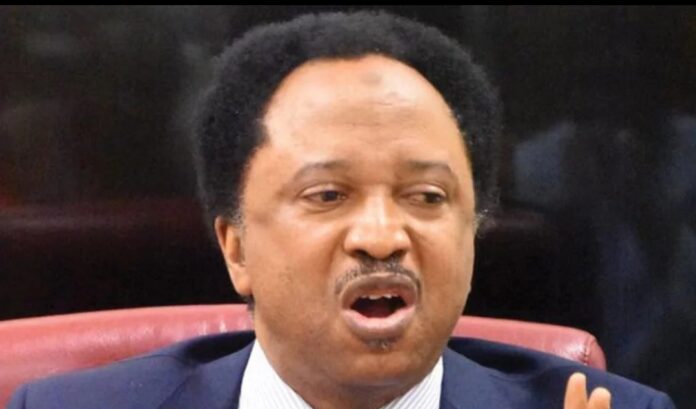

Shehu Sani also urged critics of recently proposed tax bill to remove their political lenses and read the document thoroughly

By Kehinde Okeowo

Human rights activist and former federal legislator, Shehu Sani has thrown his weight behind the Chairman of the Federal Inland Revenue Service (FIRS), Zaccheus Adedeji, saying it is unjust for only four states to receive 70 per cent of the Value Added Tax (VAT) distribution.

He declared his support for the newly proposed tax bill by the federal government in a statement he shared on his X page on Tuesday.

Adedeji had during a recent briefing of federal lawmakers told the House of Representatives members that only four states take 70 per cent of VAT, namely Lagos, Rivers, Oyo, and the FCT, citing an example of MTN paying most of its VAT to Lagos while all the states consume its services.

Reacting to this, Shehu Sani, admonished critics of the newly proposed tax bill to remove their political lenses and read the document thoroughly.

ALSO READ: Assault on the military in Abia and government`s timely response

The former Kaduna senator also said the bill should be supported to end the prevailing tax injustice in the country.

Speaking via his verified social media page, he tweeted, “The revelation made yesterday by the FIRS Chairman before the House of Reps that presently only four states corner 70 percent of VAT, namely Lagos, Rivers, Oyo, and FCT, is unjust. This is a strong justification for the tax reform.

“He also cited an example of MTN paying most of its VAT to Lagos while all the states are paying for its services. I still admonish the critics of the Bill to remove their political lenses and read the document thoroughly.

“The Bill will ensure equity, fairness, and allocate more resources to all other states. All the sentiments raised against the Bill are not contained in the Bill. The Bill should be supported to end the prevailing tax injustice in the country.”