By Jeph Ajobaju, Chief Copy Editor

First Bank grew USSD banking customer base by 1,025,889 by June to a total 12.267 million in half year 2021 (H1 2021), up from 9.5 million in 2020, with bright prospects for a bigger share of this market as more Nigerians own telephone lines.

The impressive growth reflects the trust the general public and customers have both in First Bank itself and in its digital banking platform, based on a solid image built over a century.

Users of Unstructured Supplementary Service Data (USSD) form 40.66 per cent of the bank’s total 30 million customers served across all platforms through more than 750 business locations and more than 100,000 Banking Agents nationwide.

There are 192 million mobile phone subscribers in Nigeria as of May 2021, representing 90 per cent of the population of 211 million, according to the Nigerian Communications Commission (NCC).

But a report by OpenSignal shows that 66 per cent of mobile phones in Nigeria are dual SIM phones, which ranks Nigeria with the highest number of dual SIM phone users in the world, followed by Bangladesh and Tanzania.

Besides, many Nigerians have more than one handset as well as multiple lines. In reality, 192 million active lines translate into about half that number of people or 96 million, which is 45 per cent of the total population of 211 million.

The total 12.267 million customers of First Bank who make transactions through USSD are actual number of people. In contrast, only about half the 192 million active mobile lines in Nigeria may translate into actual number of people.

So, the actual 40.66 per cent among the actual 30 million customers of First Bank who do mobile banking is roughly equivalent to the 45 per cent actual number of people in the country who have mobile telephone lines.

In percentage terms, therefore, First Bank is doing well with its ratio of customers using USSD for transactions, and is on fertile ground to grow the segment much larger as the actual number of people in Nigeria who have phone lines increases.

USSD allows users with a feature or smartphone to do mobile banking through a code without data/internet connection. It can be used to transfer funds, obtain account balance, bank statement, among other uses, according to bankbazaar.com.

Transactions through First Bank’s USSD code *894# enable financial inclusion of the underbanked and economically weaker sections of society and integrates them into mainstream banking.

Per month, the average Value of transactions in the bank’s mobile banking service in monetary terms is N370,543 and the average Volume of transactions is N99,746.

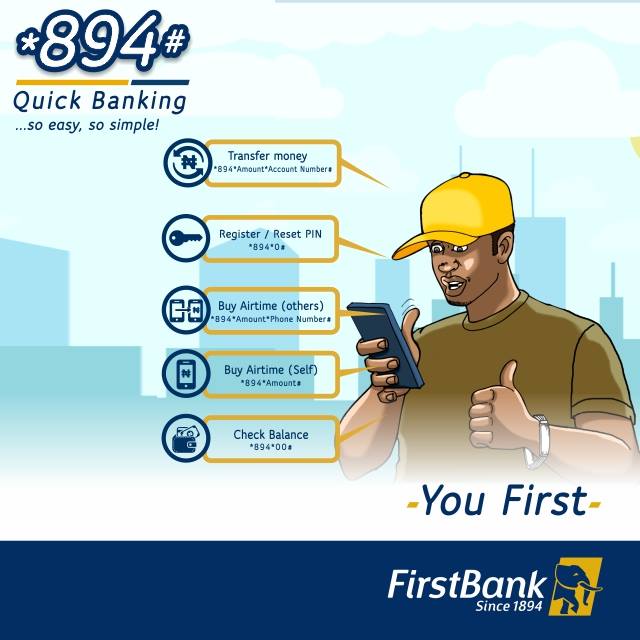

*894# Banking

Features

• Airtime recharge self – 894Amount#

• Airtime recharge third party – 894Amount*PhoneNumber#

• Funds transfer – 894amount*AccountNumber#

• Data vending self – 8942#

• Data vending third party – 8942*PhoneNumber#

• Account opening, enrollment and PIN reset – 8940#

• Balance enquiry – 89400#

• Mini statement – 894AccountNumber#

• Account number enquiry – *894#

• BVN enquiry – *894#

• Self-Opt-Out – 894911#

• First Advance

• Merchant payments – 894Merchant ID*Amount

Popularity of USSD banking

Chuma Ezirim, First Bank Group Executive (e-Business, Retail Products), disclosed that by April 2020, the *894# USSD quick banking service was being used by 9.5 million customers.

He said in a statement issued in Lagos that this clearly demonstrated the bank’s leadership in electronic banking, per reporting by the News Agency of Nigeria (NAN).

He reiterated that the USSD service, launched in January 2015, is an easy to use, convenient, fast, user-friendly mobile banking channel through which various banking activities are carried out on a mobile phone.

The USSD can be used across the four major mobile networks in the country without the use of the internet, he added.

His words: “Customers are able to enjoy a wide range of banking services using the bank’s *894# USSD banking.

“These services include data and airtime top-up for self and third-party individuals, quick balance enquiry, fund transfers and BVN enquiry, among others.

“At First Bank, we are excited about the impact our innovative solutions are making in the Nigerian payment landscape.

“Our *894# USSD banking has been a viable platform through which we take our banking services to the doorstep of our customers, right on the palm of their hands, without the limitation of an internet connection.

“We remain committed to creating various avenues to enable Nigerians carry out various financial activities conveniently, safely and securely anytime, anywhere in Nigeria.”

Quick, Convenient, Secure, Easy

On its website – https://www.firstbanknigeria.com/personal/ways-to-bank/ussd/ – First Bank pitches its USSD code 894 as a quick, convenient, secure and easy way to perform your banking transactions.

It says with the code, one can transfer money, check balance, buy airtime, pay bills and do lots more anytime and anywhere, using any type of phone without need for internet connectivity or data.

Customers can also dial *894# and get access to Quick Banking services in a menu-based layout without having to dial the codes.

When dialed, two options are displayed for the customer to choose from:

· Quick Banking – Follow prompts to access the listed services for FirstBank account holders ONLY.

· FirstMonie – For electronic wallet-based transactions. This product is available to both account holders and non-account holders.

“Once you have a First Bank account with a linked debit card, a phone number profiled for SMS alert and a mobile phone, you are just one dial away from enjoying the unbeatable 894 experience.

“Simply dial 8940# to get started!”, the bank says.

Answers to frequently asked questions

First Bank also provides on the website the following answers to frequently asked questions (FAQs):

What is 894?

894 is a quick, convenient, secure and easy way to perform your banking transactions (transfer money, check balance, buy airtime, pay bills and lots more) anytime and anywhere, using any type of phone without internet (data).

Who can use this service?

All individual account holders with phone numbers enrolled on the bank’s SMS alert platform.

Joint, corporate, and multiple signatory accounts are not eligible for this service.

What services are available on 894?

You can transfer money, buy airtime for yourself and others, check your account balances, make purchases, pay your bills, open accounts, and lots more.

Can I use the service on more than one of my accounts?

Yes, you can.

How do I enroll for 894 services?

If you have an existing First Bank debit card(s) linked to your account(s):

· Simply dial 8940#

· A list of masked debit card numbers linked to your account is displayed

· Select your preferred debit card

· Enter the 4-digit Personal Identification Number (PIN) for the selected debit card

· Create a new 5-digit PIN

· Your number is now LIVE on the First Bank USSD Quick Banking Service

Is this service available on all mobile networks?

Yes, all subscribers of Airtel, MTN, Globacom, and 9mobile networks can use and enjoy the services.

How secure is the 894 Mobile Banking?

894 is secure as it requires registration and PIN authentication on all your banking transactions.

Who do I contact for support or enquiries?

Please call 0700FIRSTCONTACT (0700-34778-2668228), or email firstcontact@firstbanknigeria.com

You may also visit the nearest First Bank branch