Naira free float shoots up states’ external debt, Lagos tops list with N829b

By Jeph Ajobaju, Chief Copy Editor

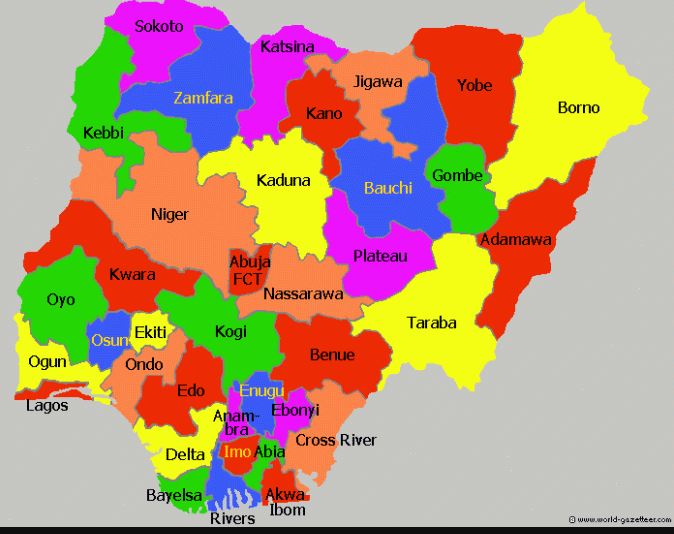

Free floating the naira on the foreign exchange (forex) market by the Central Bank of Nigeria (CBN) may increase the debts of the 36 states and the Federal Capital Territory (FCT) by 40 per cent in the coming months.

Their total debt has already shot up to N3 trillion.

On June 13, a day before the CBN changed its foreign exchange (forex) policy, the total external debt of the states was $4.46 billion (N2.09 trillion at N471/dollar) as of December 2022, according to Debt Management Office (DMO) data.

By June 16, the debt, while retaining its dollar value of $4.46 billion, had grown to N2.96 trillion at N663.04/dollar. This means states will need more revenue in local currency to pay their foreign debt.

The CBN on June 14 directed banks to remove the rate cap on the naira at the official Investors and Exporters’ (I&E) Window of the forex market to enable its free float against the dollar and other global currencies.

“The Central Bank of Nigeria wishes to inform all authorised dealers and the general public of the following immediate changes to operations in the Nigerian Foreign Exchange Market: Abolishment of segmentation. All segments are now collapsed into the Investors and Exporters window,” the apex bank said.

This led to an immediate decline in the value of the naira, falling from 471/$ to 664.04/$ at the I&E window, according to data from the FMDQ Exchange.

The naira has continued to rise and fall on the I&E window since last week.

Analysts and economists are divided on whether the naira will appreciate or depreciate in the coming months.

________________________________________________________________

Related articles:

CBN injects N701b into circulation to ease scarcity

NECA warns of long consequences of naira scarcity

Fintechs warn cashless policy may erode trust in banks

__________________________________________________________________

Breakdown of states’ debts

Per reporting by The PUNCH, the prevailing exchange rate means the external debts of states have grown in naira terms as follows:

- Lagos ($1.25 billion) – from N588.78 billion to N828.84 billion

- Kaduna ($573.74 million) – N270.23 billion to N380.42 billion

- Edo ($261.15 million) – N123 billion to N173.16 billion

- Cross River ($209.53 million) – N98.69 billion to N138.92 billion

- Bauchi ($165.78 million) – N78.08 billion to N109.92 billion

- Abia ($94.28m) – N44.41 billion to N62.51 billion

- Adamawa ($104.61 million) – N49.27 billion to N69.36 billion

- Akwa Ibom ($44.85 million) – N21.12 billion to N29.74 billion

- Anambra ($103.82 million) – N48.90 billion to N68.84 billion

- Bayelsa ($60.39 million) – N28.45 billion to N40.04 billion

- Benue ($29.94 million) – N14.10 billion to N19.85 billion

- Borno ($18.10 million) – N8.53 billion to N12 billion

- Delta (59.87 million) – N28.19 billion to N39.69 billion

- Ebonyi ($58.57 million) – N27.59 billion to N38.84 billion

- Ekiti ($105.59 million) – N49.73 billion to N70.01 billion

- Enugu ($120.86 million) – N56.92 billion to N80.13 billion

- Gombe ($32.48 million) – N15.29 billion to N21.54 billion

- Imo ($51.09 million) – N24.07 billion to N33.88 billion

- Jigawa ($26.99 million) – N12.71 billion to N17.89 billion

- Kano ($100.67 million) – N47.41 billion to N66.75 billion

- Katsina ($53.92 million) – N25.39 billion to N35.75 billion

- Kebbi ($40.93 million) – N19.28 billion to N27.14 billion

- Kogi ($52.79 million) – N24.87 billion to N35.01 billion

- Kwara ($44.87 million) – N21.13 billion to N29.75 billion

- Nassarawa ($52.99 million) – N24.96b billion to N35.14 billion

- Niger ($69.23 million) – N32.61 billion to N45.90 billion

- Ogun ($136.26 million) – N64.18 billion to N90.35 billion

- Ondo from ($90.68 million) – N42.71 billion to N60.13 billion

- Osun ($91.78 million) – N43.23 billion to N60.85 billion

- Oyo ($72.24 million) – N34.02 billion to N47.89 billion

- Plateau ($32.39 billion) – N15.26 billion to N21.48 billion

- Rivers ($87.13 million) – N41.04 billion to N57.77 billion

- Sokoto ($36.56 million) – N17.22 billion to N24.24 billion

- Taraba ($46.47 million) – N21.89 billion to N30.81 billion

- Yobe ($22.51 million) – N10.60 billion to N14.93 billion

- Zamfara ($28.86 million) – N13.59 billion to N19.14 billion

- FCT ($24.36 million) – N11.47 billion to N16.15 billion

Naira expected to stabilise around N600/dollar

The naira is currently on a free fall many analysts expect to eventually stabilise around N600/dollar.

“While it will take a few days for USD/NGN spot to settle, we fully expect an initial overshoot towards the parallel market rate of -750 or higher, after which, we expect USD/NGN to settle in the high 600s over [the] coming months,” JP Morgan said.

Naira forex convergence is expected to further increase the debt burden on states, and many of them are already struggling with revenue shortages.

Abia, Benue, Plateau, Taraba, Zamafara, Cross River, and Rivers that are owing backlogs of workers’ salaries will feel the debt burden more.