The Securities and Exchange Commission (SEC) on Tuesday promised to support FMDQ OTC to create a vibrant debt capital market (DCM) aimed at financing the nation’s N3.9 trillion infrastructure deficit.

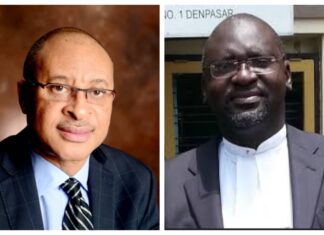

Mr Mounir Gwarzo, SEC Director-General, said this at a two-day workshop organised by FMDQ OTC, and the commission in Lagos.

Gwarzo said that the country’s N3.9 trillion infrastructure deficit could only be financed through a vibrant debt market.

Gwarzo, who was represented by Mr Zakawanu Garuba, Executive Director, Corporate Services, said that it would take the country 30 years to close its infrastructure gap.

He said the infrastructure gap would not be financed with budgetary allocations of the Federal Government but through a strong domestic debt capital market.

Gwarzo said that government should access the debt capital market for long-term projects instead of relying on bank borrowing.

He said the revenue squeeze and tight monetary policies made it mandatory for government to float sub-national bonds to close the infrastructure gap.

The director-general, who commended FMDQ for the workshop and commitment to the development of the debt market, said the company’s annual volume grew from N7.1 trillion in 2012 to N5 trillion monthly in 2015.

Gwarzo said that the right fiscal policy needs to be in place for economic growth and revival of the country’s corporate bond market.

Gwarzo said that the right fiscal policy needs to be in place for economic growth and revival of the country’s corporate bond market.

He also urged the participants to ensure effective implementation of the workshop’s blueprint.

Mrs Eme Essien Lore, Country Manager, International Finance Corporation (IFC), Nigeria, said that the corporation would continue to support development of the debt market.

Lore said that the corporations would only achieve its mission through a vibrant local debt market.

She said that Nigerian capital market was very important to the corporation because “it is the largest economy in sub-Sahara Africa.”

Lore said that Nigeria would be resilient to economic crisis with a vibrant capital market, adding that, IFC would continue to invest in the country and create access to long-term finance and job creation in Nigeria.

Also speaking, Dr Sarah Alade, Chairman, FMDQ OTC, urged participants to come out with reforms that would accelerate funding of the private sector-led power, transportation and housing infrastructure in the country.

Alade, represented by Mr Jibril Aku, Vice Chairman, FMDQ OTC, called for the establishment of blueprint on ways to leverage the nation’s DCM to stimulate sustainable growth in the real sector.

She said a vibrant debt capital market could only be achieved through successful implementation of the workshop deliberations.

Alade said that FMDQ and SEC were committed to the turnaround of the nation’s debt market.

NAN reports that the workshop themed: “The Nigerian Debt Capital Markets – Towards a Brighter Future,” is aimed at stimulating the growth of the Nigerian DCM.

-NAN