Fashola charges FMBN that: “There must be something done to help people pay their rents via their salaries, especially the problem of two to three years’ rent payment.”

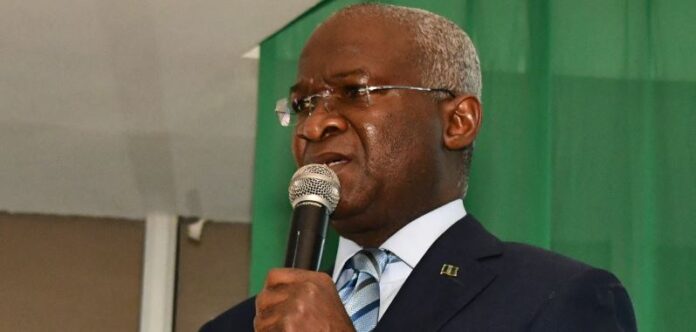

The Minister of Works and Housing, Babatunde Fashola, says addressing access to mortgage financing is the panacea to housing delivery challenges in Nigeria.

Mr Fashola said this at the opening of the board/management retreat of the Federal Mortgage Bank of Nigeria (FMBN) on Monday, in Abuja.

According to him, one of the obstacles of access to housing is the one that impedes access to finance, and this must be removed.

“If we fail to remove this impediment, then we will be failing in the reason for setting up the bank. There must be something done to help people pay their rents via their salaries, especially the problem of two to three years’ rent payment demanded by landlords in advance from tenants whose salaries come in arrears,’’ Mr Fashola explained.

READ ALSO

Airfares in new climb to N75,000 per hour

He advised the bank to collaborate with the Nigeria Deposit Insurance Corporation contributors’ fund like other commercial banks do.

Mr Fashola added that this would go a long way to finance the mortgage of contributors.

While commending the bank’s board and management for the services rendered such as home refurbishment loans and introduction of the rent-to-own initiative, he charged them to focus the retreat on better ways to serve Nigerians.

The minister said performance and repositioning were key to setting up the bank to provide housing services.

FMBN board of directors’ chairman Ayodeji Gbeleyi called for the review of both the FMBN and National Housing Fund (NHF) Acts to incorporate increment in the bank’s share capital.

“Give more flexibility in determining share capital structure in line with emerging realities. There is the case to amend the NHF Act to increase the accretion of contributors to the funds through percentage increase in contributions,” noted Mr Gbeleyi.

“Source diversification, adoption of initiatives to attract banks and insurance companies and other prospective contributors to participate actively in the NHF scheme.”

He added, “The Land Use Act has no specific provisions for the foreclosure of mortgages and this poses a challenge for investors, as mortgages can take undue advantage of the gap to delay the foreclosure process.”

Mr Gbeleyi said to close the gap, states should be encouraged to put in place foreclosure laws through their houses of assembly, adding that only Lagos and Kaduna had enacted the foreclosure laws.

FMBN managing director Madu Hamman said the need to re-focus the bank’s direction was to re-align its strategic targets in the light of prevailing economic, financial, social realities and to re-configure the strategy document to incorporate the vision and focus of the bank’s new leadership in implementing President Muhammadu Buhari’s mandate for affordable housing delivery to Nigerians especially those in the low and middle income brackets.

“Our collective vision for FMBN in the future is a financially viable and highly adaptive bank capable of adequately coping with the vagrancies of a world transiting from a volatile, uncertain, complex and ambiguous environment,” he stated. “To a brittle, anxious, non-linear and incomprehensible environment as a result of the COVID-19 pandemic and other emergence and unfolding factors.”

(NAN)