Tinubu supporter EIU says his political capital is dwindling, and market reform lacks momentum

By Jeph Ajobaju, Chief Copy Editor

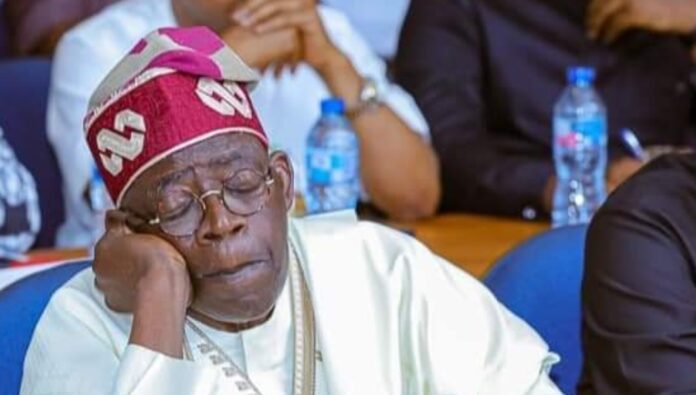

Bola Tinubu won election for President with only 36.6 per cent of the vote, and his “meagre political capital” is already wearing thin as a daring economic reform agenda clashes with unions, according to the Economist Intelligence Unit (EIU).

The EIU, one of the few forecasters of Tinubu’s (manipulated) victory during the campaigns, now says it “views the momentum for further market reform as being absent” from his administration.

Insecurity is chronic in many areas, with the security forces too overstretched to counter multiple security crises effectively, the research organization, which is based in London, said its latest country report on Nigeria.

It stressed high inflation, low economic growth and unpopular market reforms present substantial political stability risks in the context. And “labour unions are likely to be active, with a high risk of industrial action that affects the economy.”

The report is produced verbatim below:

Slow economic growth in 2024

Economic growth will be slow in 2024 as a new bout of inflationary pressure and an

intensification of monetary tightening lead to a contraction in domestic demand. Growth will accelerate to a multi-year high in 2025 as the shock of market reform passes, and will be boosted by investment in the recently deregulated power sector.

Foreign-exchange [forex or FX] scarcity will persist in the short term. The Central Bank of Nigeria (CBN) has reverted to heavier currency management after having briefly switched to a “managed float” in June, and a freely-traded naira is not expected even in the long term.

Although production is well below the boom years of the early 2010s, Nigeria’s oil and gas sector will remain crucial to the prospects of the wider economy, dominating the export profile and accounting for about half of government revenue.

Nigeria is a signatory to the African Continental Free-Trade Area [AfCFTA] agreement. However, the government will take a protectionist approach to regional trade and will do little to encourage regional trade, beyond meeting its obligations on tariff cuts.

Key changes [in forex] since October 3rd

We have revised our exchange-rate forecast to front-load a larger devaluation in 2025, to reflect a widening gap between the official and parallel-market exchange rates.

We expect another attempt at exchange-rate convergence that year, meaning a larger correction.

We have adjusted our average exchange-rate forecast for that year to N1,068.3:US$1, from N914.4:US$1 previously. As our forecast for continued currency losses over time has not changed, the projected rate is also now weaker for latter years.

A larger devaluation will have limited pass-through, given the size of the parallel market, but our forecast for average inflation in 2025 has been revised up by two percentage points, from 15.1% to 17.1%.

TBC – Monetary policy committee (MPC) meeting of the CBN:

The MPC meeting scheduled for late September was cancelled so that a new governor and four deputies could be vetted. It is unclear when the next sitting will be, feeding in to our forecast that monetary policy action will be sufficient to tame inflation effectively.

__________________________________________________________________

Related articles:

Ribadu confirms Buhari handed over a bankrupt Nigeria

Tinubu’s Chicago magicery now in CBN to enslave our future

Tinubu enlarging his media team won’t save his reputation, says Atiku

__________________________________________________________________

Major risks to our forecast

Scenarios, Q3 2023 Probability Impact Intensity

- Tinubu moves too fast on market reform and unleashes mass unrest

- Social unrest forces the government to make concessions on its reform Agenda High High 16

- Boko Haram activity spreads from north-eastern to central Nigeria

- Completion of the Dangote refinery stalls, and continued costs for oil imports increase foreign-reserve risks

- Corruption worsens under the Tinubu administration

Outlook for 2024-28

Political stability

Mr Tinubu is expected to remain in power until at least 2027, when his first term ends, but his time in office will be highly testing.

An inescapable problem will be his weak mandate; he won only 36.6% of the popular vote, on a turnout of 27%. Only 8.8m Nigerians voted for him, out of a population estimated at just over 220m.

Despite his low popularity, Mr Tinubu has embarked on the biggest economic shake-up of a generation, rapidly rolling out market reforms and dismantling vehicles for patronage and corruption.

In theory these reforms hold the key to bringing Nigeria onto a higher growth path, but in EIU’s view he moved too hard and too fast.

Mr Tinubu came to power amid high inflation, and moves to deregulate petrol prices and float the currency have aggravated cost-of-living pressures.

Given threats of mass industrial action on a scale that has not been seen since 2012, his administration has had to compromise and backtrack.

Mr Tinubu will be under continuous pressure from labour unions, the renaissance of which will last, given an outlook of stubbornly high inflation.

Mr Tinubu got further than many of his predecessors in pursuing market reforms, but as his political capital has already drained away, and because Nigeria’s security situation is so fragile, we expect the agenda to peter out.

Widespread, entrenched poverty and ethno-religious divides are on such a scale that the very future of the current federal structure of Nigeria is at risk. With the security forces overstretched, emergencies will be triaged and resources deployed to whichever is most pressing.

Boko Haram and Islamic State West Africa Province, two Islamist terrorist groups that operate in the north and have a demonstrated ability to carry out terrorist attacks elsewhere in the country, will present an ongoing threat.

Violence between farmers and herdsmen in central Nigeria – the agricultural heartland – reflects another deep seated conflict. The causes, such as high population growth and natural resource depletion, are largely unsolvable.

In recent years banditry and kidnapping in the north-east have become a destabilising national crisis.

The perpetrators are well funded and have been developing links with terrorist groups and expanding the reach of their operations.

In the oil-producing Niger Delta, distrust of the government runs deep and communities feel that they do not get a fair share of Nigeria’s oil wealth.

Governability in the region will be challenging, and criminal activity linked to militant groups will remain a risk to oil output.

Our baseline assumption is that Nigeria’s federal government will assert control over “core” areas such as Abuja, the capital, and other places of political importance, at the expense of “periphery” regions that have long been mired in conflict.

This will be enough to keep the seat of power safe, but governance will be minimal across much of the country.

Election watch

Mr Tinubu won the 2023 presidential election in the first round, and will face the electorate again in 2027. The ruling party, the All Progressives Congress, won a majority in the Senate (the upper house) and the largest number of seats in House of Representatives (the lower house).

Nigerian politics is fluid, as party allegiances are often more about political convenience than ideology.

Frustration with the two-party system was highlighted by support for Peter Obi, of the fringe Labour Party, in the presidential poll. Backed by unions, he will build the party’s profile and become a more formidable force by 2027.

International relations

Given its size, Nigeria is a major player in Africa, but economic policy has a protectionist skew.

Domestic security challenges will reduce Nigeria’s ability to contribute troops to regional military forces as it has done in the past, when the country underwrote regional security.

The Senate refused Mr Tinubu’s proposal to intervene militarily in Niger [Republic] following a coup in July 2023, and we do not expect the idea of a regional force to gain traction.

Nigeria’s army is tied up with domestic conflicts, rendering overseas intervention unfeasible.

The US has been a major arms supplier to Nigeria and is likely to maintain some security assistance, given the wider regional threats posed by Islamist radical groups.