Investor of $82 million in the Jos Electricity Distribution Company (Jos DISCO), Aura Energy Company (AURA), has placed its stake in the utility firm for sale for as low as $72 million as the bankruptcy and poor Returns on Investment (RoI) rocking the sector degenerated.

The Federal Government, it would be recalled, handed over assets of the Power Holding Company of Nigeria (PHCN) to the investors on Friday, November 1, 2013.

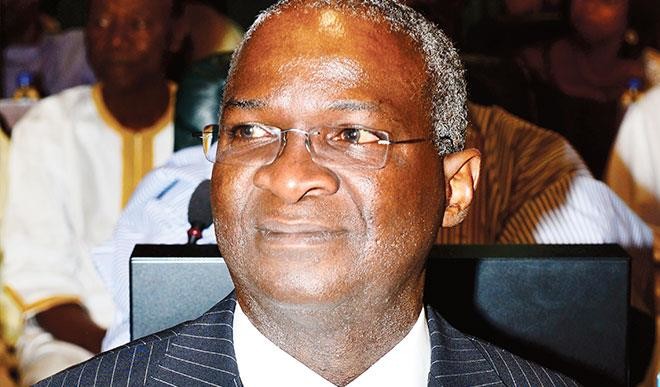

Four months into the fifth anniversary of the historic handover, Chairman, AURA who doubles as Chief Executive Officer of Jos Electricity Distribution Company Plc., Mr. Tukur Modibbo, yesterday declared plan by the investor to quit.

His company would be the second after Yola Electricity Distribution Company (Yola Disco) to quit.

Maintaining on the sideline of a news conference organised by the Association of Electricity Distributors (ANED) in Abuja that DISCOs were not bankable, Modibbo added that hence their inability to fully obtain the required funding to invest in their distribution networks.

The management of the company, he added, was ready to sell it off due to poor returns on investment.

He decried the poor rate of non-returns on investors’ funds in the distribution value chain of the power sector.

“The balance sheet of the DISCOs were not bankable, hence their inability to fully obtain the required funding to invest in their distribution networks,” he said.

According to him, Jos DISCO is ready to give up its license if the Federal Government could refund the money invested in the utility.

“We bought Jos DISCO for $82 million, we are ready to give it away for $72 million if we see buyers now, if government refunds the investors their money we will quit the business.”

He, however, called on the Minister of Power, Works and Housing, Mr. Babatunde Fashola to meet with the investors to hear their challenges with a view to evolving possible solutions to the challenges in the sector.

He said: “I was part of the team; we had to rely on records given to us by BPE. I can tell you that the records were not accurate as there was no technical audit of a financial audit of the firms when they were under PHCN.”

The estimated Aggregate Technical, Collection and Commercial (ATC&C) losses, customer enumeration and metering requirement by BPE, Modibbo said, were wrong, coupled with huge old legacy debts which the DISCOs took from the N213 billion CBN loan. The investors are currently paying interest for the sum taken from the CBN.

“We have invested much in the utility, but we have not made any gain,” he claimed, after about five years of being in the saddle.

.new telegraph