Manufacturers express concern as stockpiles threaten factory closures

By Jeph Ajobaju, Chief Copy Editor

Unsold manufactured goods in Nigeria rose 22 per cent from N384.58 billion in 2021 to N469.66 billion in 2022, with operators feeling jittery as the situation is worsened by rising inflation that robs consumers of purchasing power.

Unsold inventory piled up despite a 9.7 per cent decrease in manufacturing output from N7.39 trillion in 2021 to N6.67 trillion in 2022.

A report by the Manufacturers Association of Nigeria (MAN) attributed the rise in inventory to a dip in the purchasing power of consumers, caused by both inflationary pressures and naira scarcity in the first quarter of 2023 (Q1 2023).

“Inventory of unsold goods in the sector totalled N469.66 billion in 2022 as against N384.58 billion recorded in 2021.

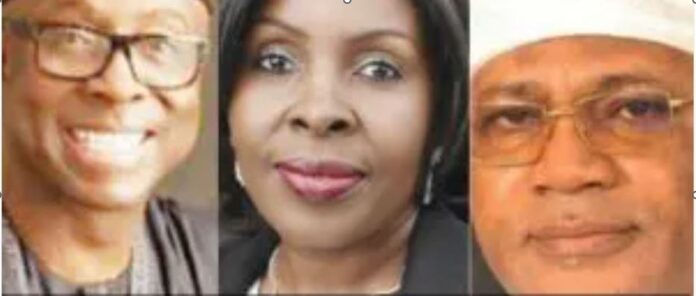

“The high inventory recorded in the period is attributed to low purchasing power in the economy due to the declining real income of households following the continuous increase in inflationary pressures in the country,” MAN Director General Segun Ajayi-Kadir said.

“This is worsened by the naira redesign policy which began in the last quarter of 2022. The withdrawal of a large amount of the ‘old naira’ without commensurate replacement with ‘new notes’ resulted in a cash crunch in the economy with very limited means of purchasing items by households across the country.

“Inventory of unsold finished products in the manufacturing sector increased to N282.56 billion in the second half of 2022 up from N169.75 billion recorded in the corresponding half of 2021; thus, indicating N112.81 billion or 66 per cent increase over the period.

“It also increased by N85.46 billion or 51 per cent when compared with N187.1 billion recorded in the first half of the year.

“In the second half of 2022 as the cost of wheat and other food inputs increased; prices of fuels, particularly diesel rose by over 50 per cent; cost of transportation logistics including shipping escalated even as the effect of COVID-19 pandemic is yet to fully die down.

“In addition to these challenges was the CBN policy on redesigning the naira. The CBN policy created a cash crunch that debilitated economic activities in the last quarter of 2022.

“This particularly affected the manufacturing sector adversely as it was extremely difficult to sell most of the fast-moving consumer goods (FMCG) and other commodities by the sector in the period.”

Ajayi-Kadir urged the government to formulate and implement a national policy that tackles high inflation.

__________________________________________________________________

Related articles:

Manufacturing output down nearly 10%

Manufacturing rises above pandemic with 9% growth

Manufacturers complain they can’t access CBN loan

__________________________________________________________________

Factory closures loom

Per reporting by Vanguard, MAN President Francis Meshioye expressed concern “the manufacturing sector has been struggling with crashing sales, mainly attributable to the sustained naira scarcity. A continuing decline in sale volumes will necessitate production cuts and a reevaluation of investments in the sector.

“Specifically, if sales proceeds can no longer sustain business overheads and operating expenses, businesses will be forced to scale down their operations which would result in factory closures, job losses, a decline in exports and much more.”

FMCGs kick against excessive taxation

FMCG operators implored federal and state governments to stop making the sub-sector the target of revenue mobilisation drive; which has led to its slow pace of growth.

Ekuma Eze, Director of Corporate Affairs & Sustainability, Coca Cola Hellenic Bottling Company, made the plea saying the FMCG sector has borne the brunt of excessive taxation.

According to him, FMCGs form the largest chunk of manufacturing in Nigeria, and is the fourth largest sector of the economy, but they are overburdened with taxes and levies, compared with their counterparts in other countries.

Eze said the introduction of, and increase in, taxes confirm FMCG companies are the target of government’s revenue drive.

He lamented company income tax rate in Nigeria is 30 per cent for companies with gross turnover greater than N100 million, compared with the African average of 23.5 per cent and a worldwide average of 23.4 per cent.

“Tertiary Education Tax is now 3 per cent going by the Finance Bill 2022. There’s been a consistent increase in excise tax for beer and tobacco companies while N10/1 excise tax was introduced in June 2022,” Eze added.

“The introduction of this new tax regime, due to price elasticity of demand, which is high among lower income consumers, who are major consumers of the products, led to reduction in sales and a revenue decline of 16 per cent between June 1 and December 2022.”

He also lamented poor implementation of naira redesign policy reduced sales in Q1 2023.

“Many FMCGs reported significant sales decreases in February and March by between 20 and 60 per cent. Many of these businesses are planning to restructure, which will worsen the unemployment problem.”

LCCI moans impact of rising inflation

Chinyere Almona, Director General of Lagos Chamber of Commerce and Industry (LCCI), moaned rising inflation has significant and worrisome impact on both household and business sectors.

“Since February 2016 to date, the country has recorded a double-digit monthly inflation rate, with an adverse effect on the size of its middle class,” she said.

“Apart from eroding purchasing power, it has led to inventory stockpiles. If left unchecked, the high inflation may further constrain production, lead to a steeper rise in poverty figures, frustrate economic growth, and lead to higher unemployment and non-competitive exports, especially in the sub-region.

“LCCI is concerned that despite consistent monetary policy rate hikes, taming the inflation trend has remained futile.

“We, however, appeal to the government to implement fiscal measures, such as reducing/ removing taxes on staple food items to protect the most vulnerable as well as spur demand-side growth.”