When in January 2010 the Central Bank of Nigeria (CBN) barred bank chiefs from serving more than two terms of five years each, the aim was to entrench good corporate governance by eliminating what former CBN Governor, Sanusi Lamido Sanusi, called key man scenario.

Mind boggling rot uncovered in rescued banks, particularly those whose chief executive officers (CEOs) became a personality cult, corrupt practices and rife abuses necessitated sweeping reforms by Sanusi, who came in from First Bank in 2009.

He set out to clean the Augean stable after sacking the CEOs of the rescued banks, and subsequently, the CBN Bankers Committee issued new guidelines which limited banks’ CEOs and directors to a maximum of 10 years.

This led to the retirement of three banks’ CEOs in July 2010, including Tony Elumelu (United Bank for Africa, UBA); Jim Ovia (Zenith Bank), and Akinsola Akinfenwa (Skye Bank).

Oba Otudeko, the then First Bank Chairman, also relinquished his position, having served for 10 years.

The CBN said the new rule was “meant to enthrone the principles of corporate governance in the banking industry and insulate the banks from being personalised by individuals who perpetuate all manner of abuses.”

According to the apex bank, the policy would raise confidence in the banking sector by finally curing the system of the prolonged financial distress, improve retaining capacity of financial capital through retention of external reserve in banks, and reduction in regulatory abuses and operating malpractices.

Who has substantial ownership controls the vision

The CBN merely scotched the snake. It did not kill it. For less than six months after Sanusi’s exit, the founding fathers have risen from the ashes of oblivion, warming themselves back into the banks they were compelled to leave four years ago, raising questions of what becomes the fate of the reforms initiated by Sanusi.

Godwin Emefiele, former CEO/MD of Zenith Bank, who became CBN Governor on June 2, succeeded Sanusi after the latter’s suspension by President Goodluck Jonathan three months to the end of his first tenure of five years.

Emefiele has partially reintroduced ATM charges on remote-on-us transaction which was abolished.

Former MDs and founding owners of banks have controlling shares which make them control the decisions of sitting MDs even from retirement.

Armed with the understanding that whosoever has substantial ownership controls the vision, the owners maintained controlling shares directly or indirectly by themselves, proxies, relations, or stockbrokerage firms and companies linked with them.

Diamond Bank metamorphosis

With Kunoch Holdings’ successful acquisition of Actis, CDC’s stake in Diamond Bank, the bank has metamorphosed into Dozie family bank in relation to shareholding structure.

With four subsidiaries, Kunoch Limited, incorporated on August 8, 1991, was launched by the Dozie family to consolidate the family’s diverse investment portfolio in a holding company.

With its acquisition of 14.79 per cent of issued share capital of Diamond, Kunoch currently holds about 20 per cent stake in the bank and may increase its stake to 22 per cent if it converts its debt estimated to translate into 256 million shares, and pick up its rights in the bank’s rights issue.

Besides Kunoch’s stakeholding, billions of Diamond shares linked with the Dozie family was put at over 53 per cent. But the exact volume of shares and total stakeholding could not be confirmed at press time.

In view of this fact, should the Securities and Exchange Commission (SEC) have approved Kunoch’s acquisition of Actis, CDC stake in Diamond Bank, mindful of CBN’s guidelines on shareholding structure of banks?

Kunoch Holdings has the following as its executive team: Pascal Dozie (CEO); Chiekezi Dozie (Director), Kelechi Dozie (Director).

An Australian, Harvey Zabusky, is the Head of ICT and Chinedu Ebo doubles as Company Secretary and Chief Administrative Officer, while Ike Nwankwo is Project Director.

Kaizen Venture Capital, its financial adviser, is managed by Chijioke Dozie and Ngozi Dozie, also key directors.

Analysts at Renaissance Capital said “while it’s good to see clarity around the ownership status of the bank … who replaces Actis’ two representatives on the board and implications for corporate governance going forward is important?”

Actis current representatives are Ngozi Edozien (CEO of Actis West Africa) and Allan Christopher Michael Low (former Standard Chartered CEO in Tanzania, Kenya, India and South African and currently DGM at National Bank of Kuwait).

Based on 2013 financial report, a total N42,438,682,629 credit granted by the bank is linked with directors, and N37.955 billion loan tagged performing are yet to be recovered.

Beneficiaries of the term loans, over drafts, and leases are largely associated with the Dozie family along with Igwe Achebe, Chairman of the bank. These account for over 75 per cent of the credit.

With such huge credit tied around key directors, it is therefore not surprising that pioneer stakeholders like Actis, CDC pulled out of the bank at a time it is raising N50 billion from rights issue after it had raised about N50 billion from Euro bond issue.

Both the bank and the SEC declined comment when contacted.

However, analysts who spoke on condition of anonymity expressed grave concern, saying good corporate governance is in jeopardy unless the shareholding of the bank is adequately diluted with neutral and external influence.

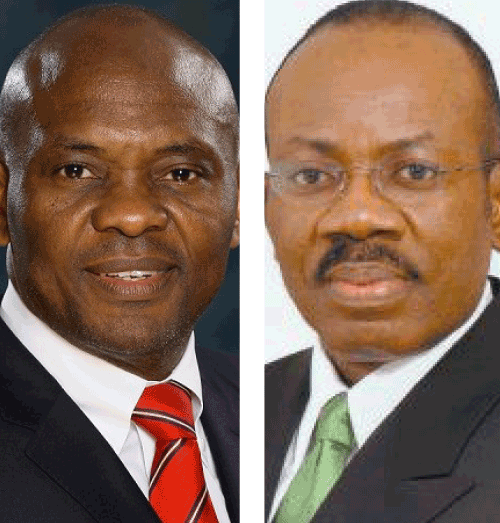

Elumelu returns to UBA

On Monday, August 25, the board of UBA announced the appointment of its former CEO, Tony Elumelu, as Chairman, succeeding Joe Keshi.

Elumelu retired as Group Managing Director (GMD) and CEO of UBA in 2010, following the introduction of the 10-year tenure limit.

He launched the Heirs Holdings, a proprietary investment company through which he holds stakes in UBA, Transcorp, and other entities.

Through his investment company, and some proxy entities, Elumelu is said to own greater percentage of UBA’s 16.5 billion shares fully paid up out of its 22.5 billion share capital.

Impeccable source close to him disclosed that he had been planning his return to consolidate and ensure safety of his lifetime investment in the bank that prides itself on providing services to more than 10 million customers, across Africa, in London, Paris, and New York.

Elumelu, being on the board of Tenoil Petroleum & Energy Services Limited, and Seadrill Limited, will require extraordinary agility to cope in this glut of boardroom assignments across corporate entities and other Heirs Holdings’ portfolio businesses.

However, UBA GMD/CEO, Phillips Oduoza, enthused that “Tony Elumelu’s track record at UBA speaks for itself …. We are privileged to have him lead the board at this critical stage in our development.”

Elumelu himself betrayed his hankering after the bank when he said: “I am very much looking forward to returning to the group – UBA represents a tremendous investment opportunity, and is at an inflection point in its growth path.

“We have an extremely powerful executive team and I am looking forward to bringing my experience and energy, to guide UBA’s long-term strategy.”

Peterside back in Stanbic IBTC

On the heels of Elumelu’s return to UBA, Standard Bank Group, parent company of Stanbic IBTC, announced the appointment of Atedo Peterside as a non‑executive director to its board and the board of The Standard Bank of South Africa with effect from August 22, 2014.

Stanbic IBTC Holdings CEO, Sola David-Borha, said “we are very pleased that Peterside, Chairman and Founder of Stanbic IBTC, is joining the board of directors of Standard Bank Group as well as the board of directors of the Standard Bank of South Africa.”

Peterside disclosed that he would shed some of his private sector responsibilities in Nigeria in order to discharge his new overseas role effectively.

About three years after leaving as MD/CEO, he was appointed the Chairman of Stanbic IBTC Bank, part of the Standard Bank Group. He is also Chairman of Cadbury Nigeria, a Director in Flour Mills of Nigeria, Nigerian Breweries, Presco, and Unilever Nigeria.

Peterside, who is also a member of both the National Economic Management Team and the National Council of Privatisation, was the Chairman of the Committee on Corporate Governance of Public Companies in Nigeria.

Stakeholders react

Principal partner of Sola Ephraim-Oluwanuga & Associates, Sola Ephraim-Oluwanuga, said corporate governance codes provide for years of interruption before former CEOs can come back. The interruption period, according to him, offers others the chance to run the company.

Oluwanuga added that it is good for them to return to manage the banks better, since they created them, but warned that regulators should guide against abuses.

“The disclosure requirement should be high. The regulators should ensure that transparency system is also high.

“We are in a capitalist economy but there are corporate governance provisions to handle key man situation. It is up to regulators to enforce those provisions,” he advocated.

Renaissance Shareholders Association Chairman, Olufemi Timothy, said it is a welcome development, insisting that it was wrong for the CBN to have forced the owners of banks to leave.

He argued that the 10-year limit on tenure of banks’ CEO is contrary to a capitalist economy.

“Their coming back is a good development. It will ensure that the banks are better managed than before. If I have over 50 per cent stake in a company, I cannot leave for anybody to manage it for me. You can’t thrust your life time investments in the hands of another person.

“So, Sanusi made a mistake in the first instance to limit to 10 years the tenure of the founding fathers of banks who have majority stakes. The limit should have applied to non-majority stakeholders because nobody could have run the banks better than the man who staked lifetime savings in it,” said Timothy, a shareholder activist.

Reminded that banks’ key men were used to empty the treasury, Timothy riposted: “It is the role of regulators to ensure they don’t run banks down rather than to sack them. Regulators should put them on their toes.”