Increasing use of the dollar in domestic transactions, and poor outlook of growth in domestic economy combined to make the Central Bank of Nigeria ( CBN ) lose sleep in recent times.

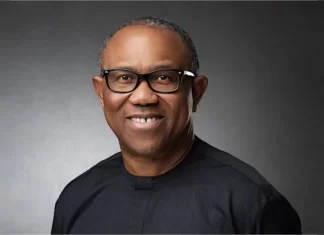

CBN Governor, Godwin Emefiele, told newsmen at the end of Monetary Policy Committee (MPC) meeting in Abuja on Tuesday that weakness of the naira has fuelled the illegal use of dollars in day-to-day domestic transactions.

According to the apex regulator who described the development as illegal, people now pay rent, school fees, and other major expenses in dollar, adding that action would soon be taken against defaulters.

“The CBN will very soon in due course come after them,” Emefiele vowed.

He also expressed worries about the outlook of economic growth, but added that investment and business confidence should pick up once the presidential elections are over this weekend.

“I’m optimistic that after the elections, confidence will improve, businesses will resume,” he said. “I’m confident the economy will be resilient,” CBN governor emphasised.

Key policy decisions retained

The MPC maintained the MPR at 13%, while retaining CRR on public and private deposits at 75% and 20% respectively with liquidity ratio also sustained at 30%.

The committee noted inflationary pressure aggravated by elevated spending ahead of March 28 election but hiped that tight monetary policy should offset the effects.

It also observed that its previous decisions needed the passage of time to fully permeate and shape the economy.

It however expressed concerns about the outlook for growth which had moderated on the back of the fall in global oil prices, unfavourable FX rate and election related headwinds.

The MPC also noted its dissatisfaction regarding the growing spread between the interbank and BDC rates which now provides an avenue for arbitrage and speculative bargaining in the FX market.

Nevertheless, Emefiele said the MPC was satisfied with efforts to stabilise the naira that has been under serious pressure in the last six months following oil prices slump.

Inflationary pressure has intensified after naira dropped from N165 to the dollar less than a year ago to N198 this week, about N206 in the interbank market last month and weaker than N220 in the black markets.

Commenting on the outcome of the meeting, analysts at Meristem Securities Limited stated in an email note that “We do not expect the latest decision of the MPC to have significant impact on the financial markets as the outcome was largely expected.”