DMO blames NASS because it approves loans

By Jeph Ajobaju, Chief Copy Editor

China has stopped giving loans to Nigeria, saying it has listened to the agitation of Nigerians in the media and online that Abuja is borrowing mainly to steal and may default in payment. Nigeria already owes China $3.48 billion.

Beijing’s rebuff notwithstanding, Nigeria is pressing on to obtain more loans, evidenced by $1.25 billion raised through Eurobonds on Thursday, part of N150 billion bond issuance planned for 2022 and beyond.

Debt Management Office (DMO) Director General Patience Oniha disclosed on the day in Abuja that total national debt rose to N39.55 trillion in December 2021.

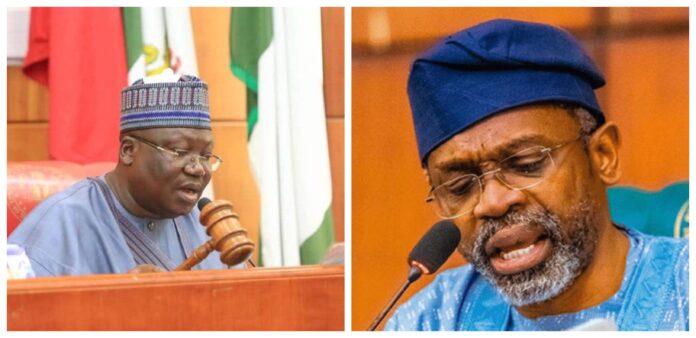

An overwhelming majority of Nigerians blame President Muhammadu Buhari for the loans, but Oniha insisted the National Assembly (NASS) and other arms of government are also responsible for the growing debt.

“It is not only the President and the Minister of Finance that endorse borrowing. The National Assembly passes the budget which contains how much will be borrowed after budget defence and public hearings.

“Borrowing came from the budget. The figures didn’t just happen. They came from many years of consecutive borrowing authorised by existing laws,” Oniha said.

She added that Nigeria’s debt to Gross Domestic Product (GDP) ratio is now 22.47 per cent which is within the 40 per cent threshold allowed by the World Bank.

__________________________________________________________________

Related articles:

Under Buhari, even lawmakers are stealing billions, says ICPC

Abuja plans new N150b bond issue to raise debt

Buhari balloons Nigeria’s debt by N20.8tr in 5 years. Servicing it costs N10.26tr

__________________________________________________________________

Debt rises 4.1% in 3 months

The N39.55 trillion total debt in December 2021 represented a N1.55 trillion or 4.1 per cent increase in three months compared with N38 trillion in September 2021.

Oniha explained that the sum is the total external and domestic debts of the federal government, the 36 state governments, and the Federal Capital Territory (FCT), according to News Agency of Nigeria (NAN) reporting, published by Nairametrics.

Her words: “For the federal government, it would be recalled that the 2021 Appropriation and Supplementary Acts included total new borrowings of N5.48 trillion to part-finance the deficits.

“Borrowing for this purpose, and disbursements by multilateral and bilateral creditors account for a significant portion of the increase in the debt stock.’’

Loans raised from different sources

Oniha said loans were raised from different sources, including Eurobonds issuance, Sovereign Sukuk, and Federal Government of Nigeria (FGN) Bonds.

She added that Abuja has introduced measures to deal with revenue challenges which make it tough to service loans.

“These Capital raisings were utilised to finance capital projects and support economic recovery.

“With the total Public Debt-to-Gross Domestic Product ratio of 22.47 per cent, the debt ratio still remains within Nigeria’s self-imposed limit of 40 per cent.

“This ratio is prudent when compared to the 55 per cent limit advised by the World Bank and the International Monetary Fund (IMF) for countries in Nigeria’s peer group.

“The federal government is mindful of the relatively high Debt-to-Revenue ratio and has initiated various measures.

“The measures are to increase revenue through the Strategic Revenue Growth Initiative and the introduction of Finance Acts since 2019.’’

Concern over debt

Despite Oniha’s assurances, economic, finance experts as well as the World Bank and the International Monetary Fund (IMF) have raised concerns about Nigeria’s huge debt, saying it is not sustainable.

Nigeria spends about 90 per cent of its revenue on debt servicing, forcing it to borrow to fund annual budgets.

Buhari and his cohorts insist that loans fund infrastructure, not recurrent expenditure; and what the country has is a revenue problem and not debt problem.