Equities on the Nigerian Stock Exchange (NSE) fell to N170.8 billion in August, down 23.8 per cent from year ago, as the benchmark stock index fell to 29,540 points.

The sharp fall was stoked by unmitigated portfolio offloading by foreign investors hurt by a weaker naira withdrawing cash from equities to reduce losses.

The Nigerian market, which has the second biggest weighting after Kuwait on the MSCI frontier market index, remains at a more than five-month low, and was further weakened by recent Gross Domestic Product (GDP) data supplied by the National Bureau of Statistics (NBS).

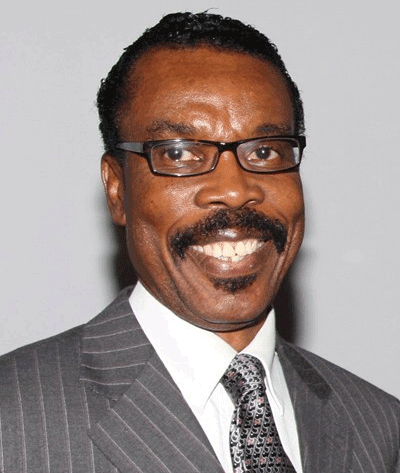

Hecker

Financial analysts, including Financial Derivatives Managing Director, Bismarck Rewane, and a financial expert and media trainer based in France, Jurgen Hecker, have urged the Central Bank of Nigeria (CBN) to further devalue the naira as one of its responses to worsening impact of global oil market.

They said now is the time for Nigeria to devalue its currency since the required proportion of devaluation is still marginal, and that further delay will require greater proportion and cost to the economy.

Hecker, who was in Nigeria for the training of financial journalists facilitated by Sterling Bank, noted that increasing decline in oil price poses problems of current account deficit and drop in revenue.

According to him, devaluation would make the naira more realistic and cause new industries to come up.

He argued that Nigeria could export more as its exports become cheaper, and that more dollar earnings will increase opportunities for the diversification of the economy.

“Countries are gradually phasing out fixed exchange rate regime, because if you fix the rate, then you should have the means to defend it. But with the globalisation of the financial markets, nobody has that power any more,” Hecker said.

He added that based on how markets work, his perception from the outside is that Nigeria does not have the required foreign exchange (forex) reserves to continue to defend the naira.

“In other words, it has lost the battle. It would have been better not to start the fight in the first place. For you to have started, you should be certain that you will win. I see that defending the local currency is a traditional practice here.

“But I guarantee you that the market will continue to be toughened and toughened again, until there is not a single dollar left in the treasury. That is quite obvious.”

Rewane

Rewane, an economist, brings home the message with the analogy of a cancerous leg amputated too late at the expense of the patient’s survival.

“It is better to amputate a decaying leg when the tumor has not reached knee level than to delay and amputate the same leg when the tumor has crossed the knee.

“And the worst is to get so confused that the wrong leg is mistakenly amputated,” he warned.

He believes it is impossible for the naira to firm up until certain bottlenecks like subsidy and leakages are removed.

In his view, as long as the government hesitates to remove fuel subsidy, heightened demand for dollars by marketers, among others, will continue to haunt the economy.

Rewane also wants a process that leads to the determination of naira exchange rate rather than defending and fixing rates overnight.

He said devaluation at this stage of Nigeria’s economy is not about what “we want, but what needs to be done,” stressing that monetary and fiscal authorities have to understand and agree that the problem has reached a stage which requires optimal solution.

Economic agents make decisions and in each decision, something has to be given up, Rewane added.

“If you are consuming butter when your income was high,” he stressed, “you have to change to margarine when your income falls. If you ate ripe plantain before, you have to change to unripe plantain.

“You will move from cornflakes to yam, from three newspapers to one. We as individuals make these decisions every day. If we can make them at individual household levels every day, we have to make them at the national level.

“Whether you like it or not, you must make that decision. We must understand that we have to make some adjustments and how much such adjustment should be.

“Your problem determines the kind of doctor you go to. You can’t have an orthopaedic problem and go to a midwife.

“We have to look for advanced solution now before it gets more advanced than it is at the moment.”

To him, the reality is like when people refuse to do the obvious because they do not understand what they are doing and then try to confuse the majority with slogans, raising ignorance to power two.

“Almost all oil exporting or commodity producing countries are facing the same issues and how you deal with them depends on how courageous you are to deal with them and the timing.

“I submit that our fiscal issues include subsidies, spending, fiscal recklessness and corruption. If you deal with all these, the monetary suitability will follow to reinforce the fiscal policies that you have adopted.”

Emefiele’s position

However, CBN Governor, Godwin Emefiele, has insisted that devaluation will make the economic situation worse because the country would be importing inflation without the ability to gain from cheaper imports.

He said this is the sad but painful reality that Nigeria is dealing with, which makes monetary policy management very difficult.

He believes that what is needed is to first build up the productive base of the economy in manufacturing, agriculture, power, and other key sectors before exploring the kind of devaluation that China and other much stronger economies can attempt.

Emefiele explained that after devaluing the naira by over 23 per cent, it is “appropriately priced” for now because the interbank exchange rate has remained stable since February 18, trading within the band of between N193 and N197 to the dollar.