If all it takes for people to acquit themselves creditably in assignments is multiple degrees in the field of Economics, why did Soludo effect a banking consolidation that left an acrid stench of corruption in its wake, a mess that his successor, Sanusi Lamido Sanusi, had to clear?

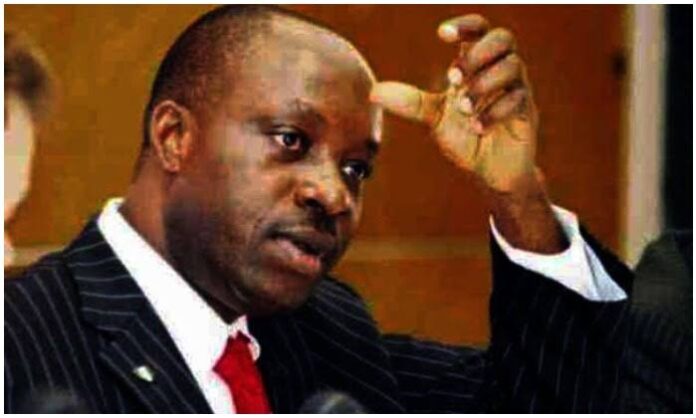

By Chuks Iloegbunam

Charles Soludo’s contemporaries say that, as an undergraduate, he came up with this rather fine slogan: Soludo is the solution, when he vainly contested for the secretary-generalship of the University of Nigeria, Nsukka, Students’ Union. In 2010, he again used the Soludo is the solution mantra but disastrously lost the Anambra State governorship election.

This means that Soludo, the serial electoral loser, is fixated with the illusion that he alone constitutes the solution to every imaginable problem on God’s terra firma. Little wonder that his controversial article entitled Buhari vs Jonathan: Beyond the Election (published on January 25, 2015 by a number of Nigerian dailies and on Internet platforms) was nothing other than a 6000-word tirade aimed at situating himself at the dizzying heights of the only possible answer to every economic challenge.

Soludo cleverly disguised his article to look like an economic disquisition. Since he is acclaimed as a brilliant economist, a professor of Economics, and a former Governor of the Central Bank of Nigeria, serious-minded people rushed to read his intervention, believing that, given Soludo’s pedigree, its essence would come down on the side of reason.

Instead, the piece turned out to be an unmistakable effort at lashing out at perceived opponents, a conceit-ridden epistle in which the self-proclaimed “Iroko tree” of global economics saw his unfortunate victims as ignoramuses, a “coterie of clowns” and “provincial palace jesters”.

Soludo wrote with condescension, almost in the manner of a primary school teacher labouring beyond the call of duty to impart rudimentary knowledge to numskulls pretending to be pupils.

In the end, informed readers had little positive to say about Soludo’s piece. It simply became the subject of animated and outlandish discussions in the social media, those sordid instruments for listless people screened behind aliases and pseudonyms. Fortunately an informed response came from the Federal Ministry of Finance. This will be addressed shortly. But, first, some background information.

It is clear from carefully going through the dubious article in question that Soludo’s animus was principally against three individuals: President Goodluck Jonathan, Dr. Ngozi Okonjo-Iweala, the Finance Minister and Coordinating Minister for the Economy, and Mr. Peter Obi, the former Governor of Anambra State. He has good reasons for his disdain for the three.

Although he was sacked by President Umaru Musa Yar’Adua, Soludo believes that Dr. Jonathan, who was then the Vice-President, played a role in his ouster from the Central Bank. In 2010, Soludo was the PDP flagbearer in the Anambra State governorship election. He attributes his electoral defeat to non-support from President Jonathan.

His grouse against Peter Obi is less for the fact that Obi trounced him in the 2010 gubernatorial ballot and more because, during the 2014 ballot, Soludo, who had suddenly transformed into an APGA governorship aspirant, found his ambition truncated by Obi. Therefore, in trying to get back at the former Anambra State Governor, he took liberty in repeatedly calling him a trader and disparaging his administration, not finding it in his heart to give credit to a man who governed a state for eight years without borrowing a single kobo.

On leaving the Central Bank, Soludo claims credit for leaving behind the sum of $45 billion “during the unprecedented global financial and economic crisis” but castigates Peter Obi who left N70 billion in funds and assets in Anambra’s coffers at the completion of his mandate because “his children were dying of kwarshiokor”.

READ ALSO: Abia APC, the judiciary and Ikechi Emenike factor

What is not so clear is the reason he detests and resents Dr. Okonjo-Iweala, his benefactor. Sometime in the early 2000s a certain Charles Soludo surfaced at the World Bank in Washington DC and asked to see Dr. Okonjo-Iweala. He had just set up the Enugu-based African Institute for Applied Economics and would want the then Country Director at the World Bank to accept to chair its Governing Council, in order to give credibility to the fledgling think tank.

That was how Dr. Okonjo-Iweala came to know Charles Soludo. As a supportive Nigerian that she is, she accepted to chair the council. When President Obasanjo appointed Okonjo-Iweala his Finance Minister, this same lady recommended Soludo for appointment as Chief Economic Adviser. Soludo, characteristically has been all over the place denying this version of his past, utilizing every opportunity to take a swipe at his benefactor.

That is why Soludo’s invectives against his victims are particularly galling. He went about criticizing the quality of those in the Economic Management Team, creating the impression that, unless someone holds a professorship in Economics, they cannot contribute anything to their own growth or to national prosperity.

Perhaps, Soludo is unaware of the fact that, of the 10 richest people in the world, two dropped out of university, three didn’t even matriculate to begin with, while only Warren Buffet has a Masters’ degree in Economics.

If all it takes for people to acquit themselves creditably in assignments is multiple degrees in the field of Economics, why did Soludo effect a banking consolidation that left an acrid stench of corruption in its wake, a mess that his successor, Sanusi Lamido Sanusi, had to clear?

Taking this into consideration, someone like Soludo should not be speaking with brashness and a holier-than-thou attitude, especially given the revelations contained in the Finance Ministry’s response to his diatribe.

“Let it be noted for the record books that Soludo’s single-handed mismanagement of the banking sector led to an incredible accumulation of liabilities that will cost tax payers about N5.67 trillion (being the total face value of AMCON-issued bonds) to clean up,” wrote Paul Nwabuikwu, the media adviser to the Finance Minister.

“Let it be noted also that this amount, which is more than the entire Federal Government 2015 Budget, constitutes the bulk of Nigeria’s ‘contingent liabilities’ mentioned in Soludo’s article.”

Soludo made a sing-song of the economic growth that took place during former President Obasanjo’s second term, following reforms supported by the President and implemented by the Economic Management Team.

Nwabuikwu’s rejoinder put that in context with the following sentence: “Please note that the Finance Minister under whose leadership that good performance took place, including massive unprecedented debt relief, is still Finance Minister today.”

Two critical points were drawn to Soludo’s attention: (1) At a time when global economic performance was mediocre, with GDP growth averaging about 3 percent per annum, Nigeria’s GDP growth in the Jonathan administration – averaging about 6 percent per annum – is indeed remarkable. (2) This Jonathan administration managed to control inflation, which he Soludo, was not able to do during his time at the helm of monetary policy in Nigeria. “When he left the Central Bank in 2009, inflation – which hurts the poor and vulnerable in the society the most – was above 13 percent per annum. Now, inflation is at single-digit, at 8 percent per annum.”

For two reasons – spite, and the angling for appointment in a Buhari government of his phantom expectation – Chukwuma Charles Soludo decided to abandon the clear path of reason and integrity, to tread a field strewn with the thorns of pointless self-devaluation.

That, in sum, represents his apotheosis.

- Iloegbunam (iloegbunam@hotmail.com) is a commentator on national issues.