The dust is yet to settle on the bizarre ambition of Mr. Emefiele to succeed President Muhammadu Buhari on May 29, 2023 when he, again, in a now familiar fashion, plunged the economy into a needless crisis by his naira redesign policy.

By Toyyib Musa-Omoloja

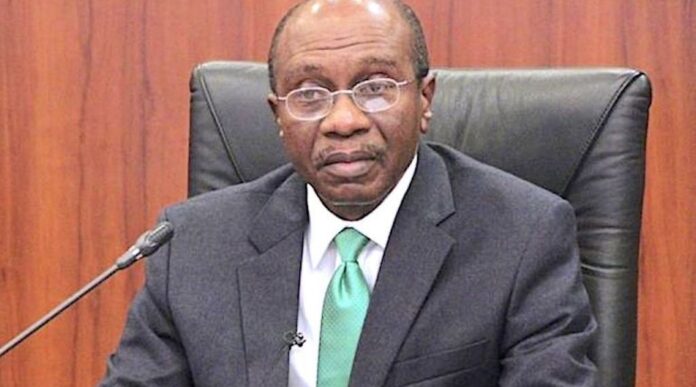

In search of ‘something big, or really outstanding ‘, the Governor of Central Bank of Nigeria, Godwin Emefiele, has got himself enmeshed in an unending pollution of the public space.

The dust is yet to settle on the bizarre ambition of Mr. Emefiele to succeed President Muhammadu Buhari on May 29, 2023 when he, again, in a now familiar fashion, plunged the economy into a needless crisis by his naira redesign policy.

When the idea first filtered out, many a commentator flayed the policy as a needless distraction. Events have however borne out the fears of those that criticised the idea from the outset.

Announcing the intention to redesign the 1000, 500 and 200 denominations on Wednesday, 26th October, 2022, the CBN Governor said the move will help to check counterfeiting of our currency, strengthen the economy, promote financial inclusion and reduce the expenditure on cash management.

READ ALSO:

Mobile internet subscription grows to 154.28m

Stripped bare, the policy was zero on economics. While nothing is wrong with currency change or redesign, at least, there should be cogent reasons for such all- important action. Currency could be changed, redesigned or modified to curb hyperinflation, massive counterfeiting or exchange rate collapse. Sometimes, it could even be a war strategy or an intentional exercise such as when a sovereign nation decides to join a monetary union etcetera etcetera

Unfortunately, Mr. Emefiele’s experiment was almost inaudible on the important reasons that should necessarily underpin such a complex and risky endeavour.

What President Muhammadu Buhari in cahoots with Governor Emefiele did was to intentionally punish Nigerians for no reason whatsoever; or for reasons best known to them. Mopping more than 2 trillion naira from circulation and replacing such with about three billion naira can only be wicked and satanic. As at the end of January 2023, the Nigerian Security Printing and Minting Company Limited only has the capacity to produce about two hundred billion naira (NGN200b).

And this wickedness was perpetrated in a developing economy that is largely mercantile and import dependent. As a matter of fact, the backbone of Nigeria economy is the informal sector. The informal sector which could be called shadow economy sometimes is that segment of the economy that seems to evade government oversight. It is neither taxed nor regulated.

For you to understand better, the vulcaniser by the road side, the mama that sells roasted plantain at the other side of the road, that lady hawking groundnuts and so on so forth, all constitute the informal sector of the economy. Most of these people cannot survive without daily cash. And they constitute 57.7 % of our economy. As at 2021, 80.4 % of employment came from that unregulated sector.

Starving this category of people the direly needed cash for survival is no longer economics but something sinister. No wonder people have being going naked in banking halls and in fuel stations all because of the multiple calamities visited on them by the twin scarcity of fuel and money even at the eve of a general election.

Taken one after the other, all the reasons given by the CBN when announcing this doomed policy, including those dredged up afterwards by the Presidency could hardly stand rigorous scrutiny.

The global standard for number of counterfeits notes per million is 100. The ratio of counterfeit notes to volume of bank notes in circulation was 13 pieces per million in 2020, whereas in 2019, it was 20 pieces per million. Evidently, this shows that counterfeiting was not as rampant and crippling as Emefiele advertised. The reason has to be something else then.

On financial inclusion, it still beggars belief that withdrawing money from circulation equates or will create financial inclusion. Data from Multiple Indicator Cluster survey published by National Bureau of Statistics last year indicated that as at 2021, 64.6 of women and 52.8% of men aged between 15 and 45 had no bank account or any similar setup in any financial institution in the country. And this is apart from the fact that more than 42 million adults live in rural areas that lack basic banking services, according to report published by EFInA. This means, these significant demographics rely on physical cash for their daily lives. How does starving them of cash relate to financial inclusion?

Nigerians will have to be convinced that cashless policy started with Mr. Emefiele’s management of our treasury. Available data indicated that this is a policy that preceded his administration and it has continued to record significant success year on year.

Frankly, the CBN has succeeded on cashless policy because the percentage of cash to all money in Nigeria had fallen from 11% in 2007 to about 5.6% as at June , 2022. That’s not all. The percentage of cash to GDP had fallen from over 2% of GDP in 2007 to 1.6% as at the end of 2021 and this still compares favourably with countries such as the UK, US, China and Japan which has about 3.5%, 7.5%, 9% and 10% of currency in circulation relative to their GDPs.

Arguments such as curbing terrorism and hoarding are as jejune as they come. Whatever money in circulation, new or old, redesigned or repainted, can always be used as ransom and could as well be hoarded. The hoarding of the redesigned notes buttresses this point.

By the way, the idea that about 80% of our money is outside the banks’ vaults sounds too feeble. Perhaps I’m wrong. But the layman’s understanding of money is that it should be held, spent and generally utilised to facilitate economic activities. Why should the money be serving siesta in banking vaults when it should be working hard to bring prosperity to our country?

While the fisticuffs among the major political parties about the desirability or otherwise of the policy have been hilarious, we can all be certain that it is simply about whose interest the tattered economy engendered by Emefielenomics will serve best.

But then, the alternative explanation for Emefiele’s ill-processed policy, perhaps, could be located in his obsession for something big or truly outstanding as legacy. Emefiele was preceded by two outstanding intellectuals in that office. Charles Soludo, a first class brain and an itinerant scholar was renowned for his bold policies during his tenure. Apart from banking consolidation and generally low inflation rate, he grew the foreign reserves from ten billion naira (NGN10b) to sixty two billion naira (NGN62b). On his own part, Mallam Sanusi Lamido Sanusi, another first rate intellectual, initiated extensive banking reforms termed the ” Sanusi Tsunami”. He took over the reins of affairs at the apex bank during the global financial crisis of 2009, and to his credit, he successfully managed, overhauled and stabilized the Nigerian financial system.

These were the legacies Mr. Emefiele is contending with.

The other explanation which, I hope, I’m wrong about, is that the naira redesign was a weapon of war against the Nigerian elite class for standing against the ambition of Mr. Emefiele to succeed President Muhammadu Buhari. Yes, if the man is a closet psychopath, he might want to whip Nigerians for embarrassing his inordinate ambition.

Yet, another thing is that could there be an Nnamdi Kanu hibernating within the Emefiele persona? Only the CBN Governor can clarify these curiosities.

However, whatever might be the motives of Mr. Emefiele, rather than inflict pain and misery on the hapless people of Nigeria, unifying the discordant exchange rates in the economy, curtailing the stagflation imperiling daily existence of Nigerians and improving the value of our currency among others would have been better as endeavours to tame his self-induced restlessness. Enduring legacies are built by creating viable solutions to problems not compounding the misery of the people.

Toyyib Musa-Omoloja is a public affairs analyst