EIU sees Nigeria’s economic growth dragged down by inflation, monetary tightening

By Jeph Ajobaju, Chief Copy Editor

High inflation and monetary tightening are expected to drag down Nigeria’s economy, with real Gross Domestic Product (GDP) growth likely to rise from an estimate of just 2.2 per in 2023, but to remain sluggish in 2024, at 2.6%.

This is the prediction of the Economist Intelligence Unit (EIU) in its current country report on Nigeria which covers politics, economy, security, governance, and other spheres.

The EIU, which is sympathetic to President Bola Tinubu, projected poor GDP performance will cause domestic demand to contract for a third year running in 2024, an unusual stretch of decline in a country where the population expands at about 2.5 per cent a year.

The report is produced verbatim below:

Net exports as sole growth driver

Net exports will be the sole growth driver early in the forecast period.

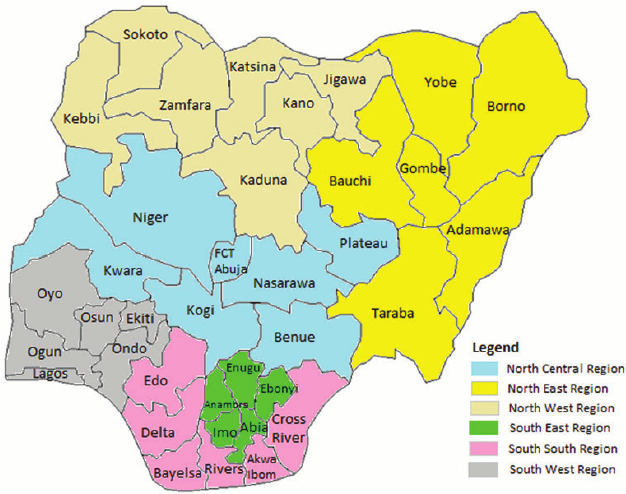

We expect oil export volumes to increase as security in the Niger Delta allows higher oil output; the balance will be complemented by the displacement of fuel and chemical imports in 2024 as the Dangote refinery ramps up production.

As inflation falls and monetary policy becomes expansionary from 2025, domestic demand will return to (low) growth.

Consequently, real GDP growth will rise to 4% in 2025 – the highest rate since 2014, owing partly to rebound effects – and average 3.2% in 2026-28, with the PIA [Petroleum Industry Act] and recent deregulation of the power sector expected to support investment over the medium to long term.

Inflation

Inflation has continued to rise throughout 2023, and the pace has quickened since June owing to market reforms, which are likely to have powerful second-round pass-through effects.

Currency losses on the parallel market, where a sizable share of foreign exchange is transacted, will be a major driver of imported inflation into 2024.

From an estimated rate of 30.5% at end-2023, inflation will stay high in 2024, at 23.6% on average for the year, owing to a delayed and insufficient monetary response coupled with fiscal expansionism. The decline assumes that petrol prices will be held steady over much of the year.

In latter years an undercurrent of softer global commodity prices should foster a continued disinflationary trend until 2028, although in no year will inflation fall within the 7-9% target range.

Factors behind this include insecurity, a large devaluation in 2025, the need to deliver cost-reflective electricity tariffs and the CBN’s dovishness. We expect inflation to average 13.2% in 2025-28.

__________________________________________________________________

Related articles:

Ribadu confirms Buhari handed over a bankrupt Nigeria

Forex scarcity reduces imports to 65%

Manufacturers lament yoke of multiple taxation

__________________________________________________________________

Exchange rates

The naira’s “float” in June was followed by heavy losses on the parallel market (of 45% against the US dollar since June), in part driven by low liquidity in the NFEM and speculation.

The CBN has since reverted to guiding the exchange rate by limiting access to foreign-exchange sales for banks and other dealers that quote hard currency outside a preferred rate.

An unsupportive monetary policy implies that the naira will remain under pressure, and the CBN lacks the firepower to adequately supply the market or clear a backlog of foreign exchange orders, valued at over US$6bn, which will keep foreign investors unnerved.

Official foreign reserves are reported at US$33bn, but up to one-third of the assets are encumbered, tied up in derivative contracts or loans. In the short to medium term the official exchange rate will continue to be propped up by access restrictions, implying long lead times at the NFEM.

The CBN is expected to resist another attempt at convergence until petrol imports are eliminated in late 2024, with the naira ending that year at N822.9:US$1, down from an estimated N810:US$1 at end-2023 (accounting for some likely near-term weakening).

Sizable devaluations are expected in 2025 – or possibly sooner – causing a 38.5% loss against the US dollar over the year, to N1,142.5:US$1 at end-December.

However, we do not expect lasting commitment to a market-led naira, as the CBN lacks experience of conducting monetary policy under a float.

High inflation and a continued spread with the parallel market will leave the exchange-rate regime unstable and result in periodic devaluations. We project a rate of N1,262.1:US$1 at end-2028, with a continuous spread with the parallel market expected.

Forecasting the naira

The government officially adopted the NAFEX rate for official foreign-exchange transactions in May 2021, and the Central Bank of Nigeria (CBN) exchange rate was discontinued.

For the sake of continuity, data in previous periods will be for the official exchange rate before its merger with the NAFEX rate. The NAFEX rate is as quoted by the CBN.

External sector

Strong oil prices, rising crude output and a ramp-up of the Dangote refinery, which should eventually eliminate all imports of petrol (15% of total imports) and export fuels regionally, will deliver a comfortable current-account surplus as a share of GDP, of 2.9% in 2024 and 3% in 2025, up from an estimated surplus of 2.1% in 2023.

In later years sliding world oil prices will be a dominant trend, outweighing further incremental increases in crude production. Owing to this and growing domestic demand, which will suck in imports, the surplus will narrow throughout 2026-28, to 0.1% of GDP at end-2028.

The narrower trade surplus in these years will sit beside large structural services and income deficits, mainly related to the hydrocarbons sector. This will leave the surplus heavily dependent on remittances from the large Nigerian diaspora.

As economic growth strengthens in advanced economies these inflows should also rise, although the ease of operating through unofficial channels or through cryptocurrency will limit inflows formally recorded in the current account.