Industry stakeholder hail fuel subsidy removal, NLC warns of fallouts

By Jeph Ajobaju, Chief Copy Editor

Industry stakeholders have expressed support for the removal of fuel subsidy announced by President Bola Tinubu but the Nigeria Labour Congress (NLC) is edgy about it because of the consequences for the economy.

Stakeholders who saluted subsidy removal and also welcomed a unified foreign exchange (forex) rate announced by Tinubu include the Manufacturers Association of Nigeria (MAN) the Nigerian Chamber of Commerce, Industry, Mines and Agriculture (NACCIMA), and the Centre for the Promotion of Private Enterprise (CPPE).

NLC warns subsidy removal will drag down economy

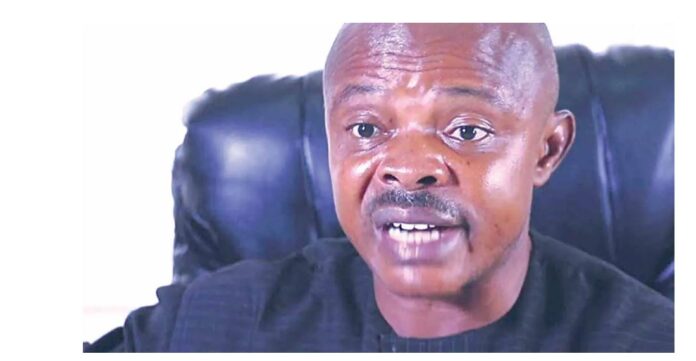

NLC President Joe Ajaero, however, argued “the comment [by Tinubu] on fuel subsidy removal is not well thought out, coming as an inaugural speech.

“It is going to draw the economy of the country backward by over 50 per cent within the next 48 hours. Nigerians will speak in one accord at the appropriate moment.”

__________________________________________________________________

Related articles:

Subsidy removal sparks new fuel queues, price jumps to N600 per litre

NUPENG tells Tinubu, let Dangote Refinery hit market before subsidy removal

Fuel subsidy removal likely to cost consumers N8tr in 6 months

__________________________________________________________________

MAN sees policy in the right direction

MAN said the proposed policy to utilise the full range of fiscal measures to promote domestic manufacturing signals better days ahead for manufacturers.

MAN Director General Segun Ajayi-Kadir explained the announcement would be subjected to critical considerations by manufacturers.

“It is highly commendable and an assurance of better days ahead to hear the President saying that his industrial policy will utilize the full range of fiscal measures to promote domestic manufacturing and lessen import dependency,” he told Vanguard.

“For me, this is a positive development. It is an unmistakable indication of a far-sighted strategic choice, one that is borne out of a deep reflection on the current inclement manufacturing environment and the need to stop the drift into inglorious de-industrialisation of the Nigerian economy.

“What is most gratifying is that it came from the President from day one. The issues of multiple and often times punitive taxation; conflicting and contradictory fiscal and monetary policy measures; skewed and poor management of the foreign exchange regime and the long overdue stoppage of the fuel subsidy were addressed in the President’s speech and I believe they resonate with manufacturers in particular and the business community in general.

“A marching order is needed to move the Central Bank of Nigeria (CBN) towards a unified exchange rate.

“We also expect that, in line with his promise, to enable a supportive fiscal policy regime, the President will order a reversal of the unwarranted violation of the government‘s three-year excise escalation roadmap on alcoholic beverages and tobacco.

“As we have shown, the latest hike as contained in the 2023 Fiscal Policy Measures is not only going to ruin the affected sectors, it will be counterproductive for government revenue in the near future.”

NACCIMA applauds forex harmonisation

NACCIMA Director General Sola Obadimu applauded some of the promises made by Tinubu about the economy in his inaugural speech.

“They are good steps in the right direction. He spoke on the need to harmonise forex rates which is also good for probity and attracting foreign investment, and for the need to make it easier for foreign firms to repatriate their money. These are all very good.”

CPPE eyes enormous potential benefits

Muda Yusuf, Centre for the Promotion of Private Enterprise (CPPE) Chief Executive Officer, enthused about the enormous potential benefits of subsidy removal.

His words: “We welcome the position of our new President, Bola Tinubu, on subsidy removal. Fuel subsidy removal has enormous potential benefits.

“First, there is the revenue effect. The removal would unlock about N7 trillion into the Federation Account. This would reduce fiscal deficit, and ultimately ease the burden of mounting debt.

“Second, is the investment effect. Currently, it is extremely difficult to attract private investment into our petroleum downstream sector because of the unsustainable subsidy regime and the stifling regulatory environment.

“The subsidy removal will eliminate the distortions and stimulate investment. We would see more private investments in petroleum refineries, petrochemicals and fertiliser plants.

“Post subsidy regime would also unlock investments in pipelines, storage facilities, transportation and retail outlets. We would see the export of refined petroleum products petrochemicals and fertiliser as private capital comes into the space, and quality jobs will be created.

“There is a foreign exchange effect. This would result from import substitution as petroleum products importation progressively decline. This would conserve foreign exchange and boost our external reserves.

“Increase in investment would also translate into more jobs in the petroleum downstream sector.

“There must be palliatives which should be segmented into immediate, short term and medium term deliverables.

“Immediate and short-term options include wage review in public service, the introduction of subsidised public transportation schemes across the country and reduction in import duties on intermediate products for food-related production to moderate food inflation.

“In the medium to long-term, there should be accelerated efforts to upscale domestic refining capacity, driven by private investments; accelerated investments in rail transportation by the government to ease logistics of fuel distribution across the country as well as domestic freight costs.”

CMAN upbeat on subsidy removal, forex unification

Uche Uwaleke, Professor of Capital Market and President of Capital Market Academics of Nigeria (CMAN), expressed support for the removal of fuel subsidy and unification of forex rates, insisting subsidy was at a huge cost to the economy.

“I support the removal of the fuel subsidy due to its huge cost on the economy. Fuel subsidies have proven to be unsustainable,” he said.

“I equally support the unification of exchange rates because doing so will discourage round-tripping, bring more transparency to the foreign exchange market which supports foreign investments.

“However, in order to minimise negative impact on the livelihoods, issues of fuel subsidy and exchange rates unification which he mentioned in the speech should be handled with care. Stakeholder engagement is required.”