Sixty five-year-old United Bank of Africa (UBA) recently introduced Next Gen, an account with features likely to resonate with the target market.

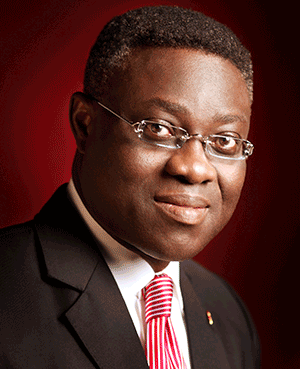

Phillips Oduoza, Group Managing Director/CEO, UBA Plc

The product, designed for the educated and enlightened teenager and young adult from ages 13 to 34, allows the bank to mentor and guide account holders into a future life of prosperity.

It comes at a time the vast youth population is looking for mentorship and guidance through careers supported by financial options.

Advantage of economic growth

This growth period of the Nigerian economy is the time to capture and mould tomorrow’s leaders through guidance, supported by financial options, for the personal and academic development of the individual.

Next Gen account is designed for the next generation of educated and enlightened professionals, employees, entrepreneurs, self employed persons, from all walks of life, early in their financial life cycle.

One of the benefits is that it grows with the customer from teenage years to young adulthood.

Youth needs

“It takes care of the unique needs of teenage customers when they are in secondary school through university to when they get their first job, start a family and even consider building their first house.

“At each of these critical stages in their lives, the Next Gen account provides financial options and opportunities to make life more comfortable for them and their family,” explained UBA Chief Executive Officer, Phillip Oduoza.

Iyke Idukpaye, UBA Head of Current Accounts and Credit Products, said the account holders will become part of the UBA Teen Fan Club which offers networking.

When they gain admission into tertiary institutions, they will enjoy scholarship, mentorship and internship. After graduation, they will enjoy exclusive invitation to job and career fairs and entrepreneurship workshops.

Account holders will also have access to 24-hour online banking, besides other privileges such as branded MasterCard, interest bearing savings account, career advisory and work place experience with the UBA Group.

Looking long into the future

Analysts expect that the product, if well marketed, will outlive generations as UBA is encouraging banking culture among 70 per cent of Nigeria’s 170 million population and entering into a pact with young persons across Africa.

The bank intends to guide them into a future world of prosperity because they are the Next Generation and the future.

The young people of today have needs that are different from those of their parents because the world they live in is different from the world their parents grew up in.

Said Oduoza: “We know that today’s world has no boundaries as technology has dissolved geographical barriers. The youths have a strong urge to be successful and to be able to compete globally.

“They want to be on top of their game, be the first to know, have the latest and most savvy gadgets, and most importantly, get the best jobs or start a business of their own.”

But this cannot be achieved without mentorship and guidance, and this is where Next Gen account fits in.