Inbound remittance, estimated at $32 billion in 2013 across Africa – with Nigeria getting $21 billion – is set to hit $41 billion by 2016.

This confirms that Nigerian banks are used to inbound money transfer remittance, few engage in outbound.

However, the new policy of the Central Bank of Nigeria (CBN) on the outbound business has thrown the segment open and United Bank for Africa (UBA) is the first bank to key into it.

UBA Group Managing Director/Chief Executive Officer (CEO), Phillips Oduoza, said remittance is very important to the bank and it is growing rapidly across the market.

The partnership between UBA and MoneyGram dates back 16 years, and it is the first bank to start remittance through MoneyGram.

Newly launched MoneyGram outbound money transfer service allows Nigerians to send money abroad through any UBA branch in Africa. The money is paid in the currency of the receiving country.

Naira can be sent to over 200 countries around the world through UBA branches in Nigeria or in the 18 other African countries where the bank operates or through any other MoneyGram agent bank.

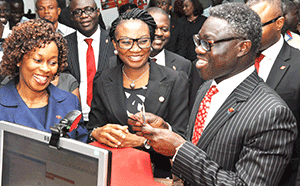

The launch of the service, held at UBA’s head office in Marina, Lagos, was hosted by Oduoza, who demonstrated how it works by sending money from Nigeria to Ghana.

He sent naira which was received in real time in Ghanaian cedis by the CEO of UBA Ghana. The transaction was witnessed by the media and other guests both in Ghana and Nigeria via video link.

Oduoza enthused that the service will boost trade and business between African countries, as many Nigerians who do business across the continent no longer have to move around with cash.

They can easily transfer money to their business partners in other African countries or in China, Europe, and America to pay for goods and services.

He described the service, called ‘Naija Sends’, as yet another testimony to the innovative, customer-centric disposition of both UBA and MoneyGram.

His words: “This service opens a new vista of opportunity for Nigerians to easily trade with other Africans and also trade with other parts of the world. It also offers a great platform to send money to loved ones abroad.

“As Africa’s global bank, we are proud to partner with MoneyGram to make this service available. It opens a whole new world of opportunities for our customers.”

MoneyGram Regional Manager (Anglophone West Africa), Kemi Okusanya, said the launch of ‘Naija Sends’ deepens the brand’s reach and service in Nigeria.

She recalled that “over the last two decades MoneyGram has facilitated over 15 million transactions in Nigeria, enabling safe, convenient and reliable transfer of funds from the Nigerian Diaspora to their loved ones.

“As Africa’s largest economy, with over 10 million migrants, we are glad we are now able to also offer Nigerians the opportunity to send money abroad to their loved ones and for business transactions.

“MoneyGram with over 300,000 locations in over 200 countries, partnering with UBA with over 700 business offices in 19 African countries and offices in New York, London and Paris, offers the best choice for Nigerian’s sending money abroad to loved ones.”

MoneyGram started operation in Nigeria in 1998 with UBA as its first agent bank partner. Today, its network includes 13 agent bank partners operating in about 5,000 locations.

Oduoza said the cost “is a very small amount. I am sure if you look at that it is going to be a very good and viable proposition for customers. If a customer is going to go a distance to do it he or she is going to spend to get to that particular distance.

“Secondly, if you are going to exchange it in the parallel market the exchange rate differential is going to be prohibitive. In this particular one you get the transaction done at the official rate which is a significant discount from parallel market rate.”

He reiterated that the advantage to the economy is that it is very easy, simple, and cost effective for a foreigner living in Nigeria to send a small amount of money to relations and friends.