By Jeph Ajobaju, Chief Copy Editor

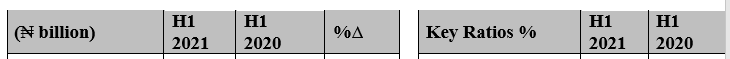

FBN Holdings (FBNH) – a conglomerate of insurance, asset management, commercial banking, and other financial portfolios – has declared N45.2 billion profit before tax for half year ended June 2021 (H1 2021), a 9.2 per cent rise on ₦41.4 billion made in H1 2020.

Profit after tax notched N38.1 billion, up 6.9 per cent year-on-year (y-o-y) against N35.6 billion in H1 2020, which Group Managing Director Urum Eke described as “a resilient performance in the half year, reflective of our focus on strengthening the organisation in recent years.”

FBN Holdings subsidiaries include insurance (FBN Insurance and FBN General Insurance), commercial banking (First Bank), merchant banking and asset management (FBNQuest Merchant Bank Group, FBNQuest Capital Group and FBNQuest Trustees).

Gross earnings were down 1.7 per cent to ₦291.2 billion, compared to ₦296.4 billion in H1 2020. Net-interest income also dipped 20.9 per cent to ₦103.8 billion against ₦131.3 billion in H1 2020. But operating expenses rose 9.6 per cent to ₦152.6 billion above ₦139.2 billion in H1 2020.

Other indices that grew include

- Total assets ₦8.0 trillion (4.4 per cent)

- Customer deposits ₦5.1 trillion (3.7 per cent)

- Customer loans and advances ₦2.5 trillion (14.5 per cent)

- Non-interest income ₦118.7 billion (48.1 per cent)

- Operating income ₦222.5 billion (5.3 per cent)

“We remain committed to our strategic objective of driving further stability in performance, as well as delivering sustainable growth over the years to come,” Eke added.

“In line with our focus on revenue diversification, we continue to grow our non-interest income as we progressively become a more transaction-led institution and implement innovative and technological driven measures to improve overall efficiency.

“The macro and socio-economic conditions remain challenging given the COVID-19 pandemic and the low-interest rates environment.

“While these points negatively impacted overall revenue generation, we are confident that FBNHoldings can navigate this challenging operating environment and keep delivering sustained innovative solutions that enrich customer experience as well as deepen financial inclusion.

“During the period, the CBN appointed new non-executive Directors at FBNHoldings and FirstBank, and retained the Executive Management.

“As we transition from the clean-up phase, after firmly stabilising and strengthening the institution, we forge ahead with vigor and unwavering commitment to deliver growth, enhance profitability and restore the organisation to its leadership position.”

Income Statement

• Gross earnings of ₦291.2 billion, down 1.7% year-on-year (y-o-y) (Jun: 2020: ₦296.4 billion)

• Net-interest income of ₦103.8 billion, down 20.9% y-o-y Jun 2020: ₦131.3 billion)

• Non-interest income of ₦118.7 billion, up 48.1% y-o-y (Jun 2020: ₦80.1 billion)

• Operating income of ₦222.5 billion, up 5.3% y-o-y (Jun 2020: ₦211.4 billion)

• Impairment charges for losses ₦24.5 billion, down by 20.0% y-o-y (Jun 2020: ₦30.7 billion)

• Operating expenses of ₦152.6 billion, up 9.6% y-o-y (Jun 2020: ₦139.2 billion)

• Profit before tax of ₦45.2 billion, up 9.2% y-o-y (Jun 2020: ₦41.4 billion)

• Profit after tax ₦38.1 billion, up 6.9% y-o-y (Jun 220: ₦35.6 billion)

Statement Of Financial Position

• Total assets of ₦8.0 trillion, up 4.4% y-o-y (Dec 2020: ₦7.7 trillion)

• Customer deposits of ₦5.1 trillion, up 3.7% y-o-y (Dec 2020: ₦4.9 trillion)

• Customer loans and advances (Net) of ₦2.5 trillion, up 14.5% y-o-y (Dec 2020: ₦2.2 trillion)

Key Ratios

• Post-tax return on average equity of 9.9% (Jun 2020: 14.5%)

• Post-tax return on average assets of 1.0% (Jun 2020: 1.5%)

• Net-interest margin of 4.4% (Jun 2020: 6.8%)

• Cost to income ratio of 68.6% (Jun 2020: 65.8%)

• NPL ratio of 7.2% (Jun 2020: 8.8%)

• 15.7% Capital Adequacy Ratio (FirstBank Nigeria) (Jun 2020: 16.5%)

• 21.4 % Capital Adequacy Ratio (FBNQuest Merchant Bank) (Jun 2020: 17.2%)

Selected Financial Summary

Income Statement

Business Groups

Commercial Banking

- Gross earnings of ₦273.9 billion, down 1.7% y-o-y (Jun 2020: ₦278.7 billion)

- Net interest income of ₦102.4 billion, down 18.8% y-o-y (Jun 2020: ₦126.1 billion)

- Non-interest income of ₦109.3 billion, up 50.1% y-o-y (Jun 2020: ₦72.8 billion)

- Operating expenses of ₦145.3 billion, up 10.0% y-o-y (Jun 2020: ₦132.1 billion)

- Profit before tax of ₦42.9 billion, up 17.9% y-o-y (Jun 2020: ₦36.4 billion)

- Profit after tax of ₦37.4 billion, up 14.9% y-o-y (Jun 2020: ₦32.6 billion)

- Total assets of ₦7.7 trillion, up 12.5% y-t-d (Dec 2020: ₦6.8 trillion)

- Customers’ loans and advances (net) of ₦2.5 trillion, up 26.4% y-t-d (Dec 2020: ₦2.0 trillion)

- Customers’ deposits of ₦4.9 trillion, up 15.2% y-t-d (Dec 2020: ₦4.2 trillion)

“The Commercial Banking Group’s financial performance in H1 was impressive with a 17.9% and 14.9% uplift in PBT and PAT, respectively,” explained Adesola Adeduntan, Chief Executive Officer of FirstBank and its subsidiaries.

“These results were delivered despite the challenging macro-economic conditions that were further exacerbated by the negative impacts of the COVID-19 pandemic as well as the prevailing low yield environment which continues to compress margins.

“The effects of these factors resulted in the slight drop recorded in gross earnings and net interest income.

“That said, the benefits of the Bank’s investments in strong transactional and digital banking capabilities reflected in the solid 50.1% growth in non-interest income, and supported the 15.2%, 26.4% and 12.5% growth in customers’ deposits, loans and advances to customers and total assets, respectively.

“Going into the second half of 2021, the Bank will fully harness the returns from the strong and quality risk assets portfolio created in the first half of the year, taking advantage of the uptick in interest rates.

“Accelerated growth in the second half of the year will also be supported by the Bank’s dominance and increased opportunities in the financial inclusion and digital banking businesses.”

Merchant Banking & Asset Management (MBAM)/FBNQuest

- Gross earnings of ₦18.3 billion, up 4.9% y-o-y (Jun 2020: ₦17.5 billion)

- Profit before tax of ₦4.9 billion, down 19.4% y-o-y (Jun 2020: ₦6.1 billion)

- Profit after tax of ₦3.3 billion, down 21.1% y-o-y (Jun 2020: ₦4.2 billion)

- Total assets of ₦362.4 billion, up 9.6% y-t-d (Dec 2020: ₦330.7 billion)

Explainer

[1] Non-interest income is net of fee and commission expenses

[2] Operating income defined as net interest income plus non-interest income

[3] Profit after tax from continuing operations

[4] Basic EPS computed as profit after tax divided by weighted average number of shares in issue (from continuing operations)

FBN Holdings

FBN Holdings is the most diversified financial services group in Nigeria. FBN Holdings Plc. was incorporated in Nigeria on October 14, 2010, following the business reorganisation of the FirstBank Group into a holding company structure.

The Company was listed on the Nigerian Stock Exchange (NSE) under the ‘Other Financial services’ sector on November 26, 2012 and now has in issue and fully paid-up share capital of 35,895,292,792 ordinary shares of 50 kobo each (N17,947,646,396).

More information can be found on the website www.fbnholdings.com.

The subsidiaries of FBNHoldings offer a broad range of products and services across

- Commercial banking in 10 countries (Lagos, Nigeria; London, United Kingdom; Paris, France; Beijing, China; Kinshasa, Democratic Republic of Congo, Accra, Ghana; Banjul, Gambia, Conakry, Guinea, Freetown, Sierra Leone; and Dakar, Senegal),

- Merchant Banking, Capital Markets, Trusteeship as well as insurance brokerage.

The Group, with about 8,306 staff, has 818 business locations (591 local branches, 144 QSPs and agencies for FirstBank (Nigeria) and 83 (local and international) subsidiary locations).

Prior to June 1, 2020, FBN Insurance and FBN General Insurance were subsidiaries of FBNHoldings (both owned by FBNHoldings 65% and Sanlam 35%).

However, FBN Insurance Brokers remains a subsidiary of the FBN Holdings offering broking and advisory services to the Group’s captive businesses and other clients.

Commercial Banking

Commercial banking comprises First Bank of Nigeria Limited, FBNBank (UK), FBNBank DRC, bank subsidiaries in West Africa, a representative office in Beijing, a branch office in Paris as well as First Pension Fund Custodian.

This group provides both individual and corporate clients/customers with financial intermediation services. This business segment includes the group’s local, international and representative offices with operations in 10 countries offering commercial banking services.

Merchant Banking & Asset Management

Merchant bank & asset management comprises FBNQuest Merchant Bank Group, FBNQuest Capital Group and FBNQuest Trustees.

These are wholly owned by the holding company.

FBNQuest Merchant Bank Group comprises FBNQuest Merchant Bank and its subsidiaries, FBNQuest Securities and FBNQuest Asset Management.

FBNQuest Capital Group comprises FBNQuest Capital and its subsidiaries FBN Funds and FBN Capital Partners.

The Group creates value by providing advice, finance, trading, investing and securing services to large institutions (corporations and government agencies) and individuals.