Leakages and corruption deprive treasury of funds to solve problems

By Jeph Ajobaju, Chief Copy Editor

Leakages and corruption in tax administration are responsible for low treasury revenue which triggers a double whammy of budget implementation hindrance and borrowing that balloons national debt.

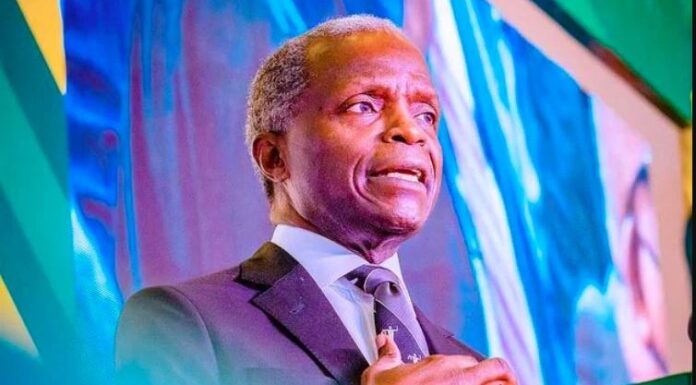

Vice President Yemi Osinbajo made the point in Abuja and stressed the need for rapid digitalisation of Nigeria’s economy to rank it among the top in the world.

He spoke at the 24th Annual Tax Conference on “Global Disruption, Taxation and Digitalisation: Implications For Socio-Economic Development” where he was represented by Federal Inland Revenue Service (FIRS) Chairman Muhammed Nami.

Osinbajo insisted that insecurity and all other criminal acts can only be tackled if the government has adequate revenue. He urged the Chartered Institute of Taxation of Nigeria (CITN) and other Nigerians to comply with tax laws.

“Nigeria’s economy is fast, digitalising. The digitalisation of Nigeria’s economy means that the way and manner of organising and doing businesses have changed.

“Indeed the radical changes brought about by digitalisation have displaced the traditional approach to tax administration. Consequently, the digitalisation of tax administration is unavoidable. That is why our government has continued to heavily invest in the automation of tax administrative processes and digital infrastructure,” he said.

“To provide an enabling environment for the digitalised tax administration, the government has been making necessary tax policy change, developing rules for translation of the digital economy, enacted required legislation and also provided political backing for the team negotiating the new International tax rule for the digitalised economy.”

________________________________________________________________

Related articles:

EFCC discovers 17 properties amassed by Idris

Malami again stalls EFCC’s arraignment of Oduah

Auditor says 15 MDAs fail to remit N127.13b to treasury

__________________________________________________________________

Need for full digitilisation

Osinbajo canvassed support for full digitalisation of tax administration processes due to the imperative for multi-stakeholder support in tackling disruptions occasioned by digitalisation and entrenching efficiency, ease of administration, ease of compliance, and general ease of doing business, per Vanguard.

He said President Muhammadu Buhari in 2021 directed all stakeholders, including Ministries, Departments, and Agencies (MDAs), to support the Tax Automation drive of the FIRS in assessing their data processing systems.

“It is in the best interest of our country that government at all levels should be in revenue. Delivery issue of insecurity, crimes and criminalities, inadequate social-economic infrastructure, et cetera can only be addressed if there is adequate revenue in the hands of government.

“Therefore, I call on the CITN and every Nigerian to comply with extant tax rules, encourage others to comply and report those not complying. We must all understand that Nigerians alone have the responsibility to build the Nigeria of our dreams.

“We must therefore take the destiny of our country in our hands, create and develop the future that we all desire for this generation and the generation to come in the future.”

CITN President Adesina Adedayo tasked all tax professionals to be solution providers in mitigating challenges occasioned by COVID.

“The world witnessed an unprecedented disruption in 2020 with the COVID-19 pandemic circling the globe, which led to global economic downturn. Governments, businesses, and tax agencies have been tackling the new challenges strenuously,” he said.

“As tax professionals, we should be more resilient and proffer lasting solutions to mitigate these disruptions, some of which have been highlighted in my address.

“In the light of recent developments, there is need to interrogate the most relevant out of the 15-point OECD-BEPS Action Plans and their effect on our economy.

“Of particular interest are Action Plans 5,6,13,14, which currently form the implementation of the OECD-BEPS Project 4 minimum requirements.

“They are Harmful Tax Competition, Treaty Abuse, Country by Country Reporting, and Alternative Dispute Resolution respectively.”

Adedayo lamented Nigeria’s exit from the Global Corporate Minimum Tax Agreement in July 2021 saying, “this decision too has its disruptive impact on our nation’s economy.”

Annual Tax Conference Committee Chairman Ruth Arokoyo stressed the need to use technology to compete globally without the interruption of distance.

“The global COVID-19 pandemic has altered business transactions across the globe, causing business communities to adopt technology to mitigate the effect occasioned by the pandemic,” she added.