Some, like manufacturers and importers of finished products, lament their woes in the weakness of the naira, but underwriters and insurance brokers earn more as clients revalue insured assets to reflect dollar denominated policies.

Thanks to the National Insurance Commission (NAIC) which put its foot down against operators’ fear that the ‘No Premium, No Cover’ introduced in 2013 would ruin an industry already suffering from low patronage.

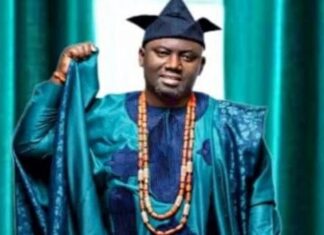

In this interview, Multiple Bond Trust Insurance Brokers Managing Director and Chief Executive Officer, Abiodun Durodola, explains to Assistant Business Editor, KELECHI MGBOJI, how naira devaluation and ‘No Premium, No Cover’ policy have become a blessing in disguise.

Naira devaluation, blessing in disguise

When there is a devaluation of the naira, the value of assets go up. If this thing is worth $1 which was valued at about N160, but now the dollar is worth N222, the value of this asset in dollar value will go up, and so premium will increase, not in the rate but in the resultant figure.

If the rate of the premium is 10 per cent of the value, then 10 per cent of N160 is not the same as 10 per cent of N222. So, I get more premium. That is how insurance works.

Insurance thrives during devaluation, though premium is worked out in naira value.

Take a house for instance. If the house was valued at N160 million equivalent of $10 million (N160 per dollar), but now the exchange rate is N222 per dollar, and I still apply the same percentage rate. So the premium goes up.

But the affordability becomes an issue for the insured except for things that are insured in dollars, especially the joint venture (JV) assets.

JV assets insured in dollars become a problem because it becomes difficult to source dollars to keep up the pace at which the insured have to pay. The policy holder will come back to you wanting to pay in naira.

The Central Bank of Nigeria (CBN) has made the rule that all payments in the country must be denominated in naira, not dollar.

So, if I collect naira from the insured, and I am unable to get dollar to remit payment overseas, when there is problem, it fires back at me. You have to pay in dollar.

But I will not collect the dollar from you directly because I am restricted by the CBN’s rule from collecting payment in dollar. Since you are paying to a reinsurance firm overseas, you pay directly to it but the payment has to pass through the CBN.

Since the scarcity of dollar is also a problem, I have to apply through the National Insurance Commission (NAIC) to the CBN. The NAIC must approve the transaction for the CBN to allow it. Then the firm you paid to will remit your commission to you.

The whole idea is that dollar value vis-a-vis naira affects premium. Now that the value of dollar has appreciated significantly against the naira, it is better for underwriters in terms of making more money.

Underwriters revaluing policies

Some of the underwriters are revaluing dollar denominated assets. They write policies in dollars directly, especially for multinationals or foreign companies. But for us Nigerians who don’t have anything in dollars – my building, for instance, is worth N100 million – there is no basis for me to revalue.

I used naira to value the building and it is valued at N100 million. It has not changed. What we are saying applies to the industry generally.

Foreigners constitute bulk of insurance consumers

Insurance is still an elitist business. The most serious consumers of insurance products are foreigners – Asians, Europeans, Americans who operate here. If you remove them, what we have is peanuts.

Nigerian investors and businessmen do not appreciate insurance. Even though the Indian or Chinese may have an ulterior motive the fact remains that he doesn’t want to suffer any loss. So he takes up insurance.

If you aggregate the Lebanese, Chinese, Indians, a few Europeans and Americans, the industry is done. Even when the industry came up with ‘No Premium, No Cover’, those people still adjusted and complied. But Nigerians would tell you stories.

Foreigners are the people doing insurance here and they are the ones that we pay heavily.

Benefits of ‘No Premium, No Cover’ policy

It has improved the industry tremendously.

First, let’s understand the history of the ‘No Premium, No Cover’ policy. Prior to it, insurance companies granted cover to the insured especially through brokers. That was when the brokers said this is the money.

Laws were made in the past stipulating that brokers had 30 days credit or 90 days credit on behalf of the insured. That meant that I could help somebody insure his property, and because I was the one taking it to the insurance firm, the firm would give me the papers.

The insured was on cover but premium had not been paid. If a claim occurred, the underwriter would say go and pay the premium first. They would settle the claim because they knew you were a credit customer and you were as good as having paid.

After sometime brokers started abusing it. Insurance firms also started to capitalise on it to falsify earnings figures in their books. They hid under the debts owed by clients of this category to lie about their assets.

The regulators noted that companies that claimed to have made N200 million yet had N100 million of those earnings in credit did not make actual cash.

When the companies were going to recover the debts, the timeline attached to the debts became an issue, so much that the firms could not decide when to write the bad debts off.

So, the NAIC decided that henceforth it would not be acceptable to grant cover without premium. That was two years ago.

We all thought it was going to affect the industry negatively and agitated against it. But the NAIC insisted that once any broker who sells policy without collecting premium is caught, he would be in trouble.

The objective of the ‘No Premium, No Cover’ policy is that if you declare that you have sold N100 million it becomes realistically money earned.

And also, some claims happened and some became national embarrassment where the insured had not paid premium or had just paid a deposit.

Claim occurred but insurance companies said no, you haven’t paid in full or not paid at all. So, we are not going to settle the claim. The insured said, but you have collected part of the premium; so pay me. The law says you must have paid fully before claims occur.

So, there were a lot of messy issues which warranted the NAIC to come up with ‘No Premium, No Cover’. Some customers could not cope initially. Some devised a means of payment.

Those who were so heady about the new policy opted out. But those who insured paid.

Today, it also boils down to the fact that when an insurance firm said it made N100 million in a certain period of the year, that N100 million is in its kitty. Brokers are warned that once they issue papers, it means they have collected premium.

That has brought sanity into the system. So we have had a near realistic figure in terms of earnings made by insurance companies.

But where the problem lies now is with the government. Most government accounts have not been paid since then. The issue of budget and account allocations is there. The issues of commitment by people in power and gratification are also there.

There are a lot of hindrances to government meeting up with payment in its own accounts. So, the government that initiated the policy turned out to be the violator of its own policy.

A lot of government workers today don’t have cover. Whatever happens to them, they are worse for it.

It is criminal for government assets and workforce not to be insured at this time and age. Group life insurance written on the life of government employees is invalid because the government has not paid.

Seven months’ arrears of premium are outstanding against the policy holders. The workers have no cover from January to date. Those who died from January to date, it is either the government pays from recurrent expenditure account or their families get nothing.

Armed forces have separate insurance scheme

The armed forces are exempted from this category because they have a separate insurance scheme. All other government workers as well as private sector workers are on the same pedestal.

Insurance scheme for workers

The Pension Reform Act 2004 stipulates that all employees and employers shall provide pension for them in terms of contributory pension. Employees and employers are to provide a stipulated sum of money.

Employers provide life insurance equivalent to three times the annual earnings of the employee.

Immediately that law took effect by June, it became binding on all federal workers and private sector employees.

The federal government said it is optional for states since it cannot dictate to them. So, at state level, compliance has been an issue; maybe a quarter of the states has complied.

States still pay from their recurrent expenditure and perhaps paying arbitrarily too.

Insurance brokers

Insurance brokers are the professional arm of the industry. Insurance brokerage is strictly ‘practice’ while insurance underwriting is strictly ‘business’. They are two different things.

Insurance brokers provide professional advice to clients, including how to get good rates, run after their claims, et cetera.

Insurance companies do business; they are trading having put down their money. They are not into professional service like a broker, an accountant or auditor.

In terms of the economy, we contribute by rolling out budget advice, et cetera.

We are also trying to see how we can help the manufacturing sector because there is no alternative to manufacturing and agriculture.

We service insurance, banking, and other sectors. Agriculture, manufacturing, mining are the major sectors that hold the economy.

Without these sectors, there is no money for us to count. If there are no products for us to sell, what money are we going to count?

Insurance industry conferences

There are two major conferences coming up. One is the insurance industry mega conference comprising all arms of the industry, brokers, insurance companies, loss adjusters, and other operators.

The objective is to forge a good relationship among operators to have one industry conference instead of each segment having a separate conference.

The maiden edition comes up between July 26 and 28. The NAIC conference comes up in October.