By Ishaya Ibrahim

Nigeria’s inflation rate has been accelerating at a speed that threatens any prospect for real economic growth.

The Consumer Price Index (CPI), otherwise known as the inflation rate, has remained volatile since August when the government shutdown the country’s land borders.

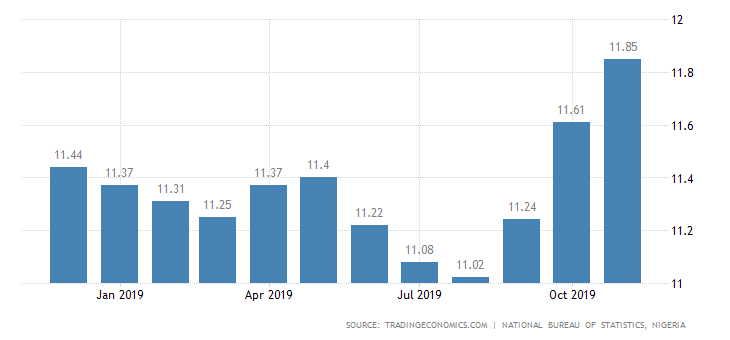

In August, the index was 11.02 per cent. It jumped to 11. 24 per cent in September. It climbed to 11.61 per cent in October and climbed further to 11.85 per cent in November.

In three months, Nigeria’s inflation rate rose by 83 basis point.

Policy makers in Abuja may be faced with the tough decisions to either reopen the borders on terms that are more beneficial to Nigeria or keep it closed and deal with the inflationary impact on the economy.

But Teslim Shitta-Bey, the Managing Editor of Proshare, a business intelligence publication, thinks the sustained inflationary rise may have no real connection to the border closure.

“Inflation essentially is a monetary policy issue. It is not really a fiscal policy issue. The border closure is a government (fiscal) policy issue. So, really and truly, it is not a primary cause for the inflation because inflation is essentially about the money supply,” he argued.

He said the border closure might have a spike in prices as a result of the market shock, but it can’t be sustained.

“If for instance the government won’t allow laptops to be imported into the country, the price of laptops will go up. But for you as a reporter that wants a cheap laptop, you go and look for tokunbo (already used). In other words, you reallocate your resources. That is, look for options that are cheaper. That will not necessarily lead to a rise in price.

“What that means is that the new laptops will be so plentiful and people who are bringing in new laptops will not be able to get people to buy them. And so, they will be forced to bring down the price. Therefore, it is difficult to ascribe so much of the inflationary impact to the issue of border closure,” he said.

Shitta-Bey said even facts from the inflationary trends prove that it may not be connected to the border closure.

“If you look at underlying food inflation, it has been declining until recently. Even though the inflation rate went from 11.20 to 11. 24, then it went up to 11. 61 to this recent one of 11.85, food inflation actually declined. It is only in this recent one that food inflation went up.

“Now, the rise in food prices is caused by a lot of factors. One, we have not resolved the issue in the middle belt which is the food basket of the country.

“Two, when you move to the end of the year, there is a huge demand for food because of the Christmas celebration. So, you will see a spike in price around Christmas season. And unfortunately because the North Central is not providing us with enough quantity of food that we normally need, food inflation has gone up,” he said.

He, however, said the government should be very worried about the rise in the prices of goods and services because of its collateral impact on the well being of the country.

“Don’t forget that there are investors who will want to bring money. These investors are also looking at the inflationary impact on their investment returns because they will say what is the inflationary rate in the U.S. or Ghana?

“If the inflation rate is lower in Ghana and the return on investment is almost the same, why should I come to Nigeria and allow inflation to wipe out my investments? All those decisions will came in,” he said.

But more troubling is the impact of a sustained inflation on the everyday activities of the Nigerian.

“If the inflation is sustained, you have to ask yourself what is the worth of the money in your pocket?

“You will also have to ask yourself why will you be saving money if inflation is going to wipe out all the benefits. So, you are going to see people trying to look for investment options and banks may actually start having problems with liquidity because a lot of people will say why should I put my money in bank and allow inflation wipe it out?

“If people save, the money they are saving will bring down interest rate and encourage investment and the economy will grow. But if savers don’t put their money into those instruments, there wont be any money to invest. And if you don’t invest, you cant grow,” he said.

He said the scenario is even worse for Nigeria that has an economy that is growing at the very slow rate of 2.29 per cent.

“Nigeria produces five million graduates from our tertiary institutions. And we create jobs for only 450,000 annually. So, the balance where will they go? So, you need to grow the economy so that you can absorb these young people,” he said.