Poor IGR reduces most states to the mercy and manipulation of federal power

By Jeph Ajobaju, Chief Copy Editor

Heavy reliance on federal allocation for yearly budgets has left most states at the mercy and manipulation of Abuja, according to a report by BudgIT, a civic-tech organisation advocating fiscal transparency and accountability in public finance.

The report shows Borno, Katsina, Plateau, Zamfara, and Jigawa are among the chief culprits most dependent on the federal treasury because of poor internally generated revenue (IGR).

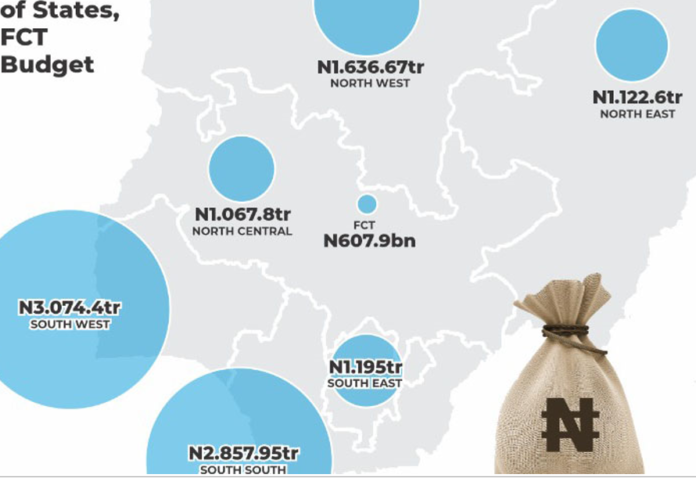

The ‘State of States’ study by BudgIT looks at their fiscal performance and healthcare delivery for improved economic development.

Iniobong Usen, BudgIT Head of Research and Policy Advisory, explained at the presentation of the report in Abuja that Lagos, Rivers, Ogun, Kaduna and Anambra, rank higher on Index A because they have limited dependence on federal revenue and thus have greater viability if they were to exist as independent entities.

He said Kaduna, Rivers, Ogun, Bauchi, and Osun have significantly grown IGR year-on-year (YoY) and are progressively reducing over-reliance on federal transfers.

________________________________________________________________

Related articles:

Naira free float shoots up states’ external debt to N3tr

Outgoing Govs set to collect mega pensions from states owing N3tr debt

PenCom lists 28 states as pension payment defaulters

__________________________________________________________________

States needing to work harder

Usen stressed Katsina, Yobe, Taraba, Bayelsa and Zamfara rank lower on Index A and need to work harder on growing IGR, considering the size of their operating expenses, or else prune their expenses, per reporting by The Guardian.

In Index B are Rivers, Ebonyi, Anambra, Bayelsa, and Kaduna, which have more public revenue left to implement capital expenditure in their budgets after fulfilling repayment obligations to lenders and their operating expenses.

Usen expressed regretted Abia, Imo, Yobe, Zamfara, and Plateau rank lower on Index B and have less revenue left to implement the capital expenditure in their budgets, and thus face a greater risk of resorting to more borrowing or under-implementing capital projects.

He said Index C contains Jigawa, Delta, Akwa Ibom, Rivers, and Bayelsa which have more fiscal bandwidth to borrow more, due to their sustainable debt profiles that are determined by their debt-to-revenue ratio, debt-to-GDP ratio, debt service-to-revenue ratio, and personnel cost to revenue ratio.