By Jude-Ken Ojinnaka

A Federal High Court sitting in Lagos has dismissed the Notice of Preliminary Objection raised by Union Bank of Nigeria Plc, praying the court to dismiss Suit No. FHC/L/CS/1460/21 instituted against it by Rokana Industries Plc.

In a ruling delivered Thursday by Justice Chukwujekwu Aneke on the Union Bank’s Notice of Preliminary Objection, the court held that the instant suit number FHC/ L/ CS/1460/21 filed by Rokana Industries Plc against the bank “is not an abuse of process of the court”.

Rokana Industries Plc had on October 20, 2021 filed a writ of summons dated same day. It filed the writ of summons along with its Statement of Claim and other processes against the bank.

The reliefs sought by Rokana Industries Plc (Plaintiff) against Union Bank of Nigeria Plc (defendant) include: “A declaration that the fraudulent excess, unlawful and illegal interest charges and the fraudulent excess, unlawful and Illegal C.O.T and VAT charges built into the Plaintiff’s accounts referred to in the Statement of Claim and the failure of the defendant to refund the said funds to the Plaintiff is contrary to the Central Bank of Nigeria (CBN), Monetary, Credit, Foreign Trade and Exchange Regulations for fiscal years 2012, 2016 and 2020/2021.

“Based on the CBN Guidelines referred to above, an Order mandating the defendant to pay the sum of N2, 019,187,215.64 being the spurious excess, illegal, fraudulent and unlawful interests, C.O.T. and VAT charges and underpaid credit interests by the defendant on the Plaintiff’s accounts as at October 31,2021 and interest thereon and a further 100 percent of the said amount as a result of the failure of the defendant to pay/return or refund the aforesaid excess interest charges, C.O.T and VAT within two weeks of becoming aware of the aforesaid excess interest charges,COT and VAT in accordance with the Central Bank of Nigeria Monetary Policy No. 39, paragraph 3.2.4(g) and or circular No 41, paragraph 3.2.5(g) issued in January 2012 and January 2016 respectively.

” Consequent upon prayers (I) and (ii) above, a declaration that the Plaintiff is not indebted to the defendant at all and that the Plaintiff is discharged from all liabilities arising from the Mortgage Debenture Deed dated 16th day of November 2005 between the Plaintiff and the defendant and as such, the defendant has no right whatsoever to claim any right or take any benefit from the said Mortgage Debenture Deed any longer and consequently, the defendant should return the Plaintiff’s title deeds in respect of the property comprised in the Mortgage Debenture Deed to the Plaintiff.

“An Order of perpetual injunction restraining the defendant either itself, agents, servants and/ or privies from selling or offering for sale or disposing or trying to dispose of the Plaintiff and its assets including its land comprised in or referred to in the Mortgage Debenture Deed dated 16th November, 2005 or any part thereof which land measures approximately 2.9871 hectares covered by the Certificate of Occupancy registered at No 1, page 1 in Volume 157 at the Land Registry Office Owerri which is more particularly described and delineated in a survey plan attached to the Certificate of Occupancy dated 24/5/85 drawn by Nze J.O. Agugua (Licensed Survey) and from taking any step whatsoever to enforce or assert any right arising from the aforesaid Mortgage Debenture Deed dated 16th November, 2005.

“An Order commanding the defendant to take all necessary legal and equitable steps to discharge the Plaintiff’s property from all legal and equitable encumbrances arising from the mortgage of the said property and in particular, issue a deed of release of the said property to the Plaintiff.

“An Order mandating the defendant to write a letter of apology to the Plaintiff with respect to the excess spurious, illegal and unlawful interest charges, C.O.T and VAT which the defendant built into the accounts of the Plaintiff referred to in paragraph 62 of its claim.

“A 49 percent interest on the total amount claimed in paragraph 62(ii) from the 31st October 2021 till judgement is delivered and a post judgement interest at the rate of 10 percent from the date of judgement until the final liquidation of the judgement sum.

“A N100 million general damages.

“A N1 billion punitive and exemplary damages for unjust enrichment, deceit, fraud and breach of the Banker/Customer relationship between the parties and for the wanton mismanagement of the Plaintiff’s account by the defendant.”

Reacting to the Suit/Claim of the Plaintiff against it, Union Bank of Nigeria filed a Notice of Preliminary Objection dated and filed May 18, 2022 in which it prayed the court for the following reliefs:

“An Order dismissing this suit in its entirety for abuse of court process and want of jurisdiction.

“And for such further Order(s) as the honourable court may deem fit to make in the circumstances of the case.

Stating the grounds upon which it filed the Preliminary Objection, Union Bank averred that “the subject matter of the Plaintiff’s claim is the same and or tied inextricably to the subject matter of Suit No HOW/613/2014 , between Mr Charles Chukwuemeka Ugwu v Union Bank of Nigeria and Rokana Industries Plc which is pending at the Owerri High Court in Imo State.

“That both the applicant and the plaintiff herein are parties and the issues and subject matter of the Suit herein are the same as the issues and subject matter in Suit No HOW/613/2014 referred above, pending at the Owerri High Court in Imo State.

“That the Plaintiff was aware of the pendency of the Suit No HOW/613/2014 at the Owerri High Court in Imo State before commencing this action.

“That further to the above averments, this Suit is an abuse of process of this Honourable Court”.

Union Bank supported its preliminary objection with a 17 paragraph affidavit and deposed to by one Jeremiah Zephaniah, a staff of the bank and 3 exhibits attached.

The bank states that in the above mentioned suit at Owerri, it averred that the sum of N449,867,415.21 representing the debt balance in the Rokana Industries Plc account with the bank as at November 30, 2014, which was as a result of credit facilities granted to the Plaintiff herein by the bank at the request of the 2nd defendant (plaintiff herein) and on the personal guarantee of the claimant therein, Mr Charles Chukwuemeka Ugwu, former Chairman of the Board of Directors of Rokana Industries Plc.

It further sought interest on the above said debt at rate of 27.5 percent per annum with monthly interest from December 1, 2014 to date of judgement and thereafter, interest at the rate of 10 percent per annum from the date of judgement until the judgement debt is liquidated.

On same May 18, 2022, the bank (defendant) filed a written address in which it raised one issue for determination, which is ” whether the claimant’s suit should not be dismissed for lack of jurisdiction on the grounds that same is abuse of court process”

The bank cited plethora of authorities to buttress its argument and finally submitted that the order which the court should make where it finds that an action before it is an abuse of process of court, is a dismissal.

Also in its written address dated and filed on July 6, 2022 in opposition to defendant’s preliminary objection, the Plaintiff framed one issue for determination, which is” whether this suit is an abuse of court process based on the pendency of Suit No HOW/613/2014, between Mr Charles Chukwuemeka Ugwu v Union Bank of Nigeria and Rokana Industries Plc.

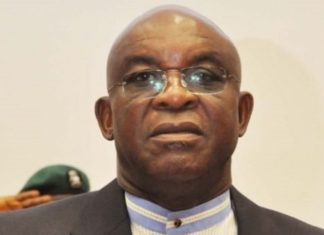

Dwelling into the merits and demerits of the defendant’s preliminary objection in his ruling, the judge raised only one issue for determination, which is ” Whether the instant suit is competently before this court in view of the pendency of Suit No HOW/613/2014, between Mr Charles Chukwuemeka Ugwu v Union Bank of Nigeria Plc and Rokana Industries Plc at the High Court of Imo State, Owerri at the time the instant suit was filed.

In determining the issue, the judge held that having seen Exhibit A1 which is the Originating Processes in Suit No HOW/613/2014 referred to in paragraph 7 of the affidavit in support of the preliminary objection, noted that in Suit No HOW/613/2014, the Claimant is one Mr Charles Chukwuemeka Ugwu, the 1st defendant is Union Bank of Nigeria Plc, while the 2nd defendant is Rokana Industries Plc.

“There is no doubt that the Claimant in Suit No HOW/613/2014 is not a party in the instant suit.

“This court is of the opinion that this suit is not an abuse of process of the court.

“It is for this reason that this court will assume jurisdiction to entertain this suit and accordingly the defendant Notice of Preliminary Objection dated and filed on the 18 – 5 – 2022 is hereby dismissed.

“Cost of N50,000 is awarded in favour of the Plaintiff against the defendant”, the court ruled.