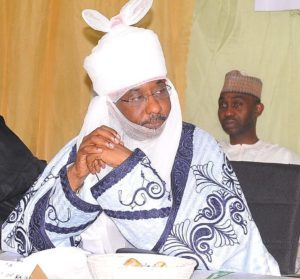

New facts emerged yesterday that the CBN advanced the Federal Government the sum of N1.193 trillion as Ways and Means as at 2nd December 2016. Asanusi fact sheet of the accounts of the Federal Government with the CBN, obtained yesterday from Presidency sources disclosed that the Federal Government did not borrow above its limit from the Central Bank of Nigeria, CBN. The Presidency fact sheet showed that inflows into the Federal Government’s Treasury Single Account, TSA, as at December 2 stood at N4.4trillion. The figure also indicated that foreign exchange transfers into the account was N101.7 billion, giving a grand total of N4.574trillion. The fact sheet also showed government spent N1.913trillion. As a result, credit balance in the TSA as at December 2, 2016 was N2.66trillion. Again, according to the fact sheet, money lent to the Federal Government by the CBN through Ways and Means was N1.467trillion, far less than what Sanusi claimed. Former Governor of the Central Bank of Nigeria (CBN) and Emir of Kano, Muhammadu Sanusi II had asserted last week that the account of the Federal Government, domiciled at the Central Bank of Nigeria, is overdrawn to the tune of N4.7 trillion by the Buhari administration. According to the traditional ruler, “CBN claims on the FGN now top N4.7 trillion — equal to almost 50 per cent of the FGN’s total domestic debt. This is a clear violation of the Central Bank Act of 2007 (Section 38.2), which caps advances to the FGN at five percent of last year’s revenues.” CBN-FG relationship His words: “The CBN-FGN relationship is no longer independent. In fact, one could argue their relationship has become unhealthy,” he said. CBN claims on the FGN now top N4.7 trillion — equal to almost 50% of the FGN’s total domestic debt. This is a clear violation of the Central Bank Act of 2007 (Section 38.2) which caps advances to the FGN at 5% of last year’s revenues. Has CBN become the government’s lender of last or first resort?” Sanusi said at the dialogue that no one was willing to lend to the Nigerian government, further stating that “if Senate approved, I want to see who will lend you $30 billion when you have five exchange rates”. Sanusi said the country is enmeshed in heavy debt, stating that out of every N1 Nigeria makes, 40 kobo goes to debt and 60 kobo is left for salaries, health, education, power, and infrastructure. He said oil is merely a working capital that cannot make the country rich. Nigeria produces one barrel for 80 Nigerians; Saudi Arabia produces one for 3 Saudis, Sanusi said.fg-balance-sheet He noted that in every economy, growth is driven by “consumption, investment and net export”, adding that “our exports cannot grow without regulatory certainty or an increase in the price of oil”. He lamented that the country is spending money on repaying debts and also on recurrent expenditure, as against education, healthcare, power, and other infrastructure. The emir also stated that Nigeria is the lowest per capita spender on development in Africa. On speaking truth to power, Sanusi said: “I can’t apologise for being who I am. The government I served, I did not keep quiet. When I am not serving the government, I cannot keep quiet.” The Presidency source, speaking to Vanguard on condition that his name will not be in print said: “Despite the Emir’s seeming knowledge of these situations, his assertions are totally false and wholly fabricated. Contrary to his claims, the Federal Government’s Treasury Single Account (TSA) balance with the CBN as of 2nd December 2016 was N2.66 trillion (credit). In line with practices that even Emir Sanusi presided over, the FG has overdrawn another account at the CBN by about N1.47 trillion (debit) as of 2nd December 2016. In effect, therefore, the net balance of the FG at the CBN is over N1.19 trillion (credit), as shown (see Table). “If a customer with XYZ Bank Limited has N100 in one account but has also borrowed N35 from XYZ Bank Limited. Even if the Bank were to demand that this customer pays off all his debt to them, he can do so and still have N65 balance with the bank. How is this a problem? How then could Sanusi have reached the conclusion that the CBN’s claims on the FG are over N4.7 trillion? Where did he get this number?” What the CBN said The Central Bank of Nigeria CBN, had on Saturday said that Sanusi Lamido Sanusi, the Emir of Kano was playing to the gallery in his comments that there are five exchange rates in the country. It said that the CBN does not allocate dollars to end users but that request for foreign exchange is made through banks. It further said that there is nowhere in the world where the apex bank sits idle and allows vicious currency speculators to distort its currency endlessly. In a response to Sanusi’ comments at a policy monitoring dialogue hosted by Savannah Centre for Diplomacy, Democracy and Development, at Transcorp Hilton Hotel in Abuja on Friday, CBN’ Acting Director Corporate Communications, Mr. Isaac Okorafor said: “First I want to state that the Central Bank of Nigeria has set up an inter-bank foreign exchange market where anyone who wishes to buy foreign exchange can bid for and buy through their banks. It is not true that CBN allocates dollars. There is nowhere in the world that the central bank sits by and allows vicious speculators to solely distort the value of its currency endlessly. All central banks intervene to buy or sell in the market to ensure that the local currency is protected from dubious attacks. According to the CBN Director, “the channels for advice and contribution of ideas on the current economic situation by all patriotic Nigerians are open. It is rather unfortunate that some people have chosen to play to the gallery and to make statements to disparage those in leadership at this time in total insensitivity to the larger interests of the Nigerian economy. He further said: “We should not forget that the seed of our current economic crisis was planted by the failure of those who occupied public office in the past but failed to act in the long term interest of the Nigerian economy. It is easy to criticize from outside. “It is always easier and the grass greener when people are out of office. The challenge we face today is a choice between pandering to the established interest in Nigeria’s speculative economy and the protection of the wages of the real stakeholders who work hard on fixed incomes, for they are the core victims of Naira depreciation. “At this critical time in the life of our country the CBN will continue to explore avenues with the Federal Government in order to find solutions to the current economic situation. Already Nigerians are waking up to the call to be more productive and to look inwards and to be less dependent on the importation of foreign goods and services.”

.Vanguard