FirstBank SMEConnect has been the cornerstone for exposing SMEs to vibrant and flexible ways to have their businesses strengthened

By Eugene Onyeji

The emergence of e-Commerce, e-Business and e-Everything has almost permanently put paid to run-of-the-mill business operations that used to be the order of the day.

All over the world, the advent and reinvention of technological practices have birthed numerous opportunities that have spurred the continuous growth of the business environment.

Amongst the areas impacted by technology is the payment methods and systems which have unrelentingly evolved as businesses have been exposed to easy, seamless and time-saving ways to foster their business transactions with customers and other stakeholders.

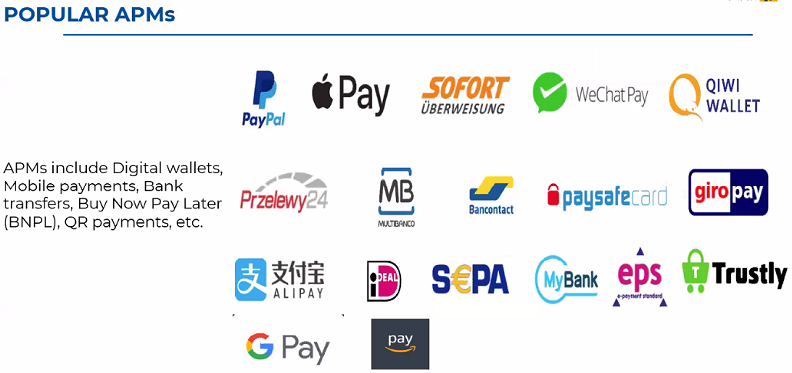

Globally, there are no fewer than 20 alternative payment platforms that are exploring and exploiting the payment revolution in order to change the mode. Among the notable ones are Paypal, Apple pay, Google pay, Wechatpay, and many others, all of which are having their fair share of the market.

Everywhere and in every way, alternative payment methods are being used to change and transform the payment landscape in the twenty-first century. More often than not, the speed of such transactions is simply amazing; efficiency and effectiveness are always assured.

In furtherance of its role in promoting the sustainability and viability of the Small and Medium-sized Enterprises (SMEs), Nigeria’s premier and leading financial inclusion services provider, FirstBank on Thursday, March 24, 2022, hosted a SMEConnect webinar to equip SMEs on how their business can take advantage of various payment channels to penetrate new markets, increase sales, and create a better customer experience.

The Zoom meeting on “Leveraging Alternative Payment Methods (APMs) to Drive Revenue for your Business” exposed SMEs to current technologies as they concern payments and demonstrate how the adoption of alternative payment methods can play an integral role in driving revenue growth.

For many years, the FirstBank SMEConnect webinar series has been the cornerstone for exposing SMEs to vibrant and flexible ways to have their businesses strengthened through visibility to new opportunities that are critical to sustaining and expanding their businesses. The webinar has been one of the Bank’s gateways to delivering the capacity building pillar of its value propositions to SMEs which has had many businesses reinvent themselves with the relevant competitive edge.

Read Also: IWD: First Bank tackles gender gap with First Women Network

The event was moderated by First Bank MSME Client Value Proposition Team Lead, Akanimoh Ojo.

Speakers included Jeffrey Williams–Edem, Group Business Head, Merchant Acquiring, Interswitch Group and Kolawole Ogunmekan, Head, Digital Innovation Lab, E-Business and Retail products FirstBank.

Jeffrey Williams–Edem, in his presentation, took the audience through the buyer’s journey, says buyers don’t wake up and decide to buy on a whim. They go through a process to become aware of, consider and evaluate, and decide to purchase a new product or service. He went on to list alternative payments, how to enable them and how it helps revenue to grow.

He stated the following as benefits to using alternative payment methods:

1. With Alternative payment options, you increase the average basket size of your customer.

2. You reduce churn rate and drop-offs, which impacted your sales revenue.

3. You improve your service delivery; happy customers mean repeat business.

4. You make your businesses competitive, and people are able to name you as an option all the time.

5. Finally, you are able to digitize your transactions, which gives you access to financial services and better reporting that enables faster and informed business decisions.

The second speaker, Kolawole Ogunmekan, highlighted factors to consider when choosing an APM as a business. They include;

1. Customer preference – Invest in a solution that aligns with your customer’s lifestyle.

2. Flexibility – Focus on convenient and frictionless payment methods.

3. Security – Choose APMs that offer security features such as fraud protection.

4. Price – Choose APMs with transparent pricing.

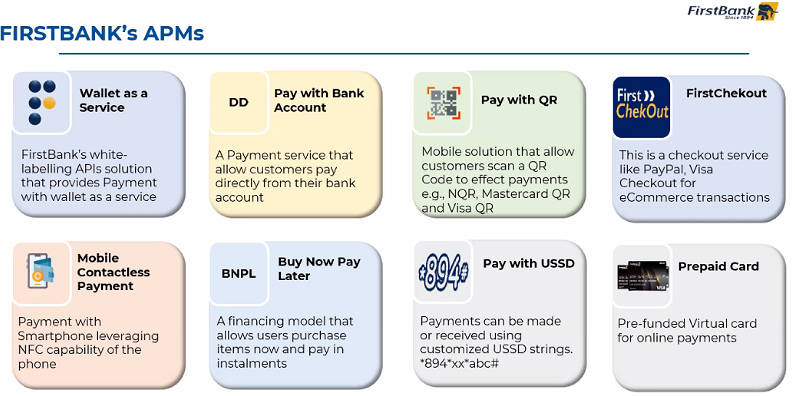

Ogunmekan went further to list the various alternative payment methods of FirstBank that their customers can leverage in doing their business to grow revenue.

The webinar ended with a question and answer session.

First Bank of Nigeria Limited (FirstBank) is the premier Bank in West Africa and the leading financial inclusion services provider in Nigeria for 128 years.

With over 750 business locations and over 160,000 Banking Agents spread across 99% of the 774 Local Government Areas in Nigeria, FirstBank provides a comprehensive range of retail and corporate financial services to serve its over 36 million customers. The Bank has an international presence through its subsidiaries, FBNBank (UK) Limited in London and Paris, FBNBank in the Republic of Congo, Ghana, The Gambia, Guinea, Sierra Leone, and Senegal, as well as a Representative Office in Beijing.

The Bank has been handy at promoting digital payment in the country and has issued over 11million cards, the first bank to achieve such a milestone in the country. FirstBank’s cashless transaction drive extends to having more than 10million people on its USSD Quick Banking service through the nationally renowned *894# Banking code and over 5 million people on the FirstMobile platform.

Since its establishment in 1894, FirstBank has consistently built relationships with customers focusing on the fundamentals of good corporate governance, strong liquidity, optimised risk management, and leadership. Over the years, the Bank has led the financing of private investment in infrastructure development in the Nigerian economy by playing key roles in the Federal Government’s privatisation and commercialisation schemes. With its global reach, FirstBank provides prospective investors wishing to explore the vast business opportunities that are available in Nigeria, an internationally competitive world-class brand, and a credible financial partner.

FirstBank has been named “Most Valuable Bank Brand in Nigeria” six times in a row (2011 – 2016) by the globally renowned “The Banker Magazine” of the Financial Times Group; “Best Retail Bank in Nigeria” for seven consecutive years (2011 – 2017) by the Asian Banker International Excellence in Retail Financial Services Awards and “Best Bank in Nigeria” by Global Finance for 15 years. Our brand purpose is always to put customers, partners, and stakeholders at the heart of our business, even as we standardise customer experience and excellence in financial solutions across sub-Saharan Africa, in consonance with our brand vision “To be the partner of the first choice in building your future”. Our brand promise is always to deliver the ultimate “gold standard” of value and excellence. This commitment is anchored on our inherent values of passion, partnership, and people, to position You First in every respect.