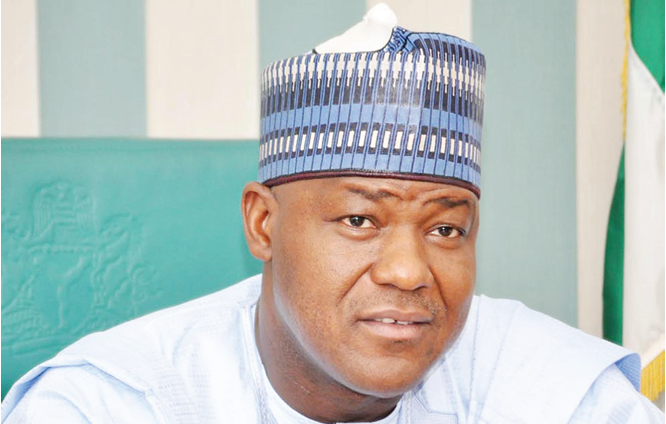

Speaker of the House of Representatives, Yakubu Dogara, has called for action against prevalent banking practices with adverse effects on business growth and entrepreneurship in Nigeria.

The speaker made the appeal at the launch of a book on banking reforms by a member of the House of Representatives, Dr. Bode Ayorinde, representing Owo/Ose Federal Constituency.

Dogara highlighted issues such as high lending rates and difficulties in accessing loans; and compared prevalent practices in the country with what was obtainable in other climes.

“The challenge in the banking industry in Nigeria is such that it is organized in such a way that it creates buoyancy and development in other jurisdictions, not in Nigeria. I have had cause to say this before, that unless you have assets or equipment, there is no way you can take loans or access loans from Nigerian banks to do business.

“If you are not careful in taking loans from Nigerian banks, one will just end up in the poverty gap.

“I don’t think our citizens are supposed to do their businesses with money they already have in their pockets.

“Businesses elsewhere are executed by loans by the banking industry in those countries. I don’t know why the interest rate in Nigeria is so high. What is it that we can do to lower the cost of funds in Nigeria, so that our young men, women and entrepreneurs can risk taking money from our financial institutions to realize their dreams?”

He queried the likelihood of success of business reforms in the country, in the light of the fact that loans remained largely inaccessible to those who most required such financial aids to grow their businesses.

“I love the fact that the Vice President is chairing the council on the ease of doing business in Nigeria but in dealing with most businesses, you are forced to ask what business are we doing? How do we fund these businesses?”