According to Emefiele, the currency redesign policy of the CBN had so far recorded about 75 per cent success rate.

By Jeffrey Agbo

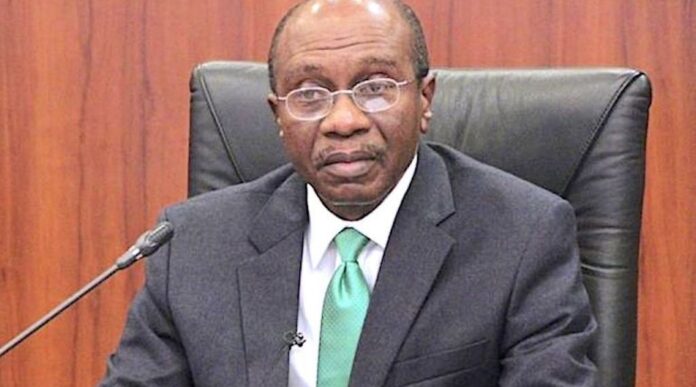

Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, on Tuesday told federal lawmakers that the naira redesign is in the overall interest of Nigerians and the economy and no one will lose money.

He said that subject to the provision of Section 20(3) of the CBN Act, Nigerians would be given the opportunity to redeem the face value of the naira in their possession after the currency would have lost its legal tender status on February 10, 2023, deadline only at the CBN.

Mr. Emefiele spoke at a meeting with the ad-hoc committee of the House of Representatives on the review of the bank’s cashless policy and extension of the timeframe of the currency swap programme.

“Nigerians will not lose their money,” he declared, just as he sought the cooperation of the National Assembly to ensure the success of the programme.

While reeling out the steps taken by the bank to ensure the effective distribution of the new banknotes, he disclosed that about N1.9 trillion had so far been collected since the commencement of the exercise.

READ ALSO:

DSS debunks reports of invading Emefiele’s office

According to Emefiele, the currency redesign policy had so far recorded about a 75 per cent success rate given the fact that many of those in the rural and underserved locations across the 36 states of the country have had the opportunity of swapping their old banknotes for the new series of the banknotes.

Emefiele, who was accompanied to the meeting by all the four deputy governors at the CBN, disclosed that the bank had deployed about 30,000 super agents to work with the bank’s staff currently in the hinterland to ensure that the underserved and vulnerable members of the society are adequately catered for.

Emefiele also disclosed that the apex bank was working closely with relevant agencies of the Federal Government to ensure full compliance with the CBN guidelines issued to the deposit money bank for the seamless distribution of the new banknotes.

Speaking earlier, the Chairman of the ad-hoc committee, Ado Doguwa, expressed the support of the House of Representatives for the cashless policy of the bank, stressing that the House would assist the CBN in achieving its mandate in that regard.

Doguwa welcomed the submission of the CBN Governor and stressed the need for more collaboration.