By Jeph Ajobaju, Chief Copy Editor

Demand for Nigerian crude oil has risen in Europe where the number of unsold cargoes dropped steadily this week from 20 to 12 or less.

Qua Iboe sold at a premium of $1.75 to dated Brent this week, its highest in months, while supply of similar grades such as Forcados and Bonga were virtually sold out, Reuters reported.

Northwest European refiners are buying more Nigerian crude, as the drop in Iranian exports following United States sanctions tightens supply in the Mediterranean.

Oil receipts fund 95 per cent of the Nigerian budget. Talk of diversifying Africa’s largest economy has gone on for years without action.

Despite the encouraging signs in Europe, prospects for a global surge in demand for Nigerian crude remain dim, with the U.S. now raising domestic output.

India is the biggest importer of Nigerian crude, but the U.S. market – its second biggest – is tightening.

In week ending November 30, 2018, the U.S. produced 11.7 million barrels per day (bpd) of crude oil, a 2 million bpd increase on the figure for the corresponding period in 2017.

However, the U.S. still imports 12 million bpd, as it consumes 20 million bpd while producing less than 12 million bpd.

Nigeria, the world sixth largest exporter of oil, currently produces 1.78 million bpd.

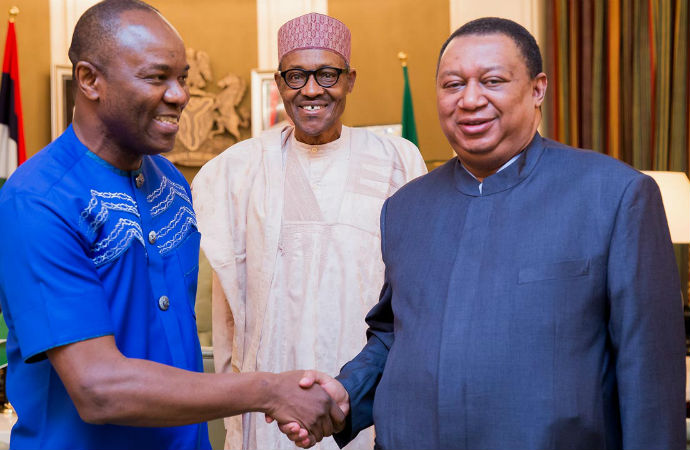

Minister of State for Petroleum, Emmanuel Ibe Kachikwu, disclosed this in Abuja on January 9.

He said output from Egina oilfield is expected to reach 150,000 bpd by the end of the month, which could boost total production estimated at 2.2 million bpd in 2019.

With production cuts agreed by the Organisation of Petroleum Exporting Countries (OPEC), Nigeria’s output is around 1.74 million bpd, excluding extremely light oil known as condensates.

Nigeria produces condensates of 350,000 bpd.