Ogebe proffers solutions to forex hassles, fuel subsidy removal dysfunction

By Jeph Ajobaju, Chief Copy Editor

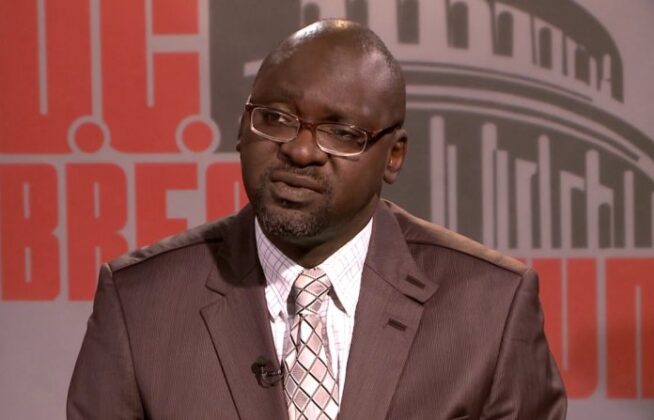

Human rights activist Emmanuel Ogebe, who is based in the United States, has written to the Nigerian Diaspora Commission (NIDCOM) reiterating previous suggestions and presenting new ones to tackle a raft of issues, ranging from recovery of Sani Abacha loot, encouraging more diaspora remittance to a better management of fuel subsidy removal.

Ogebe, who was once incarcerated by Abacha for a firsthand experience of human rights violations, also touched on solutions to the problem of foreign exchange (forex) buffeted by middlemen, round tripping, and sabotage, among other vices.

Currently Managing Partner at US Nigeria Law Group (USNLG) based in Washington, Ogebe is a regular commentator on Nigerian affairs.

His letter to NIDCOM, a copy of which was sent to TheNiche, is reproduced below:

Gesture of goodwill

Given renewed interest in governance following the Diaspora’s engagement in the recent elections, I am reaching out as a gesture of goodwill towards greater Diaspora cooperation for the benefit of the nation.

I am writing to draw your attention to several good governance issues related to the Diaspora:

1. Recovery of €200 million Abacha loot in US litigation

I wish to update you of an urgent anti-corruption matter we have tracked in the US for 10 years now.

This month [July], lawyers for the Bagudu family and the US DOJ approached the US District Court seeking another extension of time to finalize a settlement on about €200 million of seized Abacha loot.

I had approached the court making recommendations for the best interest of Nigerians because the Buhari regime was irredeemably compromised on the Abacha loot issue and Nigeria stands to lose roughly €200 million due to this conflict of interest.

I could no longer watch this travesty unfold and asked the court to share the money to Nigerian victims since the Nigerian government will not act decisively to reclaim it (see Amicus brief attached.)

Following recent regime change in Nigeria, I am appealing to relevant stakeholders to intervene to reclaim the funds which are beneficially, equitably and constitutionally owned jointly and severally by Nigeria’s three tiers of government.

It is blatantly unfair that at a time when NNPC is remitting less than $300 million monthly to the CBN, monies that belong to Nigerians are being returned to the looters in the first place with the balance going to the US government – instead of to the Nigerian Governments.

I believe it would be unjust for hundreds of millions of Euros to be lost without proactive action.

Accordingly we wish to initiate outreach to NIDCOM on how Government can recover these monies on behalf of Nigeria.

The relevant briefs filed are attached.

2. Disruption of Diaspora $22 Billion Remittances

I am concerned at recent policy reversals that threaten to negatively impact Diaspora remittances which have become a staple stabilizer of the Naira value.

As stated in my prior letter to you, Nigerians in Diaspora have in recent times remitted more money to the national economy than Nigeria’s oil production.

Besides that, the Diaspora’s multi-billion dollar annual remittances have historically been a stabilizing factor that mitigate the capital flight induced by corruption over the years. In short, our forex remittances is the life blood transfusion that has stemmed the financial haemorhagging by lootocrats.

The Nigerian government has borrowed money from the Diaspora by means of the Diaspora Bond.

Similarly the current regime … introduced a policy to incentivize more forex influx from Diaspora by CBN paying five naira for each dollar sent. This temporary policy was so lucrative that the Central Bank extended it indefinitely and remittances even exceeded oil export revenues.

In February 2022, the Central Bank of Nigeria claimed that diaspora remittances surged by 1,566.6%, accounting for a sizable portion of the CBN’s daily dollar receipts, from $6 million weekly to $100 million since the launch of the Naira-to-dollar promo

While Nigeria is unable to meet its OPEC oil production quota, Nigerians in Diaspora continue to remit funds despite pandemic and war-induced inflation and recession.

You can therefore imagine my shock that the new Tinubu administration CANCELLED the CBNs Naira-for-dollar incentivization policy effective July 1, 2023.

To fully comprehend the insanity of this action, kindly consider the following:

NNPC’s monthly forex payment to CBN dropped from $3 Billion to just $300 Million (10%) whereas Nigeria needs $1.8 Billion monthly for debt service and $4.6 Billion for importers.

Diaspora remittances, investors & FDI account for 10% of Nigeria’s forex inflow.

While manufacturers waited 3-4 years for forex allocation, cronies collected CBN forex daily to resell and become instant billionaires by abuse of the multiple exchange rates.

Although dual exchange rates have been abolished, the issue here now is that the $100 million weekly ($400 per month) Diaspora remittances which augmented the paltry $300 million remitted by NNPC by 130% is now at risk of falling to the pre-Naira-to-dollar promo rate of just $6 million weekly ($24 million monthly.) This cannot be the right direction Nigeria needs right now.

As The Guardian reported, “exporting out of Nigeria, unlike in other parts of African countries, has become too expensive for vendors,” Aladeselu said.

“All the airlines that come into Nigeria depart empty. Because it is cheaper for them to go out empty than carry something. If you load 100 tonnes of cargo on aircraft here, you are charged $35,000 in fees and taxes. Out of Ghana on the same trip is less than $4,000. That is why airlines would rather jet out empty.

“So, Nigeria is just hawking, not trading in the global cargo market. There are 500,000 to 620,000 tonnes out of Kenya every night. Here, we cannot boast of 20,000 tonnes a week.

“That is a $250 billion agro-export market wasting away. We created it for ourselves because we allow the civil servants to lord it on us all,” Okakpu said. (https://guardian.ng/news/foreign-cargo-airlines-depart-empty-over-extortion-multiple-charges/)

In this sorry state of affairs, the role of Diaspora remittances should be even more critical to the national economy than to be abruptly disrupted and endangered by this unfortunate policy reversal.

________________________________________________________________________

Related articles:

Eyes on the judiciary: My personal experience with a judge on PEPC panel, Justice AB Mohammed

Why Nigeria shouldn’t let US push it to war in Niger Republic (Pt 3) — Lawyer Ogebe

________________________________________________________________________

3. Suspension of forex delivery

As stated in my prior letter, Diaspora remittances are the sole saving grace of the naira now which would have crashed to over N1,000 to the dollar.

It is ironic that while the political kleptocrats single-handedly destroyed the Naira through their delegates dollar-bribing spree, it is hardworking Diasporans who continue to shore up the naira in a forex depleted economy.

At a time when NNPC has failed to remit forex to the government, thus exacerbating the forex shortage, Diasporans continue to inject forex into the economy.

At a time of massive investor disinvestment and capital flight, the Diaspora remains a committed investor in Nigeria.

“In 2021, Nigeria’s foreign direct investment (FDI) was merely about USD4.8 billion while home remittances by the Diaspora was estimated at just over USD 20 billion. This means that remittances were about 4 times more than foreign investments.”

Given the above, it was equally stunning to learn that dollar-for-dollar remittances has now been changed to Naira delivery.

This policy has not only crashed the naira to over 840 to $1 but it has reopened the floodgate for massive money laundering and capital flight from Nigeria!

According to press reports, “In 1996, Nigerians abroad repatriated about $4.5bn (about 50 per cent of our gross revenue from oil) and we ensured that these amounts were brought into Nigeria, intact, in foreign exchange.

“The receipts helped to stabilise our exchange rate mechanism at N82 to a dollar, throughout my tenure as the Minister of Finance, to the extent that the naira was internally convertible currency.

“Some years ago, on my visit to London, I went to Western Union office, at Marble Arch, to test by remitting £500 to my son in Nigeria.

“I first had to convert the money to dollars and to my surprise, Western Union gave me a quote in naira to be claimed by my son.

“I refused their naira equivalent and insisted that my son must be paid in dollars.

“It was obvious to me that there was an arrangement between our Nigerian banks and Western Union/MoneyGram, whereby the former pays from their excess naira liquidity while the latter retains the dollars abroad.

“In other words, the dollar remittance is retained abroad and is laundered by the Nigerian banks. This is definitely against the law which provides that all remittances must be brought into Nigeria in foreign currency via domiciliary account.

“If by chance, as in my case, the dollar is remitted into Nigeria, the Central Bank of Nigeria on August 14, 2014, introduced the Outward Money Transfer Service and authorised the same MoneyGram and Western Union to re-export, in tranches of $5,000 per transaction, to Nigerians abroad, on payment of the naira equivalent at the CBN rate of exchange.”

“Thus, Nigeria is the only country in the world re-exporting its remittances.

“It is relevant to note that the naira is not a convertible currency but remittances which are meant to stabilise our exchange rates are re-exported!

“There is something wrong at our Central Bank…

“The fact is that the Diaspora remittances are not retained in Nigeria and there is a collaboration between the CBN, Nigerian banks and Western Union/MoneyGram; in such an event, government must investigate the infraction, punish the money launderers, and recover all past Diaspora remittances retained abroad!” Etubom Ani is a former Minister of Finance 1993-1998*

From the above analysis of the ex-Minister credited with introducing Diaspora Remittances into the Nigerian economy, the recent policy of the Tinubu administration stopping dollar end-user delivery destabilizes the naira and foments money laundering and looting.

In other words, the role of the Diaspora in stabilizing the country from the looting is undermined when the looters simply use our dollars to launder their stolen Naira abroad!

This new policy must be stopped at once to stem capital flight and strengthen the Naira.

4. Subsidy Solution

For several years, I represented a successful Nigerian American in the oil sector who devised a proposal to save Nigeria millions of dollars daily on fuel subsidy.

At his instruction and expense, I flew down to Nigeria several times and testified in the Senate adhoc committee on fuel subsidy.

Our proposal opened up a can of worms that led to the ouster of an MD of a state petro company.

However, despite our presentation of the subsidy solution to three successive Nigerian presidents, it was never implemented and ultimately we were warned that the benefitting cartels would come after us.

I want to once again offer this proposal to NIDCOM in view of the acute suffering and economic asphyxiation that recent massive fuel price hikes have caused, to ameliorate conditions in the country for the citizenry.

I am regretfully unable to be in Nigeria for Diaspora Day as I just returned from a one month visit to Nigeria.

However I would be glad to continue dialogue on these good governance recommendations and opportunities at your convenience.

Thank you and I look forward to an opportunity to answer any questions you may have to move things forward.

Warm regards,

Emmanuel Ogebe

Kindly see the briefs recently filed attached.