The Chinese loans are less conditional, opaque and less transparent in such a manner that due process is compromised providing latitude for official corruption of African leaders.

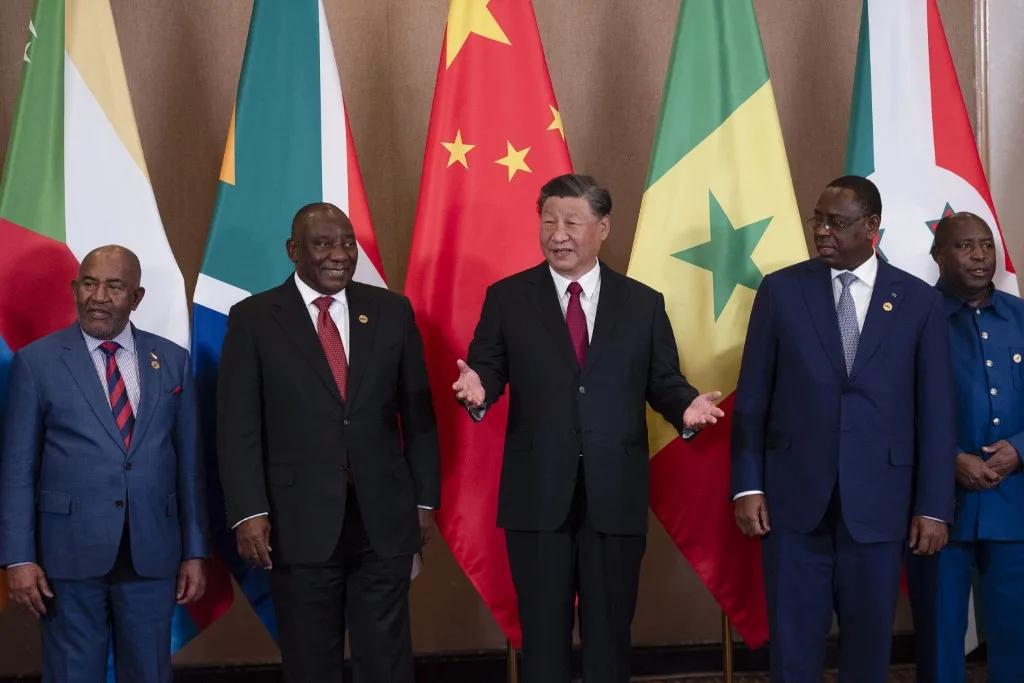

- Some African leaders with Chinese President Xi Jinping at the Summit

By Sonny Ogulewe

The 2024 China-Africa Cooperation Summit has ended in Beijing China with 51 African Heads of State, two presidential representatives including the African Union Chairperson in attendance. It means that out of 54 recognized sovereign states in Africa, only one was absent, which essentially underscores the changing dynamics in Africa’s geo-political and socio- economic milieu. This development equally carries a weight of strategic economic and security implications in the foreseeable future. The group photo taken at the Summit explained much more to me than one would imagine, particularly the explicitly humbling effect of Africa’s poverty and lack of honour much noticeable in the smiling faces of African leaders in the photo impatient to sign away their sovereignty in a fast unfolding “debt trap diplomacy” according to the United States Senate or what Bongo Adi christened “Chopstick imperialism“ in his work “Chinko Diplomacy and Chopsticks Imperialism: The Weaponization of Finance(1),” which he explained as the “weaponization of capital in the third world … to consolidate China’s new vision” and which this article considers as “neo-Sino-imperialism” in Africa.

At the 2024 Summit, China was quoted to have pledged a $50 billion financial aid to Africa in the next three years. This she pledged in order to extend the frontiers of “cooperation with Africa in industry, agriculture, trade and investment’ which XI explained was an “open and win-win” situation. This was even as China was yet to honour her commitment at the 2021 edition of the Summit, to buy $300 billion of African goods and again the inability of the African delegates to get negotiated exit framework from the stranglehold of Chinese debt trap.

Analysis of statistic provided by AidData, an Aid Transparency, Information Technology and Geocoding Institute, between 2000 and 2003 reveals that Chinese loan to Africa is estimated to have reached $182.28 billion spread across 1,306 projects in 45 African countries. This staggering figure is approximately 84.29% of World Bank loan of $216.15 billion and about 494.67% of African Development Banks’s loan of $36.85 billion to Africa within the same period. Invariably, the Chinese loans are estimated to about 72.04% of total of World Bank and ADB loans to Africa put together in same period. The top borrowers are Angola with the highest, second is Ethiopia, Kenya, Zambia, Egypt, Nigeria, South Africa, Cameroon, and Ghana in that order. To what extent these loans have been able to solve Africa’s infrastructure deficit needs to be interrogated.

In evaluating these loans some critical questions are pertinent which would explain if another variant of imperialism which could be christened as neo-Sino-imperialism is unfolding in Africa. In this context, this paper attempts to answer the following questions: Are foreign loans inevitable to Africa’s development process? To what extent has the existing loans stimulated or aided Africa’s development process? Are the conditions precedent in Chinese loans better compared to the Bretton Woods and ADB making them more attractive? Are Chinese loans transparent, sustainable and more flexible; and finally, will African countries be in a position to repay these loans and what are the implications on default? The extent we are able to interrogate these concerns will help to appropriately contextualize these loans to validate or otherwise dismiss the arguments for neo-Sino-imperialism or “debt trap diplomacy”. Debt trap diplomacy “describes an international financial relationship where a creditor country or institution extends debt to a borrower partially or solely to increase the lenders political and economic leverage over the debtor country”

READ ALSO: Publish details of Chinese loans, SERAP urges Govs

- African leaders with their host President Xi Jinping

Africa’s post-independence development gap particularly in social infrastructure is a generational concern and has become a popular and perennial political propaganda within the political party contestations in Africa. Sadly, each political party in Africa conveniently alludes to these gaps and have elevated the conversation to a rather ridiculous level of making outlandish promises of “factory! factory! factory!; water, water , water; build bridges where there are rivers or oceans, built trunk A roads for farmers, or “provide you insecurity (credit Edo APC gubernatorial candidate, 2024). This sloganeering shows the defects in our political evolution and the backwardness of the African political class that has consistently diluted the essence of governance to sloganeering, personal aggrandizement and outright deceit concomitant to her socio-economic backwardness.

Available statistics sourced from Centre for Global Development, ADB, IFC, Wilson Centre etc, has shown that over “600 million of Africa’s population representing only about 50% of Africa’s 2023 population estimates of 1.34 billion have access to electricity; 340m representing about 25% of this population lacking access to clean water and estimated 37% or 500m people lacking access to basic sanitation; only 60% of Africa’s roads are paved and 30% have access to rail network; about 50% of its urban population reside in informal settlements and only 20% internet penetration and 30% of mobile phone subscribers have access to 3G and 4G networks”. It is estimated that Africa would require between “$130 billion and $170 billion annually for infrastructure development” but presently suffers a “funding gap of between $50 and100 billion”. These gaps were not contrived but are existential challenges to Africa’s future that can only be addressed through multidimensional strategies among which are innovations, huge investments in infrastructure; foreign loans and partnerships.

Considering Africa’s poverty and technological backwardness and made worse by generational prolificacy of African leadership which has strangulated the opportunity to address these gaps overtime, with the limited resources at their disposal, it is only inevitable that huge foreign loans and partnerships are the immediate solutions if these gaps are to be addressed in a comprehensive manner. However, evidences abound that are suggestive to the fact that despite the humongous foreign loans, infrastructural deficits in Africa still persists and essentially explains the huge appetite for foreign loans. Recently, China has been very “generous with loans” to Africa and strangely dominant since the 1990s, which essentially has elicited the question of why the obsession with the Chinese in spite of the perceived flaws in their administration and particularly their unsustainability and ominous latent strategic economic and security implications.

These concerns have led some scholars to argue that Chinese loans to Africa are suspicious and encapsulate sinister motives which seemingly validate “debt trap diplomacy” phenomenon held by the US Senate. Their argument stems from the fact that the sheer size of the loans have not lifted the recipients from the intended deficits and China has consistently added to their debt profile. A good example they argued is Angola which is the largest recipient of Chinese loans, the third and fourth are Egypt and Nigeria. According to AidData Institute reports “All three have recently struggled economically, and yet China has continued to lend to them”

Instructively, the institute further observed that “despite Angola’s difficulties servicing existing loans, in 2021 and 2023, the Export –Import Bank of China, CHEXIM committed $79.7 million and $249 million to ICT projects in Angola, respectively. As financial risks have compounded in Egypt, China has maintained its unconditional and unsecured lending approach, extending a RMB 7 billion CDB liquidity loan to the Central Bank of Egypt. Finally, in the face of increasing inflation in Nigeria and a depreciating currency, China has revived financing for the Kaduna–Kano Railway Project with a $973 million CDB loan that replaces a cancelled CHEXIM loan”

The unsustainability of these debts are even clear and expectedly come with terms and in some instances the collaterals are tied to the projects themselves or to mining rights making it impossible for the countries to attract competitive prices for these natural resources which further weakens the ability to pay back. A diligent understanding of the context of this strange arrangement may offer new perspectives to the development and perhaps unravel the reasons why Chinese loans are more attractive to African countries than the Bretton woods and the African Development Bank.

Some scholars of the “debt-trap diplomacy” school of thought have also argued that “predatory geo-strategic motives on the part of Chinese government aiming not to support the local economy” in countries that took on loans through it, but “to facilitate Chinese access to natural resources, or to open the market for low-cost and shoddy Chinese goods.” Some further argued that when these countries ran into debt distress, “it [was] even better for China,” allowing China to pressure these countries into taking on more loans through it, ceding control of state assets to it, or aligning their foreign policy with it, in exchange for debt relief”. Deeper insights into these loans could reveal some creditable reasons to acquiesce with the argument of the proponent of the “debt trap diplomacy” and even more reveals a criminal connivance with the political elites to fleece their poor countries. As part of this grandiose geostrategic vision according to Adi, “China has established a military base in Djibouti thus putting to rest any doubts regarding its geo strategic intent”

The argument of the protagonists of debt-trap diplomacy is further elucidated when one juxtaposes the conditions precedent in Bretton woods loans and that of the Chinese loans. The Chinese loans are less conditional, opaque and less transparent in such a manner that due process is compromised providing latitude for official corruption of African leaders, whereas Bretton Woods demands certain economic or social reforms requirement or specific economic policies that eliminate corruptions. The key factor here is that despite the low debt sustainability, the Chinese loans are readily available because it apparently appeals to the Chinese strategic political and economic interest and equally appeals to the African leaders’ unquenchable appetite for public stealing. It is simply a marriage of opportunity to advance parochial interest.

Take the Zambia’s Kenneth Kaunda International Airport in Lusaka expansion project for instance where a Preferential Buyer Credit which AidData, noted was adopted in the contract. The agreement unequivocally stated that “The proceeds of the GCL and the PBC were to be used by the borrower to partially finance a $385,000,000 (or $385,809,673) commercial contract between the Government of Zambia and China Jiangxi Corporation for International Economic and Cooperation” This was signed on June 3, 2013 and amended on September 5, 2013 to “redesign the contract as an Engineering Procurement and Construction Contract (EPC)/Turnkey Project. (Note: A turnkey project is a contract under which a firm agrees to fully design, construct and equip a service facility and turn the project over to the purchaser when it is ready for operation” Invariably, what the agreement explicitly stated was that the loan was obtained by China Jiangxi Corporation for International Economic and Cooperation to design the airport expansion project, cost the project, construct and handover to the government of Zambia otherwise termed the Preferential Buyer Credit agreement.

The report further indicated that “this project has been plagued by corruption allegations and performance problems. In April 2015, media outlets reported that Zambian government officials and CJIC stole $25 million from the China Eximbank loan by unilaterally changing the original contract from $385 million to $360 million. This corruption allegation and contract renegotiations delayed project implementation by a few years” This was where the criminal interest of the political leaders was accommodated in the heist and of course justification for signing the dotted lines despite perceived flaws.

It is important here to explain what Preferential Buyer Credit (PBC) means to underscore the neo-imperialist motives of the Chinese loans. PBC facility demands that the recipient of the loan must use the facility to patronize the lender’s goods and services only, more or less a vendor financing facility in which the recipient has no right to make choices or contest prices and variations which invariably compromises the recipient’s sovereignty to receive competitive bids. The PBC equally by its very nature undermines local employment opportunities because the beneficiary vendors imports both the skilled and unskilled labour for the projects. That these strange conditions “compromise the sovereignty of these countries and international flexibility and resource use” is not debatable.

The same issues have equally arisen in the Chinese loan to upgrade Entebbe International airport. AidData Institute again reported “lack of clear transparency, extensive confidentiality clauses and unclear terms making it difficult for Uganda to fully understand the full implications of the debt particularly the condition that Uganda provides a cash deposit in an escrow, which can be seized in case of default” and despite these issues Uganda’s Chinese loans have grown to a staggering $3billon in 2020 further raising concerns of a sinister China “debt trap diplomacy”. Again Adi, cited the trend in the Republic of Djibouti, where “China has provided more than USD 1.4 billion in infrastructure project finance, which amounts to about 75 percent of the country’s GDP. The country’s external debt, most of it to China, currently stands at 85 percent of GDP which exposes the country’s vulnerability to a take-over by China of Doraleh Container Terminal which is a major strategic asset as a key refueling and transshipment center and a principal maritime port for imports and exports to neighbouring Ethiopia”. He equally cited that “Sri-Lanka’s, Hambantota Port, constructed with borrowed Chinese money and by Chinese engineers, fell into China hands last year on a 99-year lease because the Sri-Lankan government found itself unable to repay over USD 1 billion of the Chinese debt used to construct the asset”

Consequently, the argument by some scholars that a strange variant or wave of imperialism is gradually gripping the African continent which may potentially be more virulent and vicious than western imperialism appears credible. This wave of imperialism targets resources and sovereignty control or what scholars aptly classified as “debt trap diplomacy”. It could be a hypothetical argument but new developments in the trends of these loans and by its very nature and context are suggestive of the fact that this proposition may not after all be poles from the truth.

Following Africa’s independence the West nations were in competition to advance loans to upgrade the primitive infrastructure of the newly independent countries, which were later coordinated by the Brottonwood institutions. The process of obtaining these loans were rather transparent, corruption free and to enhance accountability and democracy. However, the late 90s has seen a gradual increase of Chinese loans to African countries because these were made attractive to African leaders who would prefer to side step transparency in processing these loans.

It is therefore evident that although foreign loans are imperative to close the infrastructural gaps in Africa, Chinese loans by its very nature and character rather exacerbates these gaps by fueling corruption which has equally facilitated the bourgeoning of dictatorial tendencies among African political leaders, compromising Africa’s sovereignty in most instances and by extension weakens capacity to be active players in global politics as well plunging Africa into a debt trap that constrains her future socio-economic and political developments. The time to therefore re-evaluate and re-think the desirability of the Chinese loans to save the future of the continent is certainly now.

Sonny Ogulewe Ph.D, is a public affairs commentator.