Earlier this year, Nigeria celebrated its rebased economy, now the biggest in Africa. But now, the economy is in the throes of a sharp fall in oil price, which led the Central Bank of Nigeria (CBN) to devalue the naira on Tuesday, November 25.

Following the hike by 500 basis-points on cash reserve requirement (CRR) on private sector deposits, the CBN drained N568 billion from the banking system to meet new requirement for private sector deposits.

This triggered a scramble for funds in the interbank lending market, where the cost of borrowing among banks almost doubled on Wednesday, November 26.

Also reacting to the increase in the policy interest rate of 100 basis points to 13 per cent, the overnight interbank borrowing rate closed at 20 per cent, compared with 10.25 per cent the previous day. Yield on 2022 sovereign bond rose 45 basis points to 14.25 per cent.

At the end of the Monetary Policy Committee (MPC) meeting on November 25, the CBN announced a hike in the CRR on private sector deposits from 15 per cent to 20 per cent.

In addition to announcing devaluation of the naira by 8 per cent, it also raised interest rates by 100 basis points to 13 per cent, the first change in more than two years.

In reaction, the naira touched new lows against the dollar, complicating efforts to contain inflation. It traded at N178.85 to the dollar shortly after the market opened, but rebounded by around 1 per cent to close at N176.35 after two oil companies sold dollars.

At the parallel market, the naira traded over N186 to the dollar, and speculation is rife that it may exceed N200 to the dollar to necessitate further devaluation.

With the likelihood of a recession in the months ahead, policy makers are considering austerity measures, implying cutting down in government spending as announced by Finance and Economy Coordinating Minister, Ngozi Okonjo-Iweala.

Analysts react

Analysts are divided in their views as to the sense or lack of it in naira devaluation.

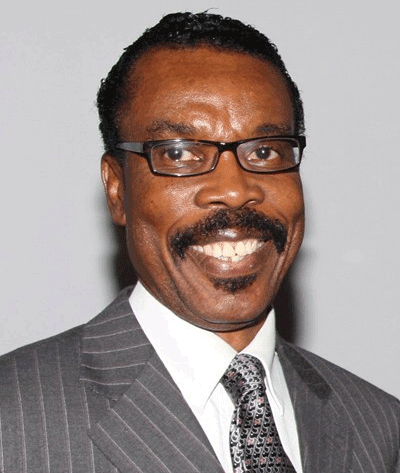

Financial Derivatives Company Managing Director/Chief Executive Officer, Bismarck Rewane, said it is inevitable because of the depreciating value of the naira caused by falling oil price, with a sharp draw-down on external reserves.

“Naira devaluation is inevitable, but the quantum of devaluation is in issue. We’re not looking for the value of the naira. We’re looking for a mechanism that means that the price of oil and our exports actually comes down to become more competitive,” Rewane explained.

He argued that it is wrong to use a one-way oil price mechanism to determine the fate of currencies in the global oil market, wondering why the naira was not revalued upwards when oil price was strong at $116 or higher.

In his view, the naira depreciated to the point that adjustment in the band became necessary, which was what CBN did, but devaluation will make export more competitive.

Analysts and dealers at Capital Bancorp Plc (CBP), a dealing member of the Nigerian Stock Exchange (NSE), echoed the views when they wrote in a research note on Wednesday, November 26 that the devaluation of the naira is in order, and will discourage currency speculation.

They said it would make exchange rate “more expensive for currency speculators to bet against the naira as the high interest rate would serve as disincentive for speculators, and hopefully this would translate to more stability of the naira as the demand for dollar is moderated.”

According to the analysts at South Africa-based NKC Research, failing to devalue would have been much worse as the cost of imports would have increased in the absence of official devaluation.

“The bold steps taken by the CBN will help tremendously to stem the drawdown in foreign exchange [forex] reserves,” wrote the analysts in email note.

“Given the sharp depreciation of the interbank exchange rate in recent months … the cost of imports would have increased even in the absence of an official devaluation.”

However, financial analysts, Henry Boyo and Austin Nweze of Pan Atlantic University, both faulted devaluation and increase in interest rate.

According to Boyo, devaluation is unnecessary and Nigeria may end up devaluing the naira by as much as 20 per cent in near future if policy makers fail to learn lessons from Zimbabwe.

Said he: “Nigeria should learn from Zimbabwe so that its money does not become worthless. I see the naira devalued by 20 per cent as CBN repeatedly continues to mop up the naira to achieve exchange rate stability.

“This means that we have not learned from what happened to Ghanaian and Zimbabwean currencies.”

Nweze implored the CBN to liberalise the circulation of the dollar, just as Zimbabwe did, instead of holding on to dollar monopoly, which is counterproductive.

“In Zimbabwe, there was a time inflation exceeded one million per cent. Then the government introduced the use of the dollar side by side with the local currency. If you want to buy anything in dollar, you pay in dollar. Today, inflation in Zimbabwe is about 2 per cent,” Nweze said.

“Why should the CBN have the monopoly of foreign exchange. If you do business and you get paid in dollar, you should be allowed to spend your dollar.

What the CBN does is to take the dollar and covert it by printing equivalent of the dollar value. Why not allow market forces to moderate all these?

“If a state government has so much dollar, for instance, and it approaches a bank for naira, the bank can offer how much it is willing to pay. That way you allow market forces to determine the value. You don’t have to spend so much dollar to support the naira. It is as simple as that.”

Devaluation and the financial markets

In a note to investors on November 26, Capital Bancorp said the outlook for the stock market will remain bearish, as flight to fixed income instruments may continue and the market may experience net outflow of Foreign Direct Investment (FDI).

Also, “because of the increase in interest rate, the prices of bonds are expected to come down and yields will go up, serving as an incentive to investors. There may be some activities in the market as new bond issues would have to be issued at market rates in line with the current interest rate regime.

“We see more flight from the stock market to the bond market as investors seek less risky instruments,” the analysts wrote.

Maxi Funds Managing Director and Chief Executive Officer, Mazi Unegbu, expressed concern for the capital market, saying naira devaluation and a rise in interest rates will result in outflow of investments.

The market is already in a turmoil, he stressed, having witnessed tremendous divestments by foreign investors, and the measures taken by the CBN may be the last straw that breaks the camel’s back.

Devaluation and man on the street

For the average man on the street, devaluation means “he has to decide whether to take coffee, ordinary tea, or just water,” Rewane explained.

He said the government is already leading the way by announcing cuts in some areas, and people will have to give up some things.

“Government’s income has come down and we have to know there is a strong correlation between what we earn and our standard of living.”

“For the worker, the situation will not only affect him but also those who depend on him. As government expenditures go down contractors will also get deferred terms.

“For the unemployed, it might not be a time to secure employment as there is likely going to be job losses if the situation leads to recession as it may.”

The analysts at Capital Bancorp expressed concern that disposable income to borrow at the prevailing interest rates will be reduced, and that government capital expenditure will be less.

There is potential inflationary pressure as a result of devaluation, election spending, and rising consumer goods.

Entities that are not able to pass costs on to consumers will reduce production, record lower profits, and may retrench workers to remain afloat.

Both Rewane and Nweze warned Nigerians to prepare for hard times from 2015 because there are no signs that the situation will improve so soon.

They urged policy makers to devise measures to restore the economy to prosperity.

Rewane added that expectation of returns in politics may no longer be rosy as government revenue and expenditure may drop by as much as 60 per cent.