He came short of repeating but almost paraphrased John F. Kennedy in that famous 1961 inaugural speech: “And so, my fellow Americans: ask not what your country can do for you – ask what you can do for your country.”

If he wanted to, he would have put it this way: Fellow Nigerians: think not of how to deprive your country of your tax resources, but think of how to increase your country’s revenue by diligently paying your taxes.

He didn’t say it exactly that way; so, I cannot quote him; but if he said it – and he almost said it, in fact he said it but in a different way. He said it the way an experienced tax-collector would say; because for sure, he is Nigeria’s chief tax collector.

I love it when people, especially professionals, speak their minds freely. I heard one of such speeches on Wednesday last week – or was it really a speech? I think it was an amalgamation of thoughts and comments – the types you hear at cocktail parties and later ask: did I hear him well?

Certainly, tax evaders – and they are many in this country, will not like the manner Sunday Samuel Ogungbesan spoke when he hosted, in his office, some editors of the Nigerian media.

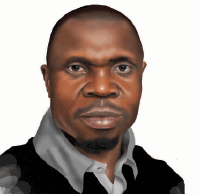

By the way, Ogungbesan is Nigeria’s chief tax collector who goes by the grandiose bureaucratic title of: acting executive chairman of the Federal Inland Revenue Service (FIRS). Having just been appointed, he needed to announce his agenda. So, he sent for journalists.

By inviting us to announce his policies regarding tax payment, he was indirectly sending a message to the media houses that they would not be excused from the big stick about to be wielded.

It was a fun-loaded event; but not without serious issues. Ogungbesan joked without allowing the communication to lose its intent. He said at FIRS, they call themselves nation builders, not tax collectors because “tax assessment and collection just happens to be our role in the mix.”

As the laughter reduced in intensity, he made it clear to the select crowd that on his watch: “tax evaders will have no hiding space. I promise you, working with my team; we will ensure that that happens. We are constantly reviewing tax laws. We will continue to prosecute tax offenders.”

He continued: “As a team of committed nation builders through sustainable revenue provision, collection of taxes is the only reason for which the FIRS was established…we will work to realise our mandate, which I repeat, is to assess, collect and account for taxes collected.”

He kept emphasising professionalism “in all that we do.” Ogungbesan sounded like a man in a hurry. As Emma Obeta, the FIRS director of communications, described him to journalists, he has the experience, the passion and the willingness to get things done.

Inside that hall, I sent a text message to one staff of FIRS who wanted to know what editors were doing at the Revenue House. I asked: can this man do this job; can he be trusted? The reply: “he is knowledgeable; quite the perfect dude for the job.”

With over 30 years’ experience in tax business, Ogungbesan does not carry any air of self-importance. He walked into the conference hall like any other staff of FIRS, smiling; except that he is not quite as tall; a situation that almost made his suit look longer.

Out of that friendly frame emerged words that could scare tax evaders and thrill budget makers. As I watched him answer questions, I recalled the words of Hurston Clarke, author of the remarkable book, Ask Not, that analysed Kennedy’s inaugural speech.

Clarke states that words are mighty, but their power waxes and wanes with time. Words can move different audiences, and generations, in different ways.

Ogungbesan’s words on Wednesday moved us to believe that tax evasion has, overnight, become a very dangerous enterprise. The man has even gone far to embrace certain technologies that would block all escape routes.

Hear him again: “I enjoin taxpayers, corporate and individuals to abide by the law. But I assure you: tax dodgers will have no space under this regime.

“Everyone who lives within the space called Nigeria and who travels on a road, fly in an airport, transact business within the socio-economic space called Nigeria, enjoys the law and order provided by government, must step up to the plate, be a good citizen and pay his or her taxes.”

Then he made a commitment: “I promise to run a professional, competent and 21st Century tax agency, which every Nigerian, every African and all developing and developed economies will be proud of.”

The chief tax collector said during his era, the use of force in tax collection will only be applied in serious cases of non-compliance: “where force is advocated, we will also respond with force. I don’t like the use of force; but if you challenge me, I may have to respond.”

He promised to “explore different avenues to do business with tax payers. We have been closing down business premises but that has more negative effects than positive because people must do more businesses to pay more tax.”

As I left the venue of the interaction with a bag loaded with publications on taxation, I kept wondering whether Ogungbesan can walk the talk. If he does – and he looked serious enough to be taken seriously – then something is about to happen.