Banks’ equities shareholders at the Nigerian Stock Exchange (NSE) are in for a double whammy.

Price values of many stocks have been depreciating, resulting in significant capital loss. Chances of dividend pay outs at full year 2014 are doubtful as regulatory headwind eats deep into earnings and profit target.

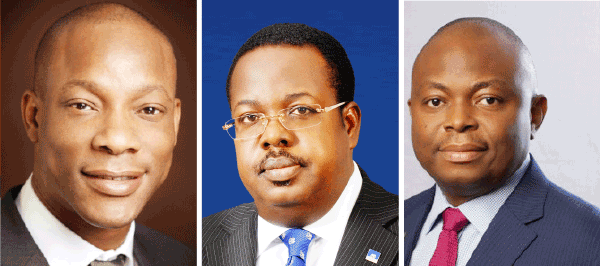

L-R: GT Bank MD, Segun Agbaje, First Bank MD, Bisi Onasanya and Fidelity Bank MD, Nnamdi OkonkwoHigher Cash Reserve Requirement (CRR), the gradual phase out of commission-on-turnover (CoT) from N5 to N3 in 2013, with zero charge likely in the months ahead, removal of charges on ATM transactions, upward review of interest banks pay on savings account of customers and increase in AMCON levy from 0.3 per cent to 0.5 per cent of total assets have taken a big bite on earnings of deposit money banks.

In April 2013, the Central Bank of Nigeria (CBN) commenced revised bank charges. By the end of the third quarter, it tightened monetary policy with upward review from 50 per cent to 75 per cent of eligible local currency public sector deposits as CRR.

With a further hike of CRR on private sector deposit to 15 per cent, up from 12 per cent, an estimated N2 trillion was sterilised from the banking system between December 2013 and the first quarter of 2014.

Banks resorted to core banking operations, advancing credits to customers for business expansion, which resulted in significant loans growth and expenses on loan loss.

Consequently, weaker performances have characterised recent financial results from banks, dimming chances of good returns on shareholders’ investment.

For instance, both FBN Holdings and Guaranty Trust Bank recorded 3 per cent average growth on credit to customers in the first half of the year ended June 30.

GTB’s profit after tax dipped 10 per cent to N44 billion, from N49 billion recorded in the corresponding period of 2013, due to 287 per cent growth in loan loss expenses.

The lender’s loan and advances to customers gained 3 per cent, moving up from N1 trillion recorded on December 31, 2013, to N1.04 trillion on June 30, 2014.

FBN’s loans and advances to customers rose to N1.84 trillion half year 2014, against N1.77 trillion in the corresponding period in 2013. Expenses on loan loss shot up 6 per cent to N108.5 billion, against N102.8 billion in previous six month accounts.

The group’s profit for the half year fell 19 per cent to N37.18 million, against N46 billion in first half 2013.

Skye Bank, Sterling, Fidelity, and Union Bank have varying degrees of credit increase and loans impairment which jeopardised prospects of return on investment.

Skye Bank credit rose 5.3 per cent to N578.9 billion from N549.9 billion and its profit accrual declined 31.1 per cent to N5.8 billion and basic earnings per share declined 31.2 per cent to N43.91 kobo per share.

Fidelity’s credit to customers inched up 3 per cent from, N426.1 billion to N438 billion, forcing profit after tax down 12 per cent to N8 billion in half year 2014, against N9.06 billion the previous year.

Sterling Bank’s credit rose 0.02 per cent to N321.8 billion even as profit dipped 7 per cent to N5.5 billion in June 30, 2014 in contrast to N5.9 billion on June 30, 2013.

UBA is not left out. Its profit and loans and advances dropped 19.57 per cent and 3.5 per cent to N22.86 billion and N904 billion respectively just as Diamond Bank reported pre-tax profit drop to N16.07 billion, 8.4 per cent lower than the N17.56 billion recorded in the same period last year.

In the same vein, Skye Bank said its half year to June pre-tax profit dropped 31 per cent to N7.26 billion, against N10.54 billion in the corresponding period of 2013. Its gross earnings also dropped to N63.88 billion from N71.16 billion.

Union Bank equally reported a drop in gross earnings, which stood at N49.6 billion, compared with N56.2 billion in 2013. Just as its profit before tax and profit after tax fell to N6.5 billion and N6.3 billion, against N9.8 billion and N9.4 billion respectively.

Its basic earnings per share depreciated 39.1 per cent to 39 kobo per share.

Reacting to banks’ poor financial results in the half year period, share prices dropped significantly on the NSE as investors picked them up at a discount. Stocks have recorded price depreciation of between 15 per cent and 51 per cent year to date.