Treasury suffers nearly N37b budget deficits by 2022 alone

By Jeph Ajobaju, Chief Copy Editor

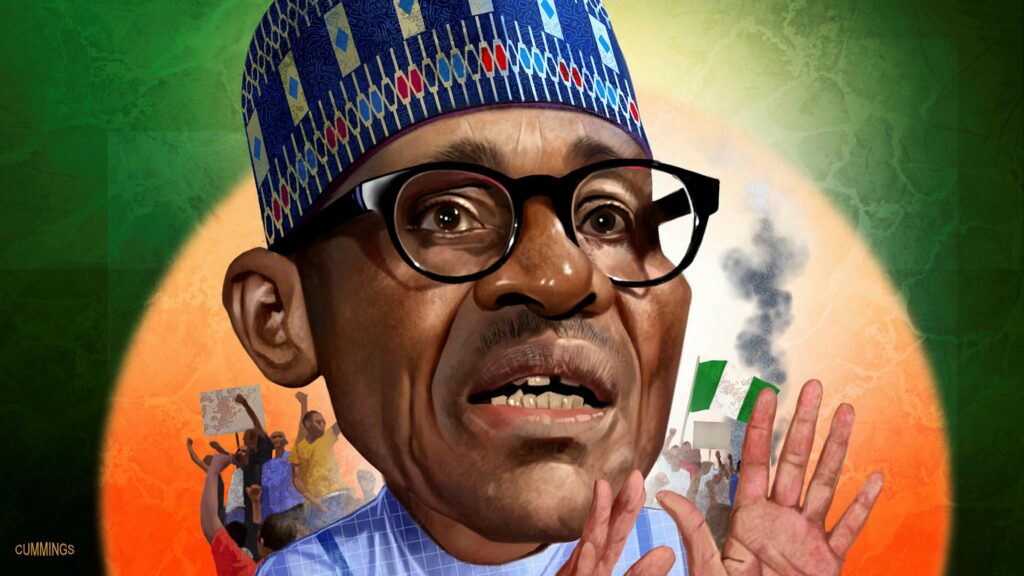

Abuja incurred a total N36.8 trillion budget deficits in seven of the eight years of Muhammadu Buhari at the helm in Aso Rock from 2015 to 2022.

Figures compiled by the Central Bank of Nigeria (CBN) on government finances from 2015 to 2022 show 77 per cent of the deficit occurred in four years, from 2019 to 2022.

Total revenue generated in the period was N32.05 trillion, expenditure (N68.8 trillion) – a deficit of N36.8 trillion.

From 2015 to 2018, the government made N13.9 trillion revenue but spent N24.3 trillion, with deficit at N10.4 trillion.

Deficit spending rose 70 per cent between 2019 and 2022. Between 2015 and 2018, it grew 31 per cent to N18.2 trillion, and expenditure 83 per cent to N44.5 trillion, creating a deficit of N26.4 trillion.

More than 22 per cent of the total deficit was incurred in 2022 alone – the year revenue grew 14.7 per cent to N5.05 trillion from N4.4 trillion in 2021. Expenditure was N13.4 trillion in 2022, up 14.5 per cent from N11.7 trillion in 2021.

As a result, the treasury incurred N8.3 trillion deficit, a 13.6 per cent increase from N7.3 trillion in 2021.

Fuel subsidy

A major driver of deficit spending is the sharp increase in fuel subsidy, which amounted to N9.34 trillion between 2015 and 2022.

Fuel subsidy shot up 571 per cent to N4.39 trillion in 2022 from N654 billion in 2015.

National debt rises 267%

The N36.8 trillion deficit incurred during the period was financed by borrowing, and DMO data shows national debt jumped 267 per cent or by N33.65 trillion to N46.25 trillion in 2022 from N12.6 trillion in 2015.

This excludes N23 trillion borrowed from CBN as Ways and Means.

__________________________________________________________________

Related articles:

Buhari to leave behind N80tr national debt

World Bank alarmed as Nigeria spends 96% revenue on debt servicing

CSOs alert Buhari’s reckless borrowing may cost Nigeria foreign assets

__________________________________________________________________

Warning from IMF, World Bank

The World Bank has warned the rise in deficit spending and the huge debt stock will worsen except the government removes fuel subsidy and takes other measures to strengthen the economy, per reporting by Vanguard.

“The fiscal position deteriorated. In 2022, the cost of petrol subsidy increased from 0.7 per cent to 2.3 per cent of GDP. Low non-oil revenues and high-interest payments compounded fiscal pressures,” the World Bank said in its report titled, Macro Poverty Outlook for Nigeria: April 2023.

“The fiscal deficit was estimated at 5.0 per cent of GDP in 2022, breaching the stipulated limit for a federal fiscal deficit of 3 per cent. This has kept the public debt stock at over 38 per cent of GDP and pushed the debt service to revenue ratio from 83.2 per cent in 2021 to 96.3 per cent in 2022.

“Fiscal and debt pressures will increase if the petrol subsidy is not phased out in June 2023, as envisaged in the 2023 Budget.”

The International Monetary Fund (IMF) has made a similar point.

“Directors highlighted the need for bold fiscal reforms to create needed policy space, put public debt on sound footing, and reduce vulnerabilities,” the IMF said in its 2022 Article IV Consultation.

“They urged the [Nigerian’ authorities to deliver on their commitment to remove fuel subsidies by mid-2023, and to increase well-targeted social spending.

“Strengthening revenue mobilization, including through tax administration reforms, expanding the tax automation system and strengthening taxpayer segmentation, and improving tax compliance is also a priority.”