, August 26, Seplat shares fell by 10 percent to N441. The negative run would have continued but for the circuit breaker which is an automatic check when there is price instability in any security

On Tuesday, August 27, the free-fall continues. The stock had shed another 10 per cent, trading at N397 per unit.

In just two trading days, Seplat shareholders saw their security eroding at the speed of light, losing 20 per cent of the value of their stock.

What then is the trouble? The Federal High Court in Abuja had on August 15, granted the Asset Management Corporation of Nigeria (AMCON) the power to take over the assets of the chairman of Seplat, Ambrose Orjiako.

The order meant that AMCON would administer all the shares owned by Orjiako pending the determination of the case.

The following week, AMCON wrote a letter to the 29 bankers of Orjiako notifying them of the judgment and their intention to control the chairman’s accounts. Seplat shareholders didn’t like the music being played because they fear that they could accidentally be hit by a stray bullet. Some of them decided to walkway.

Seplat is one of Nigeria’s leading indigenous oil and gas companies.

In its 2019 half-year result, the company posted a 15 per cent profit which stimulated investors’ appetite for the company’s shares both in the Nigerian Stock Exchange (NSE) and the London Stock Exchange (LSE).

According to the unaudited consolidated result for the period ended 30 June 2019 which was made available to the NSE and LSE on July 30, the company reported a profit before tax of $121m (N37bn) from $105m (N32bn) in the first half of 2018.

The Company’s revenue for the period also appreciated by four per cent to $355m (N109bn), which is higher than the 2018 half-year figure of $343m (N105bn).

But the court order halted the honeymoon created by Seplat financial result for the half year in 2019.

By the court order, Francis Chuka, a Senior Advocate of Nigeria, would now be the Receiver/Manager of Mr Orjiako’s assets in Nigeria and abroad, including Shebah Exploration & Production Company Limited, owned by Orjiako.

Chuka would now manage Orjiako’s assets and receive every income due to him from his personal properties at Nos. 10C and 25A Lugard Avenue, Ikoyi, Lagos; his Parkview home, an oil vessel, MT Trinity Spirit, used as a floating, Production, Storage, and Offloading (FPSO) facility in Ukpokiti Oil Field belonging to Shebah Exploration & Production Company Limited.

Also affected are all movable and immovable assets of Shebah Exploration & Production Company Limited in and outside Nigeria, including the oil production facilities and other assets belonging to Shebah Exploration & Production Company Limited located in and around Ukpokiti Oil Field.

Orjiako is among Nigerians believed to be owing banks several trillions of naira from loans they took from them but find difficult to service.

AMCON has been striving to collect the loans on behalf of the banks but met with stiff hindrances until recently when the federal government enacted a law that empowered them to forcefully collect the loans in cash and property belonging to the debtors.