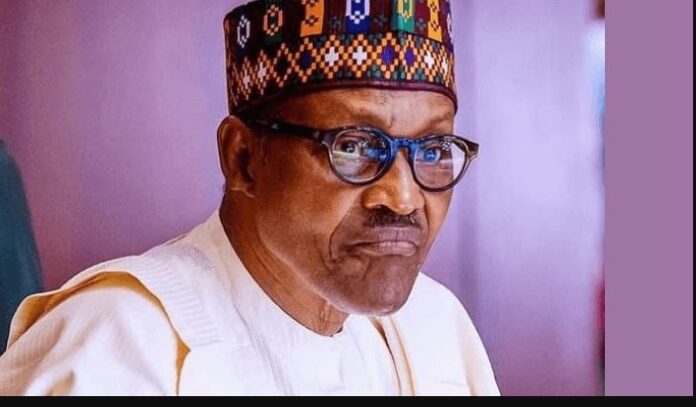

Buhari borrows N30.58tr, raises debt to N41.06tr

By Jeph Ajobaju, Chief Copy Editor

Muhammadu Buhari has borrowed N30.58 trillion to fund budget deficit since he became President on 29 May 2015, raising national debt from N12.12 trillion in June that year to N41.06 trillion in March 2022, according to government figures.

Total borrowing from the Central Bank of Nigeria (CBN) alone jumped from N648.26 billion in June 2015 to N19.01 trillion in April 2022.

The figures are collated from reports released by the Budget Office of Nigeria (BON), Debt Management Office (DMO), and the CBN.

Reports of budget implementation on the website of the Budget Office show the deficit in the seven years covering the following quarters:

- 2015 – Q3, Q4

- 2017 – Q4

- 2018 – Q4

- 2019 – Q4

- 2020 – Q4

- 2021 – Q1, Q2, Q3

- 2022 – January to April (4M)

The Buhari administration has spent N54.98 trillion on budget implementation since 2015, financed with N24.39 trillion, leaving a deficit of N30.58 trillion, according to Budget Office figures.

The data shows some of the spending as follows:

- N23.66 trillion – personnel costs, pensions, overhead costs, Presidential Amnesty Programme, other service-wide votes, and special interventions.

- N14.13 trillion – servicing domestic and foreign debts.

- N10.47 trillion – capital expenditure.

- Deficit financing – largely by borrowing.

____________________________________________________________

Related articles:

Federal treasury overshoots borrowing targets

Nigeria spends N3.82tr to service debt in 15 months

Buhari now spends 96% of revenue to service debt

__________________________________________________________________

CBN loans

“The FGN has arranged to raise short-term credit from the CBN through the mechanism of Ways and Means subject to a ceiling of 12.5 per cent of FGN’s revenue,” the budget implementation report for Q4 2015 said, per reporting by The PUNCH.

“This amount will be retired and therefore not considered as new borrowing outside the borrowing approved to finance the budget deficit.

“However, due to current fiscal challenges, the CBN had agreed to increase the Ways and Means advances threshold hence the FGN’s ability to raise N615.96 bn from this source.”

Debt rises to N41.06 trillion

Nigeria’s debt rose to N41.06 trillion in March 2022 from N12.12 trillion in June 2015, according to the DMO.

“Revenue generation remains the major fiscal constraint of the federation. The systemic resource mobilisation problem has been compounded by recent economic recessions,” Finance Minister Zainab Ahmed said when she presented the ‘Public Consultation on the Draft 2023-2025 MTFF/FSP’ in Abuja earlier in the year.

CBN Monetary Policy Committee (MPC) has since raised concerns about debt sustainability, saying the government needs to urgently diversify its revenue base.

Economists and finance experts also insist high deficit is not good for the economy and may cause inflation, recession, and slow down growth.

The views of two of them are reported below:

Akpan Ekpo (Professor of economics, University of Uyo)

“This shows that expenditure has eclipsed the revenue base, because they have to borrow, which is why there is a deficit,” Akpan told The PUNCH.

“They can’t raise enough domestic resources to finance spending. That gap is deficit.

“Talking about GDP, by the rules, it should not be more than a certain percentage of GDP, but it has exceeded that. And when you borrow, you have expectations of borrowing because if you are not transparent, we don’t know what you are borrowing for.

“If you are borrowing to finance recurrent and overhead, it is not good for the economy. If you borrow to finance capital projects, in the long run, even if you have a deficit, it will have a positive multiplier effect. The deficit, if it is used to finance recurrent, is problematic to the economy.

“One way of solving that is to raise more of domestic revenue or cut down on expenditure that is not needed, especially, the cost of governance.

“There is a need to check the expenditure profile and cut down on it. Or we could do expenditure switching, where unimportant items are switched with important items.

“We are spending more than we can raise resources and we are not spending it on hard infrastructure.”

Olalekan Aworinde (Associate Professor of economics, Pan-Atlantic University, Lagos)

“The deficit is being financed by borrowing, sales of government properties, or printing money. Any of these options has implications for the economy.

“Loans can be good and can be bad. A loan is good if it is used for productive expenditure, but if it is used for recurrent expenditure or consumption expenditure, this is not bringing back any returns.

“If the component of this deficit is majorly recurrent expenditures, it shows that we are unlikely to have any growth. There isn’t going to be any revenue coming out from there.

“The implication of this is that we are likely going to have stunted growth. Stunted growth in the sense that we are not likely going to have an increase in the total values of goods and services that are produced in the country.

“If care is not taken, we are likely going to slide into recession.

“Financing the deficit through sales of government properties would mean the government is reducing its assets base, which does not speak well for the economy.”