By Kelechi Mgboji

Assistant Business Editor

The risk of loss associated with fluctuations in interest rates in relation to higher inflation rate has sent cold waves across financial markets.

Now, more than ever before, investors in equities and fixed income instruments are taking flight to safe havens.

Current benchmark interest rate of 12 per cent is now grossly negative and renders interest rate a disincentive to savings and investment in the financial markets.

In April, the Central Bank of Nigeria (CBN) adjusted the benchmark rate upwards to 12 per cent from 11 per cent after inflation rate exceeded benchmark interest rate.

With the present inflation rate higher than the CBN’s inflation target maximum of 9.6 per cent by a huge gap of 4.1 percentage points, investors in fixed income instruments and others are offloading their stakeholding, sending the market to fresh a bearish trend.

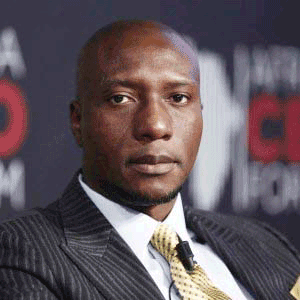

Nigerian Stock Exchange (NSE) Chief Executive Officer, Oscar Onyema, was reported as lamenting that the Exchange is concerned about the volume of foreign portfolio investors’ exit and the potential for capital flight from the market.

“We are concerned, we are monitoring the situation, we are talking to investors – both domestic and foreign – we have ramped up our efforts in terms of government relations to report what we are seeing and to look for new ways and solutions that would continue to make our market attractive to all investors,” Onyema said.

Sustained rises in the general level of prices hit a six-year high in April as inflation jumped almost 1 per cent to 13.7 per cent, from 12.8 percent in March.

The National Bureau of Statistics (NBS), in its latest report, said the April inflation reading, the highest level since August 2010, reflects increases across all sectors, unlike the previous months which had one or two sectoral exceptions.

“Lingering structural constraints continue to manifest spill-overs in April as electricity rates, kerosene prices, the impact of higher PMS (petrol) prices and vehicle spare parts were the largest contributors to the core sub index during the month,” the NBS said.

These items, as well as other imported ones, according to the NBS, continue to have ripple effects across many divisions that contribute to the core consumer price index (CPI).

Food index reflects tighter supplies across most groups that contribute to the sub-index. The sub-index increased 13.2 per cent in April, up by 0.4 percentage point from March, as all major food groups increased at a faster pace driven by higher prices in fish, bread/cereals and vegetables groups.

Year-on-year, the urban and rural indices recorded marked increases for the third consecutive month.

The urban index rose 15.1 per cent, 1.6 percentage points from 13.5 per cent in March, while upward pressure on prices were relatively less severe in the rural areas as the index increased 12.8 per cent year-on-year, 0.7 percentage point from 12.0 per cent in March.

Increases in imported and domestically produced foods resulted in a higher increase in the food sub-index in April, and all groups which contribute to the index increased, with the exception of fruit and potatoes, yams, and other tuber groups.

The latest inflation report indicates worsening economic conditions in the country, where Gross Domestic Product (GDP) growth was just 2.8 per cent in the last quarter of 2015 (Q1 2005), its lowest rate since 1999, and speculation of a further decline in Q1 and Q2 2016 is popular among economic analysts.

Financial Derivatives Company (FDC) predicted a steep rise in year-on-year April inflation to 13.2 per cent, 0.4 per cent higher than the 12.8 per cent recorded in March.

Linking the expected rise in inflation to fuel scarcity, FDC had its debilitating impact on economic activity and pressurised consumer prices.

The firm, based in Lagos, stressed that if its forecast is accurate, it will be head-turning for the Monetary Policy Committee (MPC) “which has barely recovered from the spike in March.”

Babajide Solanke, an analyst at FSDH Merchant Bank in Lagos, said in an e-mailed statement before the announcement of the April inflation rate that rise in CPI might make the MPC vote in support of an increase in interest rate.

Capital importation report for Q1 2016 showed that investment inflow into the country had dropped 89.13 per cent since its peak in Q1 2014.

Since 2007, equity had been the largest part of portfolio investment in every quarter but the economy attracted only a total investment of $710.97 million (N140.07 billion), a 54.34 per cent decline compared with Q1 2015, the lowest since the series began nine years ago.

“The total value of capital imported into Nigeria in the first quarter of 2016 was $710.97 million, the lowest level since the series began in 2007,” the NBS report said.

Investors have withheld capital importation into the country because of difficulty in repatriating earnings from investment, foreign exchange (forex) controls, and low naira value against the dollar.

The largest component of capital importation in Q1 2016 was portfolio investment which accounted for $271.03 million, or 38.12 per cent of all capital imported.

The largest subcomponent of portfolio investment was equity, which accounted for $201.69 million or 74.41 per cent of portfolio investment and 28.37 per cent of total capital imported.