By Jeph Ajobaju, Chief Copy Editor

Jeff Bezos, the world’s richest man, holds 5 per cent of his wealth in hard cash, but many Nigerians rich and poor are saving up in banks and in investments to make enough cash to relocate to where they can realise their life ambitions in better climes.

The ultrarich buy foreign citizenship through investment in European countries and, especially in the Caribbean, the jewel of them Grenada, to obtain Golden Visas that enable them travel visa-free to places like United States and Europe.

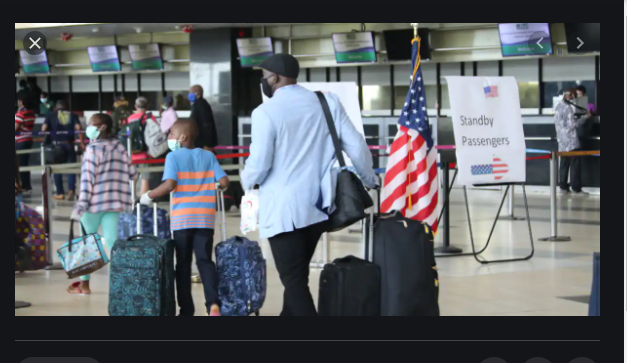

Thousands have emigrated to the US on the Green Card lottery scheme since it began in 1994. Now, some prefer Canada, shunning even the United Kingdom which had been the second home of many Nigerians since colonial times.

Nairametrics reports that for young people in developed countries, a career trajectory follows the order of: graduate from school, move to a favourite city, land a dream job, work on your promotion.

In Nigeria, the reality is a world apart. A university graduate may be jobless for five years or more, making it difficult to have a decent standard of living.

Hard struggle for survival

The major problem is unavailability of jobs. The Nigerian job market is like an evil forest full of treasures. Everyone is scared of it, yet they must go there to survive.

Every year, Nairametrics reports, thousands graduate from tertiary institutions and are pushed into a job market that does not have any room for them. With limited resources and skills to create their own jobs, they compete for few job vacancies.

Expensive option

To make it in life, many become desperate; they leave loved ones behind and travel across the seas to foreign lands where they often become strangers.

This is called “checking out” for greener pastures. While it is a viable and legal option, emigration is not cheap, especially for those who barely earn enough to sustain their livelihood.

Emigration requires a lot of planning, consistent saving, and investing.

Saving up

Many struggle to fund their relocation, but there remains one good old way to accumulate money – save more and spend less.

One Nigerian who emigrated to Europe, Charles (not his real name), relied on his savings as primary funding. Recalling how saving “helped my life,” he said he had to “save aggressively” and live frugally for more than three years.

Charles began nursing the idea to travel to Germany in 2015. He had just completed his studies and was fortunate to get a job in Lagos which paid N150,000 monthly, from which he saved up 70 per cent per month.

His ambition to emigrate helped him to make conscious efforts to save. Another thing that helped him was that he had a rent-free apartment close to his place of work. He saved up over N3 million in three years.

Making more money

Saving up is good. However, inflation messes up the value of money and frustrates plans.

Nonso (not his real name) knew this very well when he was planning to leave Nigeria before the recession which hit the country in 2018. To avoid the tragedy inflation could cause, he converted most of his naira to dollars.

“I was already earning some monthly income in dollars due to a scholarship I was on. So, considering how the value of the naira was fluctuating at the time, I thought to myself that it would be nice to hold on to the dollars as they come in instead of converting them to naira,” he recounted to Nairametrics.

“Soon, I had converted the rest of the money already in my account to dollars. With hindsight, I think it was quite a risky thing to do, keeping all those dollar bills in my room.

“But then again, the cash wasn’t even as numerous as it would have been if I was keeping the money in naira. I just had to learn to hide them properly.”

The plan worked and before long, he was buying and selling dollars. This was between 2015 and 2017 when the exchange rate of the naira to the dollar was quite high.

In the end, Nonso preserved the value of his money and earned extra in the process, which facilitated his relocation.

Borrowing

Some borrow money to beef up their account, as a bank account statement may be required for visa at an embassy.

Maryam (not her real name) explains that relatives and friends would transfer money into someone’s account to swell it up to a reasonable amount.

“The money would come in at different times and stay there over time. After the traveller has flown abroad, the money is refunded to the lenders,” she said.

Why emigration is expensive

Some people give up on emigration after realising the financial cost. But nothing good comes easy.

Nairametrics articulates that emigration is expensive for the following reasons:

· About N30,000 is needed for a passport, if you do not have one.

· It costs about N200,000 to write IELTS, TOEFL or GRE examination. Besides, money is required to register for preparatory classes.

· You need about N100,000 for visa application. Visa applications vary, depending on where and for what purpose you are travelling.

· If you are travelling for education (the avenue most young Nigerians use), admission application fee may cost up to N50,000.

· You have to travel from your base to Lagos or Abuja for embassy interview, which also chalks up the cost, whether you travel by air, land, or sea.

· After getting a visa, the flight ticket to travel out may cost anything from N300,000 depending on your destination.

· You need addition money for sustenance when you get to your new location until you start working and earning money.

You may need more than a total N3 million to finance your relocation to another country.

Emigrating can be a game changer because there are more job opportunities out there compared to here. Many Nigerians will strive to leave as long as the economic situation in the country remains dire.